How COVID-19 will affect global biofuels demand

This article was first published by F.O. Licht on 3rd April 2020. For an updated analysis, join F.O. Licht Managing Director Christoph Berg at our upcoming webinar, Responding to COVID-19: Global Ethanol Market Update, taking place 27th May at 1pm BST.

The novel coronavirus (COVID-19) outbreak is sending shockwaves through the global economy. The impact is particularly acute in oil product markets, as restrictions on international travel and regional and local movement prevent people and goods from circulating freely, which takes a heavy toll on transport fuel demand.

In Europe, restrictions on movements and social contact have spread almost as fast as the virus itself, e.g. disrupting industrial production and lowering trade and shipping activities. Moreover, the peak is yet to come, as officials warn that the number of cases will continue to grow.

An impact on the global biofuels market yet is hard to gauge. However, we take a quick look at some key markets, guided by the question to which extent the current projections for gasoline and gasoil and the existing blending targets would lower biodiesel and fuel ethanol demand.

Given the very fluid situation this assessment will have to be updated regularly.

An illustrating example – how EU road fuel demand is affected

As more countries expand quarantine measures and begin country-wide lockdowns, gasoline and diesel demand is set to plummet.

According to data from rush hour traffic trackers, commuter traffic in heavily affected cities like Milan, Madrid, and Paris fell by up to 80% compared to average levels before confinement measures were put in place. Traffic had already been affected by calls for people to voluntarily work from home.

