This article was first published by F.O. Licht on 28 September 2021. For an updated analysis, join the Sugar Africa Virtual conference which will be live streamed 7-8 December and available on-demand.

Raw sugar futures in New York hit a 4-1/2 year high at 20.37 cents per pound in mid-August and white sugar futures rose to a March 2017 high of $519.60 per tonne in the middle of this month amid ongoing concern over damage to Brazil’s 2021/22 crop from unprecedented dryness in recent months and multiple frost events in July.

The white sugar premium (March/March) has recovered somewhat to around $72 per tonne as of late after bottoming out at $36 in August but this is still too low for standalone refiners to break even. It is against this background that we are presenting an update of the world sugar balance for 2021/22 (Oct/Sep).

We would like to recall that F.O. Licht does not include the sugar equivalent of beet and cane that were not processed into the end product crystal sugar (such as those used for fuel ethanol or biogas) in its sugar production estimates, which differs from the approach used by some sugar associations and official EU statistics. As always, all production figures are in raw value terms, which can be converted to white value terms by multiplying by 0.92.

Last but not least, it may be pointed out that our World Sugar Production forecasts are based on national crop years, while each country's numbers are recalculated to a uniform time period (in our case October/September) for our World Sugar Balance forecasts - the precondition for the calculation of the change in stocks (i.e. the surplus/deficit) during a given year. While this may sound boring for expert readers it is still imperative to do this as anecdotal evidence suggests that the numbers are still mixed up from time to time.

