News

Uncovering Aisle Shopper Myths

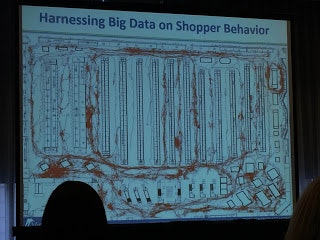

How can you drive impulse purchases? Red Bull continues to explore this concept in order to optimize their presence. Together with DataMining representatives, Laura-Lynn of Red Bull North America they presented a compelling story about in store shopping.

There is an art to it. The art is very basic:

- Tempt by being in their path- analysze the store consumers and segments

- Be relevant- what are the needs of the demographic in store- do they want your product?

- Timing is right- what are the dynamics of the store- proximity plays a key role in placement.

Red Bull worked with a team to monitor every second of every consumers' shopping trip. Each segment is different - males vs. females, millennials vs. boomers, etc. To complicate things even more- these trends change by channel.

5 Myths about Center Store Shoppers:

Center store is primary stop for many shoppers- This is not true - the majority of shoppers are looking for products that are actually in the perimeter

- 18% shop center store vs. >50% Shop perimeter

- What does this mean? Perhaps use messaging on the perimeter to drive traffic to center store..

Shoppers spend more time center store- Most time is navigation followed by 28% of the time spent on the perimeter while only 22% of time is spent in center store. BUT- 75% of spending is made in center store- so how can we make this more relevant to shoppers to drive even more purchase in this shorter amount of time spent here which amounts to about 3 minutes in grocery?

Shoppers engage longer with center store categories- People spend just 23 seconds on average shopping center store. How can you engage in that short period of time?

If they come they will buy- Not necessarily true - for ever 100 people walking into a store, only 6 buy from a perimeter category. This is even less for center store categories.

- This creates an opportunity- when people don't shop a category it's tough to convince. BUT if people already shop the category, it's quite easy to convince them to make this purchase.

Front of store end caps are more effective- High traffic does not equal sales. The conversion rate for category shoppers actually making a purchase is 44% for front end caps while BACK END CAPS show 58%.

Janel Parker, Market

Research Consultant at SKIM, an international consultancy and marketing

research agency, has a background in Marketing and Psychology from Cornell

University. Her previous experience at a social media agency combined with her

knowledge from SKIM provide for a unique understanding of the relationships

between social media and marketing. She can be reached at

j.parker@skimgroup.com.

Research Consultant at SKIM, an international consultancy and marketing

research agency, has a background in Marketing and Psychology from Cornell

University. Her previous experience at a social media agency combined with her

knowledge from SKIM provide for a unique understanding of the relationships

between social media and marketing. She can be reached at

j.parker@skimgroup.com.