Which 'alternative' strategies can diversify your portfolio?

Yasmin Dahya-Bilger, Head of Americas Beta Specialists at J.P. Morgan Asset Management, shares her view on which mainstream alternative strategies are accessible to investors which can help them diversify their portfolio, especially in a world of geopolitical uncertainty and the anxiety of recessions.

With investment returns around the world declining, investors have increasingly been looking beyond traditional asset classes to diversify their existing portfolios and to potentially pick up incremental returns. That is where the potential of alternatives comes in, says Yasmin Dahya-Bilger, Head of Americas Beta Specialists at J.P. Morgan Asset Management.

Once only available to institutional investors, alternative strategies are becoming more mainstream and accessible to individual investors through more cost efficient and liquid vehicles, such as mutual funds and exchange-traded funds. ETFs in particular, have been named by some as the very technology that is revolutionizing investment.

"Investors looking to diversify their traditional stock/bond portfolios and reduce volatility may want to consider adding a diversified alternative beta ETF to their portfolios."

A new take on diversification

Alternative strategies are a very important source of diversification in investor portfolios. A typical balanced investor can look at investments such as alternatives in two different ways:

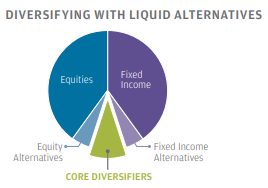

- First, as a return-enhancing diversifier where traditional diversifiers may no longer be effective. For example, an investor could reduce exposure to low-risk assets such as fixed income, which has historically been a diversifier of choice. We believe that going forward, fixed income’s ability to diversify and deliver attractive returns is likely to be diminished given rising rates and low yields. Therefore, replacing some fixed income exposure with alternatives allows for increased diversification and potentially enhanced returns at a similar level of risk.

- Second, as a risk diversifier. Reducing one’s equity exposure to allocate to alternatives can help mitigate overall portfolio risk – and, just as important, drawdowns – while achieving an enhanced Sharpe ratio, or risk-adjusted return.

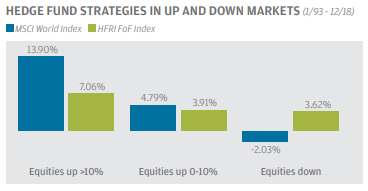

Traditional alternatives, such as hedge funds, are good diversifiers. Historically, they have low sensitivity to moves in stock and bond prices and tend to perform well when traditional asset classes are underperforming.

Alternative beta: A rules-based approach

Alternative beta is a new category that allows investors to access the systematic components of hedge fund returns. In other words, it provides a rules-based approach to capturing various hedge fund styles, in contrast to active hedge fund strategies. Because they are rules-based, these types of strategies can enable investors to access the same type of returns in a more transparent, and consequently cost-efficient, fashion than was historically the case.

"With investment returns around the world declining, investors have increasingly been looking beyond traditional asset classes to diversify their existing portfolios and to potentially pick up incremental returns."

More specifically, the rules-based approach to capturing hedge fund styles is referred to as hedge fund or alternative beta. It should be noted that this is very different from what are referred to as hedge fund replication approaches. Hedge fund replication approaches tend to be top-down, regression-based analysis that is fundamentally backward-looking.

Alternative beta, on the other hand, is bottom-up, investing in the same way as a hedge fund – by going long or short individual securities in a systematic fashion. This is the approach can be implemented across three hedge fund strategies: equity long/short, event-driven and managed futures.

- Equity long/short: Involves investing long in stocks that are likely to rise in price, offset by implementing short positions in stocks that are likely to decline, aiming to reduce exposure to overall market risk.

- Merger arbitrage (event-driven): Focuses on the risk factored into the price of the merger-target stock until the deal is completed.

- Managed futures: Aims to capture uncorrelated exposure through momentum and carry factors across asset classes.

Implementing alternative beta in investor portfolios

Investors looking to diversify their traditional stock/bond portfolios and reduce volatility may want to consider adding a diversified alternative beta ETF to their portfolios.

These products can be used as a core diversifier to a traditional portfolio. Investors seeking enhanced returns at a similar level of risk to their bond portfolios may want to fund from their fixed income allocation.

Alternatively, investors seeking enhanced risk-adjusted returns, but less risk – and, crucially – improved drawdown characteristics, may want to fund an alternative beta investment from their equity allocation.

Yasmin Dahya, executive director, is head of the Americas Investment Specialist team for the Beta Strategies Group at J.P. Morgan Asset Management. She works closely with client advisors to position JPM’s expanding suite of Beta Strategies solutions with clients. Dahya received her MBA from Harvard Business School.