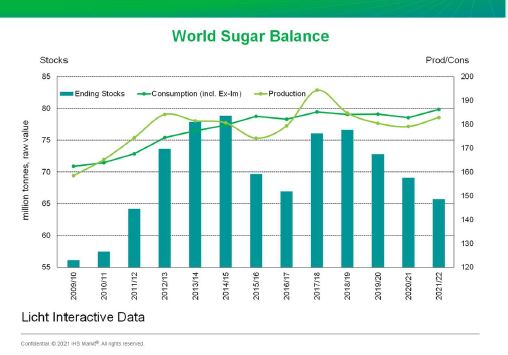

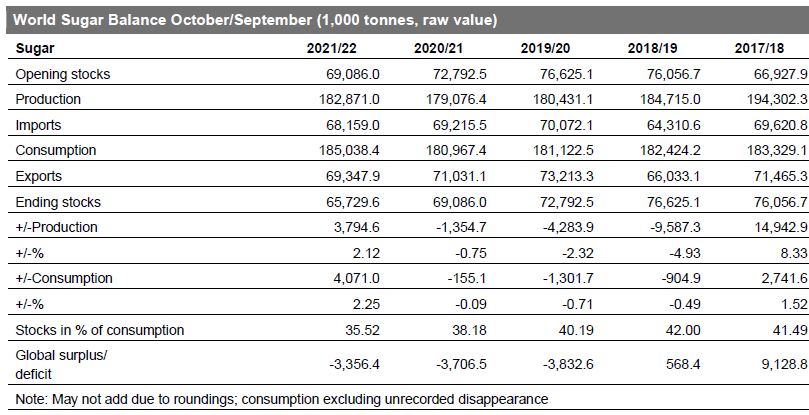

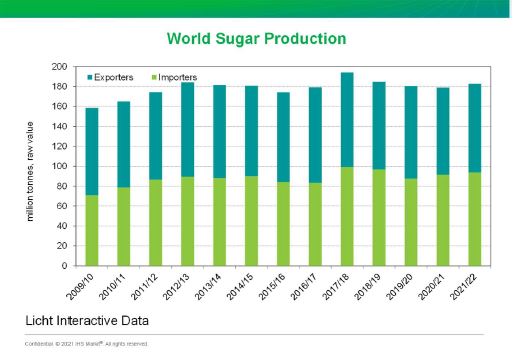

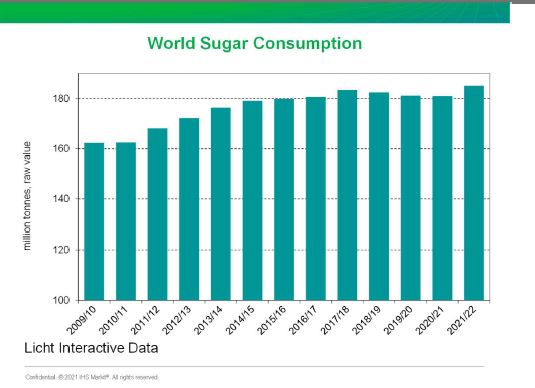

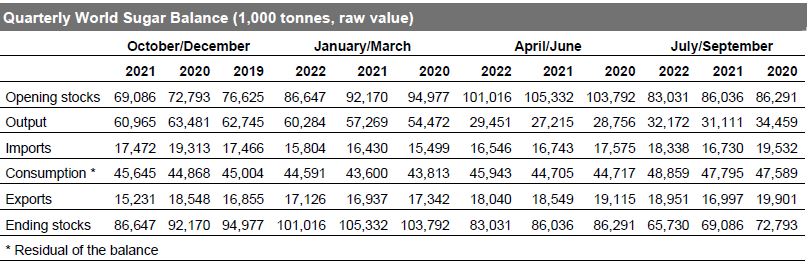

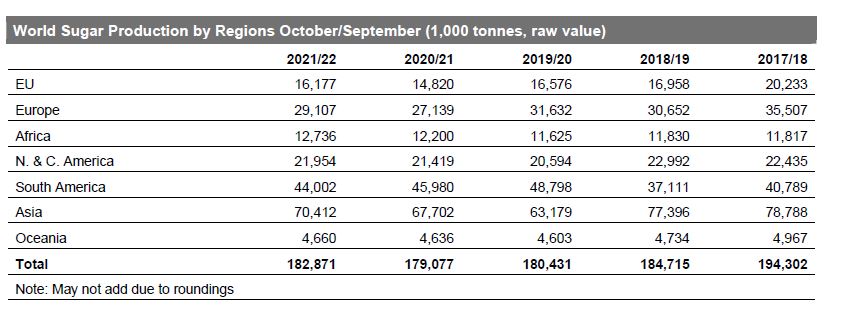

Current indications are that global sugar production in 2021/22 (Oct/Sep) may rise by 3.8 million tonnes to 182.9 million tonnes from this season’s 179.1 million, while apparent consumption is projected to rise about 4.1 million tonnes (2.2%) year-over-year to 185.0 million tonnes amid a global economic recovery with a fractional decline projected for the current sugar year.

This means that this season's deficit of 3.7 million tonnes is likely to be followed by another deficit to the tune of 3.4 million tonnes in 2021/22. That includes an allowance for unrecorded disappearance (the difference between

world exports and imports) of 1.8 million tonnes this season and 1.2 million in 2021/22. It is worth to note that the deficit for the current 2020/21 season is now 0.4 million tonnes smaller than in our August projection, while the one for 2021/22 has risen by a massive 2.8 million tonnes due to a downward revision of the production outlook in India, Brazil and Russia.

Asia to lead the growth in global production in 2021/22

Overall, the sharpest increase in output in 2021/22 is seen in Asia where sugar production is projected to rise by 2.7 million tonnes to 70.4 million due to a sharp recovery in Thailand and a further increase in Pakistan and India.

A decrease by 2.0 million tonnes to 44.0 million could be on the cards for South America in 2021/22 as the cane crush in Brazil is seen remaining below expectation in 2022 as well due to the lingering effects of drought.

Sugar production in Europe is projected to rise by about 2.0 million tonnes to 29.1 million in 2021/22 due to a rise in area under cultivation in Russia and a yield recovery in the European Union.

Sugar production in North & Central America could be 0.6 million tonnes higher at 22.0 million tonnes, while sugar production in Africa could rise by 0.5 million tonnes to 12.7 million due to an expansion in Egypt. Last but not least, Oceania's sugar production could stay hardly changed at 4.7 million tonnes next season.

Europe

European sugar production may rise by about 2.0 million tonnes to 29.1 million in 2021/22 due to a rise in area under cultivation in Russia and a yield recovery in the European Union.

Sugar production in the European Union could recover modestly to 16.2 million tonnes from 14.8 million a year earlier. The area under beet cultivation in the European Union in 2021 is only fractionally lower than the year before, while yields are generally expected to recover. There has been less disease pressure this year after a rather cold winter and wet weather and dryness has not been a problem across most growing regions this year. In fact, wet weather coupled with rather cool temperatures and a lack of sunshine has held back sugar content so far so that farmers hope for a “golden autumn” to allow the beets to add sugar just before harvesting. Last but not least, use of beet seeds treated with neonics has been approved in more countries for the 2021 crop, which is reducing losses in the field.

Russia’s sugar beet area rose by 9% in 2021 to 1.01 million ha. This year's sowing campaign began nearly two weeks later than in the previous year but it then progressed at a faster pace than last year, particularly due to favourable weather conditions in May. However, rather dry weather conditions during the summer led to poor soil moisture and slow beet growth as well as a delay of beet processing at many factories.

With about a fifth of the beet harvest completed, the beet yield is better than last year but this is offset by a sharply lower sugar extraction rate. As a result, we have reduced our sugar production forecast by 0.5 million tonnes to 6.2

million, which would still be half a million tonnes more than last year.

