Biofuels in 2021

This article was first published by F.O. Licht on 8 January 2021. For an updated analysis listen to the latest Digital Dialogues on Global Ethanol Production Expansion, Trade and Technology which took place in May.

The outlook for biofuels in 2021 promises some recovery after the COVID-19 pandemic had cut fuels demand over wide parts of 2020. Nevertheless, the pre-crisis level may not be reached that fast.

At the same time, there are interesting developments on the policy front and with regards to the oil industry's biofuels strategy.

The new Administration in the United States may bring America back under the Paris climate accord. In addition, the European Union is discussing higher emission reduction targets for 2030.

Several policy-makers across the globe see the decarbonisation of transport being a key task for the coming decade. This will create new outlets in air and maritime transport for liquid biofuels and also impacts the crude oil refining sector which will boost investment in renewable liquid fuels.

By the end of 2021, the world ethanol market will not have fully recovered. At the same time, growth prospects for biodiesel use remain positive but range far below pre-COVID-19 projections. Fuel ethanol use is seen rebounding this year, after the sharp drop in 2020 following the COVID-19-related lockdown measures worldwide. However, with respect to fuel grades, the 2021 total will remain sharply below the precrisis levels. Changes in the consumption of traditional grades (e.g. an increased use in

disinfectants/hand-sanitizers) cannot offset the losses in the transportation sector.

The situation with biodiesel (fatty acid methyl esters (FAME) and renewable diesel) showed a different dynamic. Rising mandates here prevented demand from dropping in 2020. In other words: COVID-19 “merely” cut growth prospects. We expect global biodiesel demand to continue to rise in 2021 on the expected economic recovery plus higher mandates and decarbonisation efforts, but the growth rate will remain below the strong levels seen in the late 2010s.

Europe: Biofuel Quota Changes

The growth story with renewable diesel will continue and hit the FAME sector. The worldwide use of renewable diesel in 2021 will rise faster than that for FAME. Roughly 16% of the global biodiesel use will be covered with renewable diesel. Projects, which will be completed in 2021, include the expansion of producing units run by US companies Diamond Green Diesel and the Renewable Energy Group. Global renewable diesel production capacity may rise to 13 million tonnes by the end of the year, against a current 9 million. This number also includes various co-processing projects at existing

refineries. More will follow in the first half of the 2020s. True, some of the renewable diesel output will end in the tanks of air planes or ships – but there will be enough left to lower sales opportunities for FAME.

US distillers will once more dominate the worldwide ethanol trade flows. More than 6.6 billion litres of ethanol will be exported from the United States in 2021, the most-competitive origin, with shipments ex Brazil seeing a y/y decline to roughly 1.5 billion. True, the projected progress in the global fight against COVID-19 could bring back ethanol imports in some countries to more normal levels. At the same time, any decline in COVID-19 cases on the key markets may also boost gasoline demand and prompt new sales opportunities under the various fuel ethanol mandates. For Brazilian

shippers, the availability of ethanol for export will be cut by a recovery in local fuel demand and a stronger sugar market which coincides with a weaker supply of sugarcane and the ongoing presence of US product. Higher sugar prices and the

continuing weakness of the Brazilian real have led to an unprecedented volume of next season’s sugar already being hedged by sugar millers. This speaks in favour of another sugar-biased production cycle in Brazil.