| EU: Ethanol Balance (1,000 cubic metres) | ||||

| Jan/Dec | ||||

| 2020 | 2019 | 2018 | 2017 | |

| Opening stocks | 1,029.6* | 952.6* | 890.5* | 887.0* |

| Output | ||||

| Fuel ethanol | 4,200.0* | 4,847.0* | 4,834.0* | 4,611.0* |

| Non-fuel ethanol | 2,450.0* | 2,113.0* | 2,077.0* | 2,036.0* |

| TOTAL | 6,650.0* | 6,960.0* | 6,911.0* | 6,647.0* |

| Imports | 955.0* | 1,235.8* | 535.6* | 406.9* |

| Consumption | ||||

| Industrial ethanol | 1,900.0* | 1,417.0* | 1,420.0* | 1,323.0* |

| Potable ethanol | 800.0* | 870.0* | 860.0* | 855.0* |

| Fuel ethanol | 4,430.0* | 5,037.0* | 4,736.0* | 4,570.0* |

| TOTAL | 7,130.0* | 7,324.0* | 7,016.0* | 6,748.0* |

| Exports | 580.0* | 794.7* | 368.6* | 302.3* |

| Ending stocks | 924.6* | 1,029.6* | 952.6* | 890.5* |

| Source: Licht Interactive Data | ||||

| EU: FAME/HVO Balance (1,000 Tonnes) | ||||

| Jan/Dec | ||||

| 2020 | 2019 | 2018 | 2017 | |

| Opening stocks | 7,600* | 7,107* | 4,510* | 3,284* |

| Output | ||||

| FAME | 9,800* | 11,808* | 12,473* | 11,523* |

| HVO | 3,885* | 2,960* | 2,741* | 2,816* |

| TOTAL | 13,685* | 14,768* | 15,214* | 14,339* |

| Imports | ||||

| FAME | 1,800 | 3,458 | 3,554 | 1,226 |

| HVO | 0* | 0* | 0* | 200* |

| TOTAL | 1,800* | 3,458* | 3,554* | 1,426* |

| Consumption | ||||

| FAME | 12,500* | 13,248* | 12,497* | 11,068* |

| HVO | 3,400* | 2,548* | 2,337* | 2,532* |

| TOTAL | 15,900* | 15,796* | 14,834* | 13,600* |

| Exports | ||||

| FAME | 1,500 | 1,666 | 1,158 | 595 |

| HVO | 200* | 271* | 179* | 344* |

| TOTAL | 1,700* | 1,937* | 1,337* | 939* |

| Ending stocks | 5,485* | 7,600* | 7,107* | 4,510* |

| Source: F.O. Licht | ||||

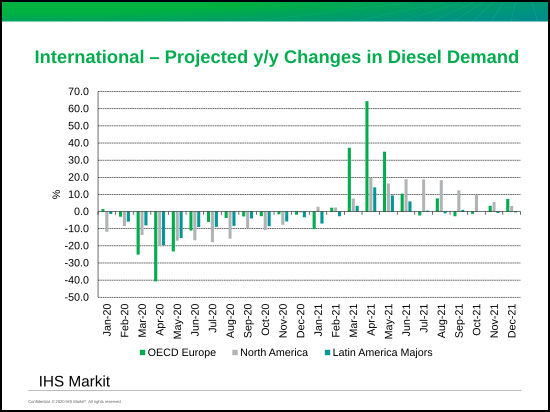

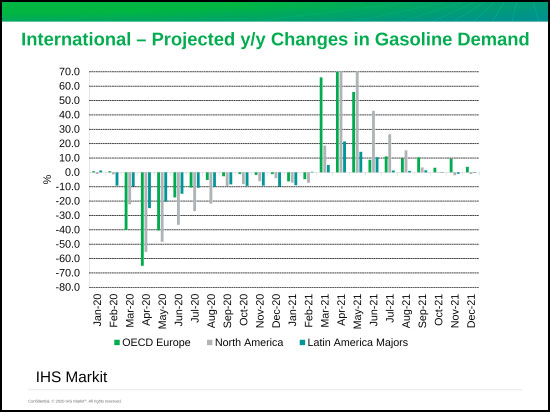

Against this background, IHS Markit is predicting a 65% y/y decline in April gasoline demand (a 1.3 mln barrels per day (bpd) drop off). Gasoil demand will fall by -40%, (close to 3.0 mln bpd) in the same month, with gasoil bunkers impacted, but the large part taken up by road diesel demand.

Fuel demand will particularly be impacted in France, Italy, Spain and Portugal; these and other southern countries usually enjoy a sizeable uptick in demand from tourism and car rentals during the summer months. IHS Markit’s forecast for Q3 assumes a sharp decline in intra-regional tourism.

Potential upsides to this outlook are an increase in intra-market travel as consumers may opt to holiday domestically rather than the more expensive (and potentially riskier) option of international travel.

Another potential upside for European demand is the lower crude prices and lower overall pump prices, which could boost demand heading into driving season, assuming travel bans are lifted by then.

There is also early evidence that as restrictions have been lifted in China, more people there are preferring to travel by private cars or taxis rather than taking public transport—it is highly likely this will happen in Europe too.

Later in 2020 and into 2021, the economic slowdown caused by the global disruptions will continue to impact gasoil and diesel demand, with factories and industrial plants running at lower levels. The potential upside for diesel and gasoil demand is that e-commerce activities - compensating for brick and mortar store closures - results in a higher number of deliveries carried by diesel-fueled vans and trucks.

Turbulent times ahead for EU biofuel producers

For the EU-27, diesel demand in 2020 is seen contracting by 10%. The expected decline in diesel demand coincides with an increase in biodiesel blending in several member states in 2020, the year when the 10.0% cal. renewable energy target in land transport in the Renewable Energy Directive (RED) and the 6.0% greenhouse gas reduction target in the Fuel Quality Directive come into the force.

How do these two factors – the expected sharp downturn in economic activity over parts of 2020 and the mandated increases in biodiesel blending – translate into figures?

In 2019, the European Union consumed an estimated 16.0 mln tonnes of biodiesel, including 13.5 mln of fatty acid methyl esters (FAME) and 2.5 mln of hydrotreated vegetable oils (HVO).

In a world without the coronavirus, biodiesel demand was set to rise by 12% to 17.8 mln tonnes, of which 3.5 mln of HVO and 14.3 mln of FAME, with the bulk of the increase coming from higher quotas with growth in diesel use delivering only a small portion of the growth.

The list of member states with strong y/y increases in 2020 biofuel quotas includes large fuel markets such as France (10.0% vs 7.0%), Italy (9.0% vs 8.0%), Poland (8.5% vs 8.0%) and Spain (8.5% vs 7.0%). Other important markets now also target higher biofuels use such as Austria (8.75% vs 5.75%), Finland (20.0% vs 18.0%) and the Netherlands (16.4% vs 12.5%). At the same time, the greenhouse gas (GHG) reduction targets in Germany and Sweden rise (to 6.0% from 4.0% and to 21.0% from 20.0% (only diesel), respectively).