Africa

African sugar production is expected to rise by 0.5 million tonnes to 12.7 million in 2021/22.

Top producer Egypt may raise production further to 3.1 million tonnes next season from an estimated 2.8 million tonnes in 2020/21 amid an expansion of the beet industry. Egypt grows both cane and beet. Cane sugar production in Upper Egypt is seen staying flat at 1.0 million tonnes in 2021/22.

Sugar output in the continent’s top cane sugar producer South Africa is estimated to rise only fractionally to 2.2 million tonnes amid expectations for a larger cane crop. Improved cane yields from the use of improved varieties are seen lifting cane yields.

Sugar output in the continent's top cane sugar producer South Africa is estimated to recover somewhat to 2.2 million tonnes next season from 2.1 million in 2020/21. It is important to note that the current 2021 crush falls mainly into the 2020/21 world sugar balance year. The South African Sugar Association cut its cane crush projection to 18.0 million tonnes for 2021 from 19.1 million previously, which would also be down from 18.2 million a year ago. SASA said on its website that the cost of civil unrest to the sugar industry included over 500,000 tonnes of burnt cane by arsonists and 121,614 tonnes of cane that could not be processed. Some 10 mills had to cease production for one week in early July. Making matters worse, there was also some frost damage.

Sugar production in Ethiopia is preliminarily projected to rise by 0.1 million tonnes to 0.5 million next season as the Tana Beles 1 sugar factory has started commercial production. Yet, the country’s ambitious sugar expansion program is remaining far behind projected volumes.

North & Central America

Sugar production in North & Central America is estimated to rise by 0.5 million tonnes to just below 22.0 million next season amid higher output in Mexico and Guatemala and flat production in the United States. The largest producer is the US followed by Mexico and Guatemala.

U.S. sugar production is projected to stay flat at 8.3 million tonnes next season as higher beet sugar output is seen offset by lower cane sugar production. Beet sugar production is forecast to rise by 0.1 million tonnes to 4.7 million in the new season due to a larger beet crop, while cane sugar production in 2021/22 is forecast to fall to 3.6 million tonnes.

Mexico's 2020/21 sugarcane crush finally came to an end on 28 July with 5.8 million tonnes of sugar produced – 0.4 million more than the drought-hit 2019/20 crop. Area under cultivation is seen unchanged for the 2021/22 harvest, but the yield may continue to recover amid improved rainfall. Sugar output may therefore rise a further 0.2 million tonnes to somewhat less than 6.1 million tonnes in 2021/22.

Sugar production in Guatemala is currently seen rising modestly to 2.9 million tonnes in 2021/22 after falling to 2.8 million this season. Cane yields have been adversely affected by excessive rainfall caused by La Nina and are expected to recover next season. Also, increased planting of an improved cane variety is expected to contribute to a higher yield.

South America

South American sugar production is estimated to reach 44.0 million tonnes in 2021/22, or 2.0 million less than this season.

Brazil's 2021/22 balance year production cuts through two Centre South (CS) campaigns. It includes the tail end of the current 2021 crush (everything produced from 1 October 2021 to the end of crushing operations in the CS) and the beginning of the next 2022 crush (everything produced up to 30 September 2022). Sugar production in 2021/22 on an October/September basis will therefore very much depend on the first half of the local 2022 crush.

Our forecast assumes that Brazil's total sugar production in the local 2022/23 (April/March) crop year (including the CS and NNE regions) will be 38.5 million tonnes (0.5 million less than assumed before) compared with 37.1 million tonnes currently assumed for the local 2021/22 (Apr/Mar) crop year and 43.3 million in the 2020/21 crop year.

Among the main assumptions is that Brazil's 2021/22 (April/March) Centre/South cane crush will fall about 80 million tonnes to just 525 million, unchanged from the previous forecast in August. The sugar mix is still seen at 45.4% for the current crush and the ATR level at 142.75 kg per tonne of cane.

This would be below 144.7 kg a year ago. If realised, this would lead to the production of about 32.5 million tonnes of sugar, tel quel (unchanged from the previous forecast), down 6.0 million year-over-year. Output in the North/Northeast region is expected to be flat at 3.0 million tonnes, tel quel. Brazil's sugar production on an October/September basis is now estimated to reach 36.9 million tonnes, raw value, in 2021/22, down from 39.2 million tonnes this season.

Colombia's sugar production is projected to rise a bit to 2.4 million tonnes in 2021/22 from 2.3 million, while Argentina’s output is estimated to recover to 1.9 million tonnes next year from a drought- and frost-affected drop to 1.7 million in the current season.

Asia

Asian sugar production is seen rising to 70.4 million tonnes in 2021/22 from 67.7 million mainly due to higher output in Thailand and Pakistan.

