7 risks that keep CROs awake at night in 2023

How are Chief Risk Officers across the industry keeping on top of increasingly volatile market conditions, ongoing cyber risk threats, stagnation, a climate emergency and evolving regulatory expectations?

An assembled panel of CROs at RiskMinds International 2023 delved into the risks and rewards at play in 2023 and beyond, featuring:

- Balbir Bakhshi, Group CRO & Member of the Executive Committee, London Stock Exchange Group

- Alexandra Boleslawski, Group Chief Risk Officer & Member of Executive Committee, Crédit Agricole

- Sotaro Kato, Executive Managing Director and Group Chief Risk Officer, Nomura Holdings, Inc

- Lakshmi Shyam-Sunder, Vice Present and Group Chief Risk Officer, World Bank Group

- Chris Knight, Group Chief Risk Officer, Legal & General

- Moderated by Maria del Mar Martinez, Senior Partner, McKinsey & Company

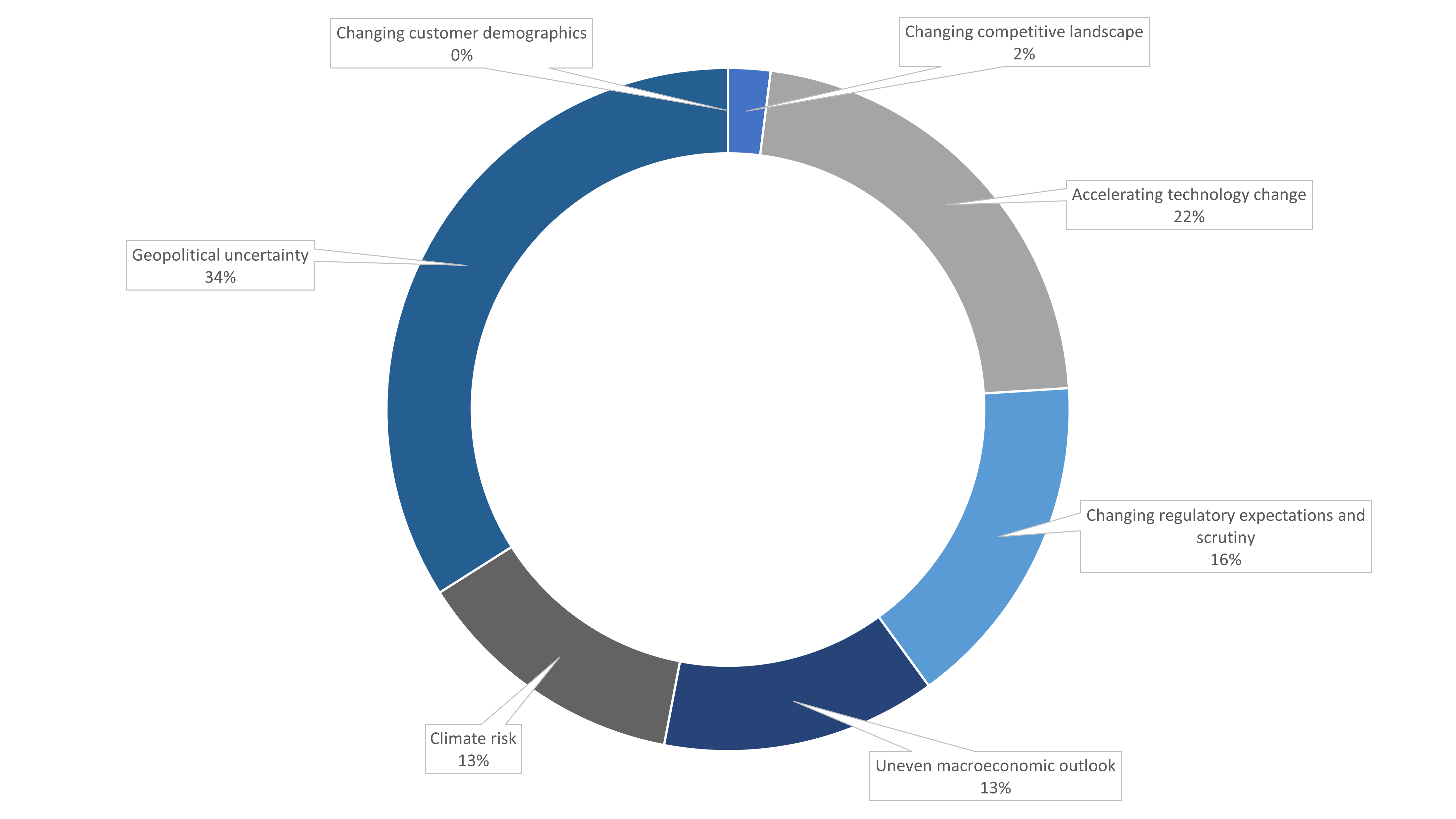

Ongoing geopolitical uncertainty, such as the war in Ukraine potentially being replicated in Taiwan, and accelerating technology change from AI and quantum computing, plus regulation were the three key worries identified in a live poll of the hundreds of CROs in the audience for the leaders’ debate, held on the opening day of RiskMinds International in London.

