Was the nightmare before Christmas just a bad dream?

"Let’s be honest. Since 2009, we have all enjoyed strong returns from markets and the impact it has had on our portfolios, but is the fun coming to an end?" With investors fearing that December’s plunges could be the beginning of the end for the economic cycle, Justin Onuekwusi, LGIM, looks at how best to avoid sleepwalking into a downturn.

Equity investors might be left pondering this after they were jolted sharply awake in December when markets significantly slumped, wiping out most or all of the year’s returns.

Yet January played host to a nice recovery, reassuring investors that a downturn may not be just around the corner. In fact, we think staying invested now is a pretty good idea, giving investors the opportunity to scoop some attractive returns in what has historically been the second-best time during the economic cycle to be in risk assets.

More broadly; global markets are not all in the same position, with the US being significantly farther advanced in the economic cycle than other major economies.

However, even if things don’t feel they are moving anywhere fast, with US Federal Reserve (‘Fed’) chair telling rate hikes to take a hike (at least temporarily) last week, we are positioning to stay alert for any potential swings.

So how can investors keep some skin in the game without getting burned?

Inflation, inflation, inflation

The underlying cause of a rapid increase in the pace of Fed rate hikes is usually escalating inflation.

Buying an asset which is likely to benefit from an inflationary upswing is a good idea – titling portfolios towards bonds with inflation protection is an attractive option.

"The ability to be active in asset allocation and in the quest for future winners is more important than ever before."

Holding US Treasury Inflation Protected Securities (TIPS) may help reduce some of the falls that a bond portfolio might suffer if there are any inflation surprises.

Duration or diversification?

Fixed income has become one of the most discussed asset classes for investors, with many questioning its role in a multi-asset portfolio.

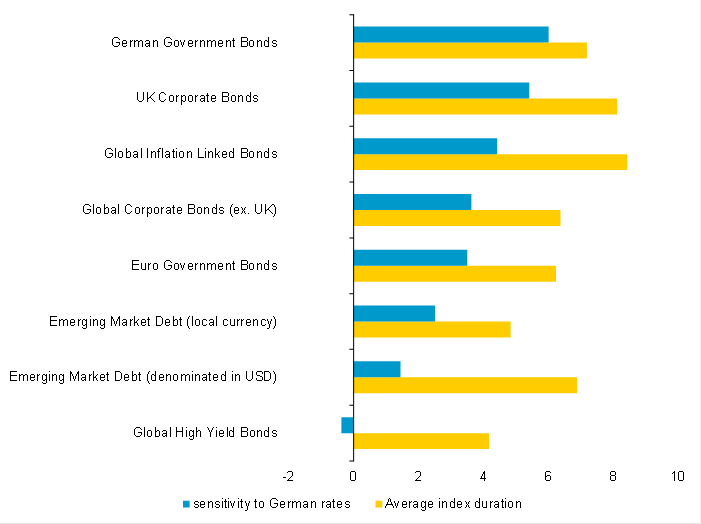

The common understanding about the relationship between duration and interest-rate sensitivity is that higher duration equals enhanced sensitivity of your fixed income assets to changes in interest rates, and vice versa.

But we caution that investors need to be careful in assuming that duration does exactly as it says on the tin – i.e. the realised sensitivity versus the index’s headline duration figure (see below).

In this case we look at changes to German bund yields and assess the historical impact on other bond markets.

Figure 1: The difference between headline duration and realised duration for key bond asset classes

- Source: LGIM, Bloomberg, JP Morgan, Barclays, Bank of America Merrill Lynch, for illustrative purposes only. The average index duration and sensitivity to changes in yields is calculated based on historical weekly changes in 10-year bund yields (weekly data from the start of 2011 to the end of October 2018). The sensitivity to changes in yields is calculated as a beta coefficient in a uni-variate regression of historical weekly total return index returns.

-

"More broadly; global markets are not all in the same position, with the US being significantly farther advanced in the economic cycle than other major economies."

We think diversifying your fixed income holdings across a number of different regions and over a number of bond asset classes should reduce the impact of future interest rate rises on your portfolio.

Secondly, assessing prices of those bonds compared to each other and dynamically allocating to those that are cheaper could be the way to protect your portfolio from specific types of interest-rate risk, but also to take advantage of opportunities.

Non-fixed income alternatives, such as equities and property, may also help protect your portfolio from specific types of interest-rate risk.

Dynamic allocation

The ability to be active in asset allocation and in the quest for future winners is more important than ever before.

With central banks starting to think about shrinking their balance sheets, or ‘quantitative tightening’, the uncertainty from the aftermath of the global financial crisis still has far-reaching effects.

Being able to react to a changing environment and dynamically adjust asset allocation will be crucial for multi-asset funds in order to manage overall risk and keep to their aim of delivering attractive returns.

So, in an environment of escalating uncertainty, it is wise to be positioned so that your portfolio can stay nimble.

Crunching the metrics and understanding that duration doesn’t necessarily do what it says on the tin, diversifying your fixed income holdings, and being alive to the possibilities of assets which can provide inflation protection may help you ride the crest of the wave — rather than letting it crash over your head.