India’s sugar production rose by nearly 4 million tonnes to an estimated 33.7 million this season, mainly due to a significant rise in the area under cane in the key sugarcane states of Maharashtra and Karnataka after previous drought.

Sugar output in 2021/22 is seen rising a little further to 34.0 million tonnes as good rainfall during the 2020 monsoon season provided good conditions for cane planting again. Back-to-back rainy seasons with a large rainfall surplus, which followed five consecutive below-average seasons from 2014 to 2018, have helped replenish reservoirs, which is favourable for irrigation and should aid cane yields. The same is true for another good rainy season this year in key cane areas of Maharashtra and Karnataka. However, a significant share of the expected increase in cane output will go towards use for ethanol production with industry sources putting its white sugar equivalent at 3.4 million tonnes in the new season, up from 2.1 million in 2020/21. This is also the main reason why we have adjusted our interim assumption for a rise in sugar output to 35.9 million tonnes back to our original forecast of 34.0 million issued in June.

Thailand's sugar production in 2020/21 fell further to 7.7 million tonnes from 8.5 million a year ago and as much as 14.9 million in 2018/19 due to a combination of a drop in area under cultivation and poor yields. This led to a

drop of the cane crush to just below 67 million tonnes from 75 million in 2019/20 and 131 million two years ago.

For 2021/22 we still expect a recovery of the cane crush to about 85 million tonnes as the sharp drop in output has led to a scramble among millers for scarce cane, leading to higher cane prices paid to farmers than the state-set

minimum price. This is believed to have taken area back from competing field crops such as cassava. If realised, sugar output may recover to 10.0 million tonnes. There is some talk that the upcoming crush could be as large as 100 million tonnes.

China's sugar production in 2021/22 may fall by 0.4 million tonnes to 11.2 million due to the first drop in beet sugar output since 2014/15. China's beet sugar production has doubled over the past six years to reach 1.7 million tonnes in 2020/21, partly thanks to large-scale mechanisation on the field and in the factory. Also, several farmers in provinces such as Inner Mongolia have switched to beet as changes in the government's corn support policy led to falling attractiveness of that crop. However, China's sugar beet area is seen falling sharply in 2021 due to declining profitability of sugar beet cultivation compared to other crops, particularly corn. Beet sugar output is therefore seen down half a million tonnes in the new season, while cane sugar output may be fractionally higher at 10.0 million tonnes.

Pakistan's cane sugar production is projected to be higher in 2021/22 at 6.8 million tonnes compared with 6.3 million this season as farmers have planted 8% more cane for harvest at the end of this year. High cane prices have led to a shift from cotton to cane.

Oceania

Sugar production in Oceania is estimated at nearly 4.7 million tonnes in 2021/22, practically unchanged on the year.

Harvesting in Australia started in June, with large-scale processing taking place from July onwards to October before production volumes drop off significantly up to the end of the crush. The number for 2021/22 therefore includes the tail end of the 2021 crush and the better part of the 2022 crush.

Queensland’s sugarcane crop is projected to be unchanged on the year at 31.0 million tonnes in 2021 but the sugar content is expected to be above last year’s due to better weather. There will be two fewer mills in operation this year due to the closure of the Bingera mill at Bundaberg and Maryborough mill.

