Top trends impacting the insurance industry in 2019

“Expect some shocks to the system”. We surveyed Chief Risk Officers from some of the biggest insurance companies in the world to find out what are the insurance industry’s top challenges in 2019.

Cyber risk

Just as in last year's survey, improving cyber security and reducing cyber risk are still at the top of CROs’ agenda. And, while it is worth noting that increased cyber risk is not specific to the insurance industry, still, the industry may be lagging when compared to the banking or defence sector.

“Cost of companies’ cyber-attacks are on the rise, as are incidents”, Frieder Knupling, Group Chief Risk Officer of Scor, told us.

“Not only do insurers have to study cyber criminality and provide solutions and insurance capacity to their clients, they also have to reinforce their own systems to remain resilient.”

Because of that, increased cyber risks impact operational resilience directly. One of the main challenges larger organisations are facing is the complexity of doing business using legacy systems which have varying levels of security. Also part of this issue is the industry’s growing reliance on 3rd parties in order to extend services beyond insurance.

“This would require partnering with companies that have the knowledge and technology that go beyond traditional industry boundaries”, a Chief Risk Officer told us. “Finding the right place in the ecosystem and the right partners will be the challenge.”

Market risk

Insurers are facing tough times as profitability continues to go downhill, thanks in-part to overcapacity. As a result, there is an increasing pressure to control and reduce expenses.

“Market volatility and sustained low rates put pressure on earnings”, a CRO told us. “In addition, in the P&C markets, rates continue to be low or with minor increases which also continues to put pressure on earnings. This all leads to cost reductions at a time where many need to invest in order to modernise infrastructure, reach customers differently and deal with the costs of increased oversight and regulation.”

Macroeconomic risk

Political uncertainties continue to baffle industries. We were told:

“Alongside the impact on our balance sheets of volatile and unpredictable economics, we are actors on a world-stage that is retrenching towards uni-literalism, harder borders, and economically-irrational (though highly politically-rational) behaviour. This impacts directly on us as multi-national businesses, as well as on our clients, and on their clients. Expect some shocks to the system!”

Furthermore, the increasing polarisation of societies is also a source of huge risks.

“The industry needs to further examine and manage the consequences on their business, including the multifaceted consequences of forced displacement and mass migration”, Knupling said.

Data

The sweeping declaration that data is the oil of the 21st century has surely crossed your screens before. What that really means is that today, data is the source of power for many areas of the business, and that is not lost on the insurance industry.

Private and corporate data is more valuable than ever. Not only data from our own environment but data from other industries will be relevant and precious to better understand what customers are eager for.

“Next to the challenge of getting the most out of all the data available, it is without saying that data is the perfect target for cybercrime," another CRO added.

2018 saw the General Data Protection Regulation (GDPR) enter into force which puts a bigger emphasis on organisations’ transparent use of personal data. Under this umbrella, the secure storage of the data – in other words, avoiding data breaches – can become a key concern for any organisation operating in Europe or organisations holding European data.

“We have yet to see and appreciate how GDPR will impact our day to day procedures. As case law becomes more available, we will need to reconsider some existing processes”, a CRO told us.

Conduct risk

Regulations continue to focus on companies’ improvement in order to create more trust and value for the customer.

“Whilst all companies will state that they are focused on good conduct and positive outcomes to the customer, how can we prove or evidence this? Ongoing FCA work suggests that it will be required in the very near future”, A CRO told us.

Talent acquisition

CROs also predict that recruitment will be one of the 7 challenges of 2019.

The skills we need are expanding and many other industries are looking for similar analytical talent. Many see the industry as sleepy, not modern, very traditional, etc. Many insurers are plagued by older systems and thus are less attractive than start-ups.

Another CRO said, “we face a shift in focus and proposition across the industry. 2019 will be a key year for those who win in securing folks with the right experience. This is as much about re-constituting the executive team for greater commerciality and consumerism as it is about stocking the operations with digital natives and the like.”

Climate risk

Similar to last year's survey, climate risk was also mentioned as one of the challenges.

The World Economic Forum’s 14th Edition of The Global Risks Report 2019 puts 5 different types of environmental risks into its top 10 list in terms of likelihood and in terms of impact. The Executive Summary reads:

“This year, they accounted for three of the top five risks by likelihood and four by impact. Extreme weather was the risk of greatest concern, but our survey respondents are increasingly worried about environmental policy failure: having fallen in the rankings after Paris, “failure of climate-change mitigation and adaptation” jumped back to number two in terms of impact this year. The results of climate inaction are becoming increasingly clear.”

According to Knupling, climate risk will have a huge impact on insurance:

“Changing weather patterns will have widespread consequences on P&C and Life claims occurrences, as well as on long-term investments. The industry needs, on the one hand, to manage the resulting financial risks and, on the other hand, to play a leading role in bringing societies together to work towards global solutions.”

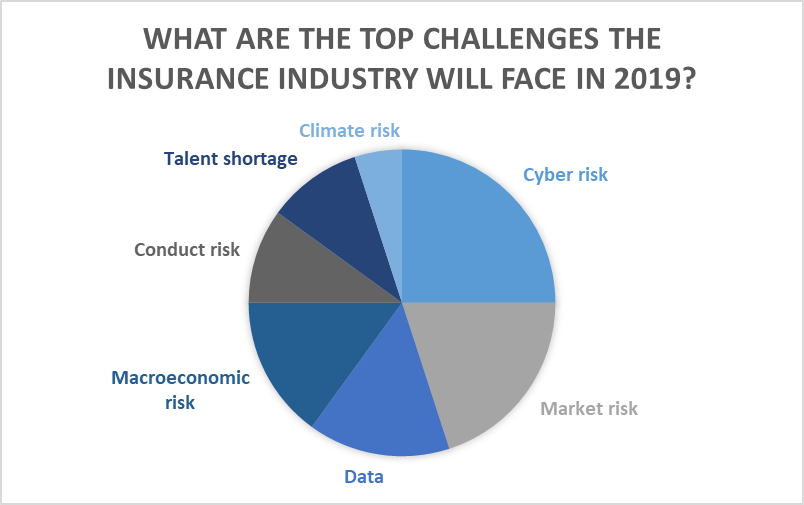

How do the results pan out?

Do you agree? Is there a trend driving the industry that the CROs missed of? have you say at #InsurTechRising