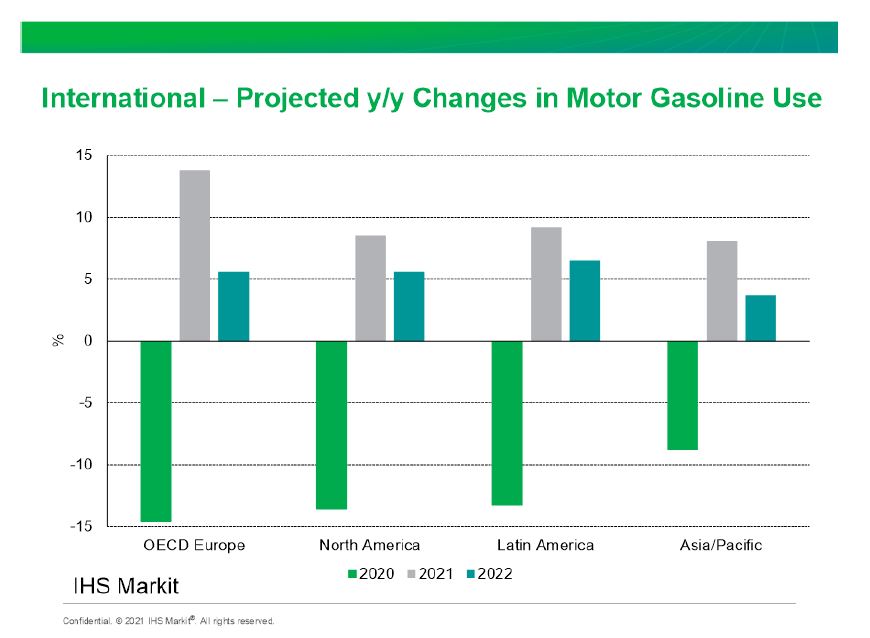

International – Projected y/y Changes in Motor Gasoline Use

Global feedstock markets offer a mixed picture: the late 2020 oilseed, palm oil rally and the China factor will also impact the oilseed and grain markets in 2021. A quick drop in prices is not on the cards and corn may not be abundant later in the year either. In Brazil, the outlook for sugarcane plantings is anything but excellent.

Several factors pushed world market prices for palm oil higher in recent weeks, and this will also play a role in early 2021. First, global supply was squeezed by a La Niña weather pattern in Southeast Asia. Second, unfavourable weather lowered the production of soybeans, sunflower, and rapeseed oil elsewhere which coincided with tight oil stockpiles in India and China. Then, there is lower fertiliser use and a slowdown in new oil palm plantings across Indonesia and Malaysia. On top of that, COVID-19 brought issues for Malaysian estates, where foreign workers, accounting for around

80% of the workforce, have been affected by border restrictions. Last but not least, La Niña can also be the cause for a drier climate in the eastern Pacific and South America, a major area for soybean production, impacting the results from the early 2021 harvests.

In Europe, winter grain sowings were completed on time in most regions but losses are expected for rapeseed crops, the European Commission's crop monitoring service MARS said. In France, winter grain plantings for 2021/22 are set to rise on the year but will remain below the trend, the first forecast from the French Farm Ministry shows. In the United Kingdom, the wheat area is set to rebound and should be up 28% from 2020/21, reaching a level around its five-year average, said the Agriculture and Horticulture Development Board (AHDB). In Germany, the federal statistics office said that winter grain seedings were up 1%, including a plus of 3% for wheat.

At the same time, Europe’s rapeseed output may rise at least slightly from the exceptionally low 2019/20 level. The EU is set to end the current 2020/21 season with low stocks, and the import potential is too low to offer substantial relief. A late-summer drought hampered field work in France and Romania, while in Britain growers have turned away from the crop because of poor yields and insect problems. France’s AgMin estimated that the area would rise slightly from 2020 but remain no less than 17% below the five-year average. In Germany, plantings for the 2021/22 cycle were estimated 3% above last year. At the same time, the UK's rapeseed area was seen falling 18.1% to the lowest since 1986.

In the US, corn plantings for the 2021 harvest may decline, and growers may favour soybeans instead. The US Department of Agriculture (USDA) in early November projected a y/y decline in the corn area from the high 2019/20 level plus a sharp growth for soybeans, boosted by excellent export prospects to China (following eased tensions and a recovery in pig numbers there) and a very tight 2020/21 US balance.

A key factor of uncertainty on the global grains market will be China’s import needs. Corn output is being closely watched amid a growing deficit in the country that has driven up prices to multi-year highs, boosting imports to record levels and fuelling purchase of other grains. The USDA attaché recently boosted the projection for corn imports in 2020/21 (October/September) from 7.0 million tonnes to 22.0 million (2019/20: 7.0 million). With tight reserves, sources indicate that substantial imports will be necessary to meet demand while also controlling further price increases and maintain stocks throughout 2021. At the same time, Beijing targets an increase in domestic production for 2021/22.