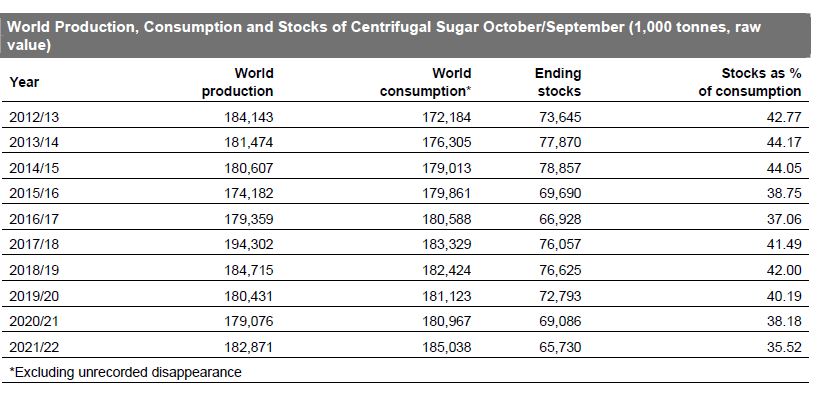

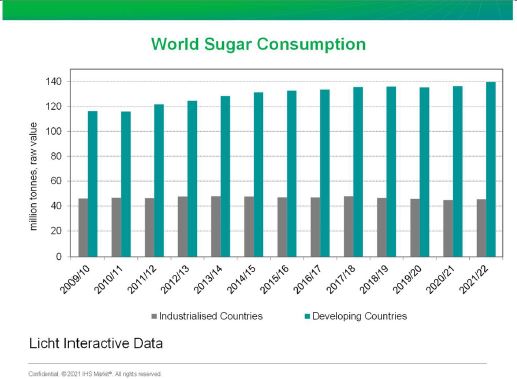

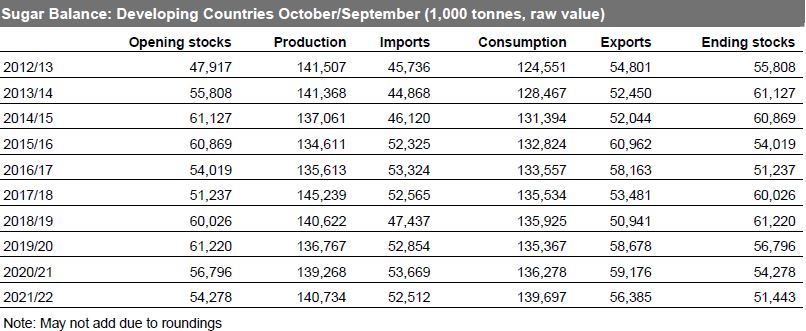

Sugar production in developing countries to rise continue recovery

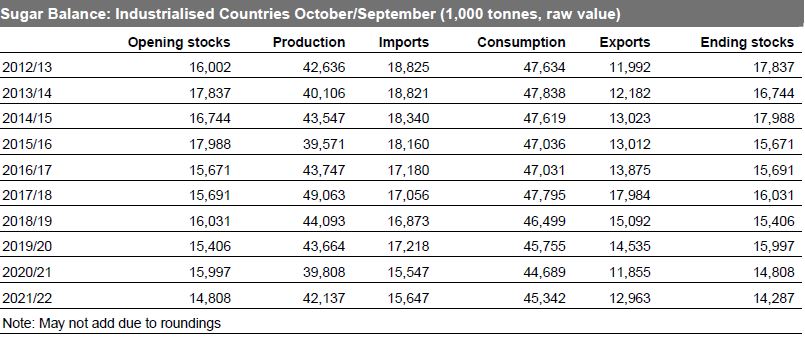

Sugar production in developing countries is projected to rise by 1.5 million tonnes to 140.7 million tonnes in 2021/22 due to larger output in Thailand, Pakistan and India. Sugar production in industrialised countries is seen recovering by 2.3 million tonnes to 42.1 million tonnes in 2021/22, largely due to the expected rise in the EU and Russia. However, this would still be less than in 2019/20 and far from the massive 49.1 million tonnes produced in 2017/18.

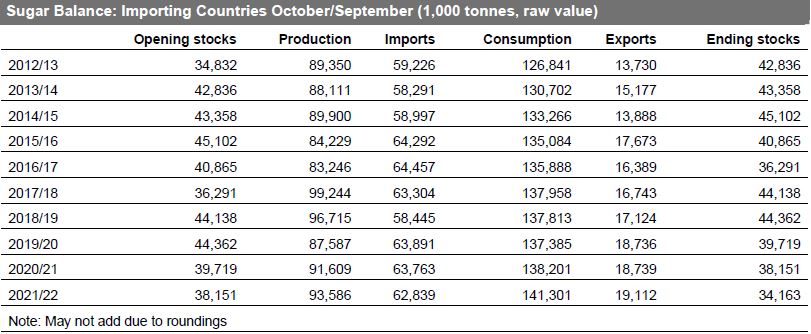

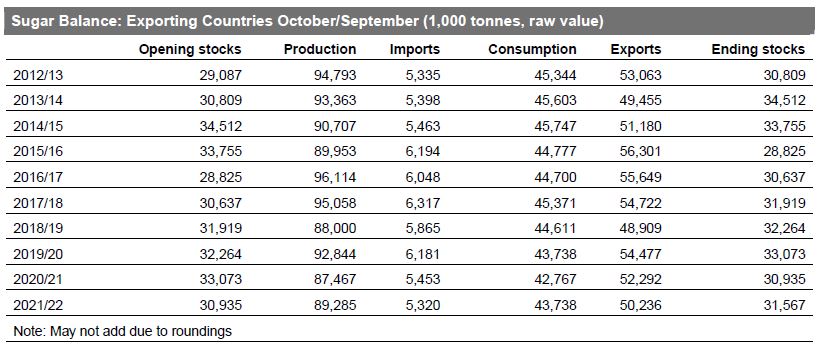

Sugar production in importing countries is expected to rise to 93.6 million tonnes from 91.6 million a year ago. Yet, this would still be significantly below the record 99.2 million tonnes produced in 2017/18. Sugar production in exporting countries may rise to 89.3 million tonnes from 87.5 million a year earlier. The biggest year-over-year increase among the countries forming this group is seen in Thailand (+2.3 million tonnes).