The panel of senior group CROs on stage largely agreed with the thoughts of their peers in the audience, although they did also add other overlapping key risks FIs should keep on their radar, such as supply chain threats and climate risk.

The seven key risks identified by the panel that face the financial services industry now and in the future were:

Uncertain macroeconomic outlook

As inflation and consequentially interest rates rise, this potentially causes inequality and social unease. With less money to spend in consumer pockets, general retail sales fall and profits are adversely affected. Specific niches like grocers and supermarkets might get more business as hard-pressed consumers stop ordering take away food or going to restaurants.

Another pressing priority for consumers is meeting mortgage and rental payment obligations, which can be challenging in high interest rate environments. The consequences of missed payments or inability to pay ultimately comes to back financial institutions to help mitigate. This can lead to wider economic pain which can be difficult to resolve.

Perhaps exempt may be luxury retailers, banks and businesses focused on high-net worth individuals (HNWIs) that are not so impacted by a general economic downturn.

Geopolitical uncertainty

From wars causing supply chain shocks, sanctions, and more generally barriers to free trade being put up – the geopolitical landscape and subsequent market reactions unsurprisingly feature heavily as a risk keeping CROs up at night. The panel observed how western governments are seeming to focus more tightly on their internal markets and domestic agendas, and how the US’ championing of these causes is waning.

Supply chain shocks were much discussed, emanating from these geopolitical risks. “This would obviously mean risk appetites need recalculating,” commented one panellist.

But supply chain shocks can also come about due to changing robotic technology advances. These could mean near shore manufacturing coming back to its source markets in the future, as the need for labour in developing countries reduces with enhanced automation. Changing demographics could impact it as well.

Changing regulatory expectations

It is evident we now operate in a landscape of increased regulatory requirements. From strengthened ESG rules or, in the UK new operational resilience requirements from regulators. There is also the UK Prudential Regulation Authority (PRA) supervisory statement (SS), known as SS1/23, which sets out the regulator’s expectations for banks’ management of model risk. The desired outcome is that banks take a strategic approach in futured to model risk management (MRM) as a risk discipline in its own right.

Accelerating technological change

Technology keeps evolving, and the emerging risks associated are often front and centre of a CROs mind, including risk of IT failure, data breaches and cyber-attacks to embedded systems.

One of the CRO panellists identified cyber risk as their key concern. Cloud computing and crypto-powered blockchains especially are increasing the necessity for better management of third parties in delivering IT and services. “Collaboration is needed” to fight this crucial ongoing concern.

More widespread usage of AI, and its democratisation via generative tools like ChatGPT, also appears to be a worry to risk managers. Given its potential to allow fraudsters to access AI power when formulating their scams more easily. Scenario management models are a good idea to plan how a CRO might fight these threats.

Another particularly potent emerging technology risk is also the advancement of quantum computing and its implications on cyber security. Quantum computing has the potential to blow apart the existing public key infrastructure security measures that give us our unique PIN codes, which rely on traditional binary 0 and 1 computing models.

Climate risk

Accelerating climate and biodiversity deterioration is a well-known threat and has the potential to disrupt the insurance landscape especially, as increased storm damage, floods, droughts and other extreme weather events become more common. Threats to populations and livelihoods will also play a role, and this macro-uncertainty may change consumer spending and saving behaviours both short and long-term.

Adding to this is the physical and transition risks of the move towards a ‘green’ economy. Identifying companies that are worth investing in within the energy and infrastructure space will become critical; oil may appear lucrative in the short term but potentially comes with more increased reputational risk, and investment in renewables and green technology may become more dialled up in the longer term.

To add even more complexity, climate risks and opportunity assessments will depend on where in the world you are looking, and needs to consider the natural resources, economic dependency, societal pressure and political appetite for diversification and transition.

Evolving competitive landscape

Reduced barriers of entry for new players as digitalisation advances, fintechs’ emergence, and new ‘green’ or automated manufacturing models evolving fall into a wider area of concern for senior risk managers around a shifting competition, and this plays a part in deciding where to allocate capital and risk.

As digitalisation narrows the prior demarcation lines between businesses, key players looking for an advantage will want a strong process to evaluate which companies will be disrupted and lose value, and which newcomers offer value creation to both consumers and businesses alike. Financial institutions’ future success depends on their ability to identify, then invest in or partner with companies which offer new business models, technology developments and an innovative vision for the future.

Changing demographics

Aging populations have different priorities and banking preferences to the upcoming generation Z, and servicing both effectively can prove difficult. Younger potential customers often expect high quality digital experiences and demonstrate different financial behaviours and interests, including more flexible working patterns and sustainability conscious investment habits in comparison to their more senior counterparts. Adapting to this may require an evolution of banking business models, plus investment into new talent and technology to stay competitive.

Conclusion

Asset concentration risk was another topic debated, alongside operational resilience, and the classic “Cs” of risk management: credit and conduct risk.

A panellists reminded risk managers “to always think about risk holistically and not in silos, consisting of credit, liquidity, counterparty risk or so forth. They overlap.”

And, on the flipside of the coin, AI and other technology tools can also help link risks more effectively in the future, allowing for better insight and ability to protect companies and business models. There is a lot to keep a CRO awake at night it seems, but a lot to feel optimistic about too.