In Brazil, sugarcane plantations are suffering from the second consecutive year of below-average rains. Adverse climate conditions in most of the country in recent months will hurt development and could lead to a smaller crush and sugar production in the 2021/22 season. Excessive dryness has led to a large number of fires, both in forested areas and in agricultural fields. The excessive dryness seen between July and September reduced cane plantings and crop care, which will lead to lower agricultural yields next year. The financial effects for the mills will be limited by the good sugar economics. Moreover, a rising share of the local ethanol supply comes from corn, and the higher sugar output will boost the availability of molasses.

The transition of Brussels' decarbonization and renewable energy targets will be the focus in the European Union. COVID-19 has interrupted the supply chains for advanced biodiesel suppliers in Europe. So far, the bulk of biofuel products supplied outside the cap for crop-based product is biodiesel made from used cooking oil (UCO) and animal fat. COVID-19-related lockdown measures cut UCO supplies sharply and supported imports of UCO and UCOME as well as the use of plant oil-based product within the limits of the Renewable Energy Directive I (RED I). In 2021, higher biofuel quotas in several member states and the expected rebound in road fuel demand will raise feedstock demand. This means that the European biofuel market will remain an attractive outlet for biofuel and feedstock exporters worldwide which serve the non-crop

segment.

On the policy front, the implementation of the RED II will be a key issue for the member states. The piece targets an increase in the RE share in road and rail transport to 14.0% from 10.0% in the RED I for 2020. However, it also includes a cap on crop-based product and the phase-out of biofuels made from feedstock with a high risk of indirect land use change (ILUC). Member state policies with regards to implementation may differ widely. Just recently, Germany’s Environmental Ministry came out with a proposal for a very strict cap on crop-based biofuels which caused an uproar across the biofuels supply chain and in the government. The RED II’s ILUC provisions target to cut the use of palm oil and are under attack from exporters such as Indonesia and Malaysia.