World sugar consumption growth to accelerate in 2021/22

The growth in world sugar consumption has come to a halt in 2017/18 and even reached negative rates in each of the past three seasons with a plethora of reasons coming into play.

As already mentioned before, one factor that is contributing to lower sugar consumption is the global war on sugar which is leading to lower use of sugar in the recipes of food and beverage producers or even the complete substitution of sugar through alternative sweeteners. Taxes on sugar-sweetened beverages have accelerated this trend massively and continue to do so with more countries introducing such taxes or raising the applied tax rates in a phased manner.

The COVID-19 pandemic dealt global sugar consumption an additional blow in 2019/20 and 2020/21 after it started to spread globally since the beginning of 2020. Several waves of lockdown of restaurants, cafes and offices in many countries has led to lower offtake by the industrial sector and this has not been offset by increased sugar use at home.

However, there is hope for a resumption of sugar consumption growth in the 2021/22 season. Global growth prospects have improved against the backdrop of rapid vaccination rollouts in a few large economies. But the stark disparity in vaccination coverage between countries and regions poses a serious risk of an uneven and fragile recovery of the world economy.

Vaccine access has emerged as the principal fault line along which the global recovery splits into two blocs: those that can look forward to further normalisation of activity later this year (almost all advanced economies) and those that will still face resurgent infections and rising COVID death tolls, the IMF noted in its July World Economic Outlook. Countries that have been quick to vaccinate their population against COVID-19 and that are managing to control infections through effective public health strategies are seeing their economies recover more quickly.

Following a sharp contraction of 3.2% in 2020, the IMF projects the global economy to grow 6.0% in 2021 and 4.9% in 2022. Prospects for emerging market and developing economies have been marked down for 2021,especially for Emerging Asia. By contrast, the forecast for advanced economies has been revised up.

This is of relevance for the sugar market as economic growth is a key pillar of sugar consumption.

With that being said, we currently expect that global sugar consumption will rise by 2.2% in 2021/22. This would be the highest growth rate since 2013/14 and compares with a contraction by 0.1% in 2020/21.

While the world economy is treading towards a recovery, the pandemic is far from over for a majority of countries. Timely and universal access to COVID-19 vaccinations will remain a key tool for beating the pandemic and putting the world economy on the path of an inclusive and resilient recovery.

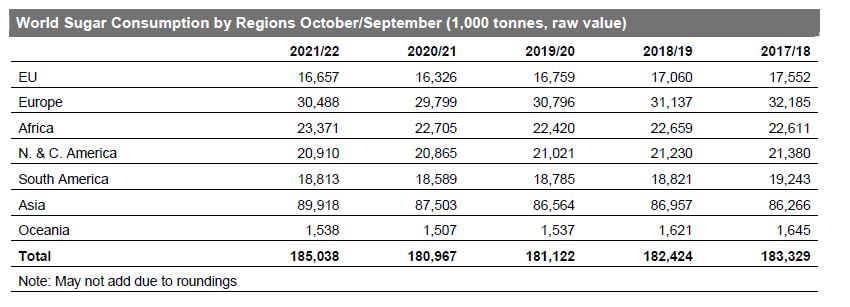

Asian sugar consumption to reach new record

Regionwise, Asian sugar consumption in 2021/22 is still expected to rise to a record 89.9 million tonnes, up from 87.5 million the year before. This mainly reflects the growth expected for India. Consumption in the world's largest sugar consumer is seen rising by a rather strong 0.7 million tonnes to 29.0 million in 2021/22. That would be a return to more significant growth after a small increase of just 0.3 million tonnes assumed for 2020/21. Indian consumption growth is supported by a rising population with the annual growth rate put at 1.1%. The economy is also seen recovering strongly with the IMF projecting 9.5% growth in 2021 and 8.5% in 2022 which compares with a contraction of 7.3% in 2020.

Chinese sugar consumption is seen rising by 0.8 million tonnes to 16.5 million in the current 2020/21 season and may rise by a further 0.5 million tonnes to 17.0 million in 2021/22. The increase is related to a notable economic

recovery, after suffering serious pandemic-driven setbacks for the majority of last year. The recovery of China’s economic activity has been swift and growth will reach 8.1% this year and 5.7% in 2022, according to the IMF.

European sugar consumption is seen recovering back to 30.5 million tonnes in 2021/22, after falling to 29.8 million this season from 30.8 million a year earlier. Sugar consumption in North & Central America may be fractionally higher at 20.9 million tonnes, which would still be below the 21.0 million tonnes of 2019/20. Sugar consumption in South America is projected to rise only fractionally to 18.8 million tonnes from 18.6 million last season, with Brazil being by far the largest user. Sugar consumption in Africa is being driven by high population growth rates and may reach a record 23.4 million tonnes in 2021/22, up by 2.7% from 22.7 million this season. Consumption in Oceania, at around 1.5 million tonnes, is very stable with practically no year-on-year change. Australia accounts for the better part of total offtake, estimated at 1.2 million tonnes.

Sugar consumption to rise 2.5% in developing countries

Developing countries are seen recording 2.5% sugar consumption growth in 2021/22 with the total estimated to reach 139.7 million tonnes - or about 75% of global demand. Sugar demand in industrialised countries has been in reverse gear for a number of years with the total seen at 44.7 million tonnes in 2020/21 compared with 47.8 million in 2017/18. The introduction of sugar taxes as well as general health concerns related to sugar is a key factor affecting consumption in this group. This may continue in coming years as sugar taxes are being under discussion in several countries. But for the time being, consumption of this group of countries may bounce back somewhat in 2021/22 to 45.3 million tonnes due to the economic recovery.

Sugar consumption in importing countries is forecast to rise by 2.2% in the new season to 141.3 million tonnes, a new all-time high. This reflects an increase of 10.6 million tonnes during the past eight years. Sugar offtake in exporting countries is also seen rising by a rather strong 2.3% to 43.7 million tonnes next season.

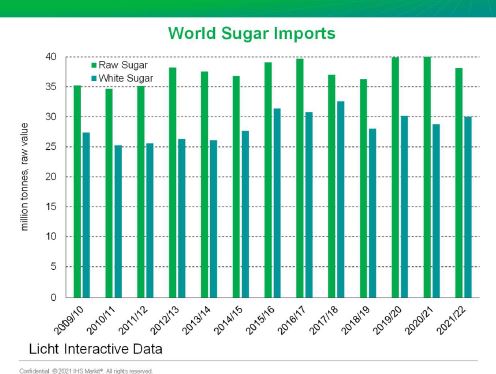

Exportable production to rise modestly in 2021/22

World exportable production (production minus consumption) is expected to recover somewhat to 55.0 million tonnes in 2021/22 after falling to 53.9 million in 2020/21. It is worth to note that this would be 3.9 million tonnes less than what was assumed three months ago, mainly due to the downward revision of the Brazilian crop outlook.

It is of key significance that this measure does not include stocks, which are still massive in India.

Exportable production in the European Union is expected to rise to 4.1 million tonnes in 2021/22 from 3.1 million a year earlier. Most of this will be exported within the bloc and only a small quantity is expected to be exported out of the bloc.

Exportable production from Africa is seen only marginally higher at 2.5 million tonnes in 2021/22. Export availability on the continent is curbed by increasing domestic consumption due to strong population growth. The rise in output in Egypt is not leading to exports but lower imports.

Exportable production in North & Central America is seen climbing to 5.5 million tonnes in 2021/22 from 5.0 million this season. The projected increases in output in Mexico and Guatemala would be responsible for the increase.

Exportable production in South America is expected to drop to 26.6 million tonnes next season from 28.8 million assumed for 2020/21. This is related to a decrease to 25.7 million tonnes from 28.0 million for the continent’s top exporter Brazil.

Exportable production in Asia is expected to rise further to 12.4 million tonnes in 2021/22 from 10.5 million this season and just 7.2 million a year ago with the expected recovery in production in Thailand being mainly responsible for the increase. Thailand’s exportable production is projected to increase to 6.9 million tonnes next season from just 4.8 million this season, which would still be far off values of up to 11.5 million tonnes per annum earlier this decade. India’s exportable production for 2021/22 may be 5.0 million tonnes, down from 5.4 million this season.

Indonesia to become top sugar importer in 2021/22

Indonesia is seen importing 5.8 million tonnes of sugar in 2021/22, up from 5.6 million in 2020/21 but below 6.3 million in 2019/20. Domestic consumption continues to rise due to economic and population growth, while domestic

production has been lingering around 2.3-2.4 million tonnes for years due to a lack of investment. Making matters worse for domestic millers, the rise in demand is almost exclusively fuelled by growth in the food and beverage industries, which rely on refined sugar produced from imported raws instead of domestically produced plantation white sugar.