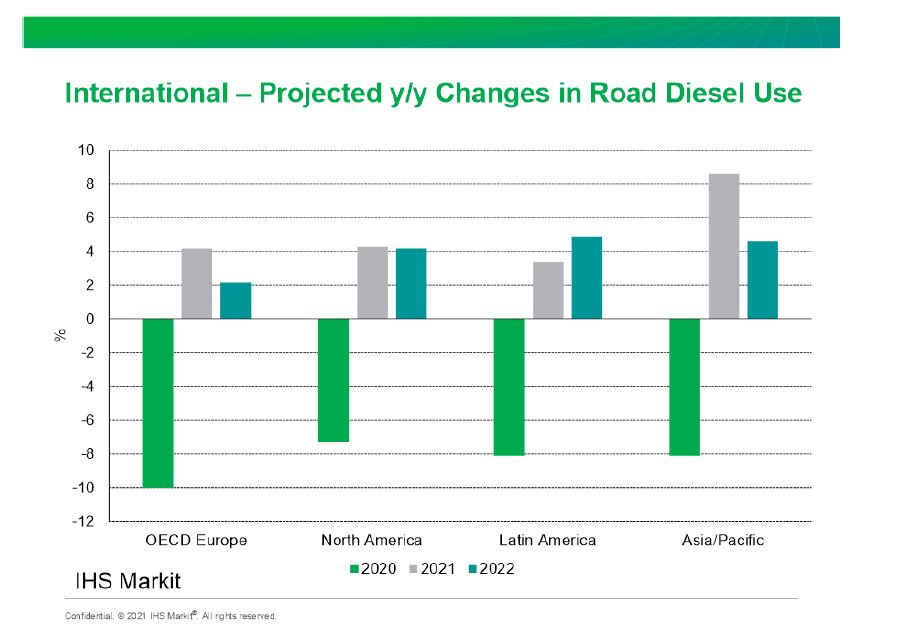

International – Projected y/y Changes in Road Diesel Use

New feedstock will enter the fuel ethanol sector in India. New Delhi has ambitious plans for its future fuel portfolio. The 2018 Biofuel Policy fixed a blending target of 20% vol. of fuel ethanol by 2030. The government aims to achieve the first milestone of a 10% blending share by 2022. The share will rise to 8.5% vol. in 2020/21 (December/November), the local press cited the Food Ministry recently as saying, significantly higher than the current 4.8%. To avoid conflicts over feedstock supplies between fuel and traditional ethanol suppliers and to help the sugar sector, the Union government allowed the use of new feedstock, such as B-molasses, sugarcane juice and damaged food grains. Corn may be the next addition. Earlier, only fuel ethanol made from C-molasses qualified for the local market.

Changes are on the cards for the biodiesel policy in Argentina and Brazil. Brazil’s government announced the sunset for the current strictly regulated biodiesel policy regime for 2022. Tight feedstock markets and better-than-expected road fuel demand prompted a roller-coaster ride for the local biodiesel and fuel sector in 2020, including excessively high biodiesel prices and revisions in the mandate.

Meanwhile, Brasilia allowed the use of imported feedstock to a certain extent. At the same time, the current auction system with its limited access to the domestic biodiesel market will expire by the end of 2021. Regarding the large size of the market, any liberalisation here has the potential to change biodiesel and feedstock trade flows significantly.

Last but not least, the future use of renewable diesel has to be clarified, as state controlled oil major Petrobras is in a reorganization process.

In Argentina, the biofuels sector was severely hit by the peso crisis, frozen fuel prices and the COVI-19 pandemic. The B-10 and E-12 mandates expire in May, and the government is currently discussing the future biofuels policy.

The future of biodiesel blending in Indonesia will impact the palm oil market. Indonesia currently runs a B-30 mandate but targets to expand this in order to achieve FX savings from lower fuel imports and to support the local palm oil sector, fearing lower oil and biodiesel exports to Europe (see above). The next stop for Jakarta’s ambitious biodiesel policy would be a B-40 mandate in road transport.

However, several problems emerged. First, technical issues regarding the usability of the higher blend have to be clarified. Second, COVID-19 and high palm oil prices boosted subsidies for the blenders. These are financed with export taxes and levies on palm oil and products. Indonesia’s biodiesel consumption primarily depends on the government’s budget. Jakarta recently boosted levies and tax rates on palm oil. However, the recent palm oil rally also prompted the government to state that the planned increase in the biodiesel mandate would not come in 2021. Nevertheless, the decision whether the current 7-8 million tonnes per year market will rise by one third will be closely watched.

Malaysia targets an increase in the mandate to B-20 from B-10. Regional B-20 started last year, but the roll-out of the higher blend was interrupted by COVID-19 and the palm oil rally. B-20 is seen boosting demand for biodiesel by 534,000 tonnes per year. A B-20 mandate will require about 1.06 million tonnes of palm oil.

Biofuels will continue to expand into new applications outside the road segment. Decarbonisation efforts will be in the focus of energy policy debates worldwide. Lawmakers will also focus on lower emissions from international maritime and air transport. Sustainable aviation fuels (SAF) and waste-/biomass-based liquid solutions for the shipping sector offer some potential on a lack of alternatives.

In Europe, the governments of Norway and Sweden earlier started supportive legislation for SAF. France is discussing a SAF mandate to be introduced in the short term. There also were reports on discussions over SAF mandates in other EU member states, including Germany, the Netherlands and Spain, while several industry initiatives are underway in the United States.

The situation with maritime biofuel is different. So far, no mandates are planned, but there are the decarbonisation and desulphurisation targets from the International Maritime Organisation. Several trials were conducted with various biofuel blends last year, and this may also be the case in 2021. Moreover, there are research initiatives

such as the one at Alfa Laval and a project with lignin feedstock in Scandinavia.

New demand for liquid biofuels from aviation and shipping will prompt a diversion of the output from biofuel units hydrotreating their feedstock, i.e. the ones currently producing renewable diesel for road applications. At the same time, these new markets may yield higher prices than product for the road and therefore be able to impact or destroy established supply chains.