China's sugar imports are seen falling to 5.0 million tonnes in 2021/22 from 6.0 million this season and 4.5 million in 2019/20. The sharp rise in the current 2020/21 season is related to the phasing out of steep additional import tariffs in May 2020, which led to a surge in arrivals in subsequent months with 2.8 million tonnes arriving in the last quarter of 2020 alone, i.e. the first quarter of the 2020/21 season. Meanwhile, the problem with smuggled sugar that has plagued China's domestic sugar market for many years has been greatly reduced by the COVID-19 pandemic in 2020, according to a local source. The drop in arrivals in 2021/22 is related to high global prices, which may entice the government to release stocks into the domestic market.

The United States is expected to import about 3.0 million tonnes of sugar in 2021/22, hardly changed from the current season. Imports had surged to a record 3.7 million tonnes in 2019/20 as a weather-induced sharp drop in production last season had lifted import demand. The recovery in production this season will lead to a drop in imports to a more normal level.

All in all, total Asian sugar imports are estimated to fall to 35.7 million tonnes in 2021/22 from 36.7 million this season. European imports are forecast to come in slightly higher at 9.2 million tonnes (including intra-EU-trade) from 9.0 million, with African imports estimated to fall by 0.2 million tonnes to 16.2 million tonnes. North & Central American imports are projected to be hardly changed in 2021/22 at 4.9 million tonnes. Sugar imports into South America are negligible and may reach 1.9 million tonnes in 2021/22, up about 0.1 million from this season.

Stocks-to-use ratio to fall to 35.5% in 2021/22!

The stocks-to-use ratio is forecast to drop further to 35.5% in 2021/22 after already falling to 38.2% in the current season from 40.2% a year ago. If realised, this would push the ratio to the lowest level since 1994/95! In other words, the global S&D picture will tighten further next season with the projected recovery in global consumption playing a key role.

Another key contributor to the tightening S&D scenario is that what initially was projected to be only a modest drop has turned out to become the largest ever year-over-year drop in Brazilian production as the adverse effect of months of below-average rainfall has been compounded by multiple frost events in July.

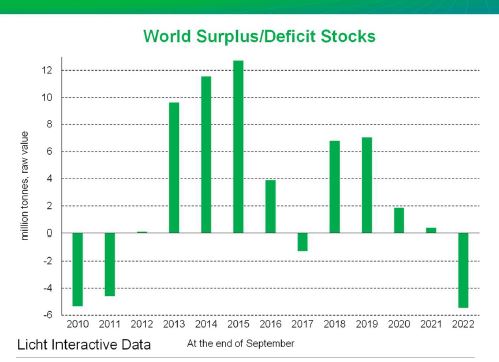

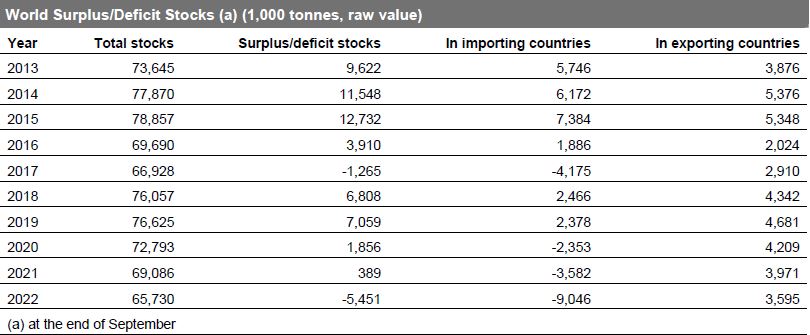

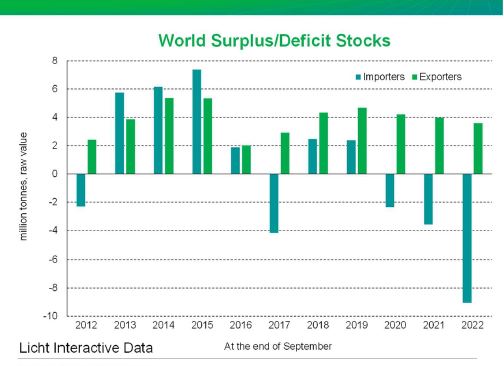

The surplus or deficit in a given sugar year is understood to be the gap between production and global demand including unrecorded consumption, with the latter being the gap between exports and imports. A closer inspection of this approach reveals that the term surplus or deficit simply means the increase or decrease in stocks.

A deficit of 3.7 million tonnes in 2020/21 is currently expected to be followed by another deficit of 3.4 million next season. The sugar market’s fundamentals are therefore seen remaining strong in coming months and the same can be said of prospects for prices. Potential downside risks for prices would be a larger-than-expected Thai crop and if the assumed global economic recovery (which aids global sugar consumption) falls short of expectations due to the persistence of COVID-19. On the other hand, there is consensus that this year’s weather problems in Brazil will also curtail the production recovery in Brazil in 2022/23. Evidently, such a scenario could give the market further upside potential.