The current projections translate into a slight decline in 2020 biodiesel demand, or a loss of 2 mln tonnes when compared with demand under “normal circumstances”. This may not sound impressive at first sight, but the devil is in the details of the EU biodiesel balance, and it can be expected that FAME from plant oils will suffer most from the demand-side contraction. Why is this the case?

First, refiners prefer to blend HVO over FAME on technical reasons (energy content, physical and chemical characteristics) and the higher blending limit. The EU-wide production capacity of the product rose in 2019, so almost 3.5 mln tonnes could be available for the market in 2020. It can be assumed that this tonnage will find its way to the market. Risk factors like coronavirus-induced production stops (see Neste’s recent news on maintenance at Porvoo) or other disruptions of the supply chain outside and inside the bloc exist, but this also applies to other fuels and also to imports and not only to HVO.

| Europe: Delta 2020 FAME Demand under Various Scenarios | |||

| Y/y change in diesel demand in % | FAME demand in mln tonnes | ...y/y change in % | ...y/y change in mln tonnes |

| 2.0 | 14.4 | 7.2 | 1.0 |

| 1.0 | 14.2 | 5.9 | 0.8 |

| 0.0 | 14.1 | 4.6 | 0.6 |

| -2.0 | 13.7 | 2.0 | 0.3 |

| -4.0 | 13.4 | -0.6 | -0.1 |

| -6.0 | 13.0 | -3.2 | -0.4 |

| -8.0 | 12.7 | -5.8 | -0.8 |

| -10.0 | 12.3 | -8.4 | -1.1 |

| -12.0 | 12.0 | -11.1 | -1.5 |

| -14.0 | 11.6 | -13.7 | -1.8 |

| -16.0 | 11.3 | -16.3 | -2.2 |

| -18.0 | 10.9 | -18.9 | -2.5 |

| -20.0 | 10.6 | -21.5 | -2.9 |

| Source: Licht Interactive Data | |||

Second, there is a strong preference for waste-based biodiesel (FAME and HVO) on the market, following the double counting provisions (DC) for that kind of renewable fuel fixed in the RED, its advantageous GHG emissions and the fact that the market share of crop-based product is capped in the RED and in member state legislations. Last but not least, high quotas in some member states make the use of DC biofuel necessary. EU-wide DC biodiesel production in 2020 was earlier projected at almost 6 mln tonnes, of which more than 3 mln from used cooking oil (UCO), while several 100,000 tonnes of UCOME were set to be imported.

Clearly, the waste segment will also suffer from the lockdown, as e.g. the UCO supply will fall (closed restaurants, canteens e.g.), while the availability of imports of UCO and UCOME (mainly from China) will likely also decline. Nevertheless, DC biodiesel remains a highly sought product, and the EU market can absorb a lot. A wildcard here is a long supply-side disruption, e.g. due to problems with collecting UCO. The lockdowns in the EU have a devastating impact on the availability of UCO, collector say. Plant oil-based could be much more easily available, also due to the high stocks, and replace DC product. However, there are the caps on crop-based product which limit demand.

Third, imports of plant oil-based FAME will fall y/y, also due to the anti-subsidy duties imposed on Indonesian product and the higher mandate there, but continue to exist. Argentina has a tariff rate import quota of 1.2 mln tonnes per year, and Malaysia should have an exportable surplus in 2020. True, the coronavirus and the peso crisis in Argentina will push the volumes below the level which would have been normally expected, but there will be significant imports also in 2020.

Fourth, there was a built-up in biodiesel stocks in the EU in recent years. In 2018 and 2019, changes in tariffs lifted biodiesel imports to above 3 mln tonnes per annum. These stocks weigh on the market and may cut output once more.

We therefore see an 8% reduction in EU biodiesel output to 13.7 mln tonnes in 2020 a likely outcome, with FAME hitting a six-year low of less than 10 mln. The projected recovery for 2021 may boost demand and output.

The EU ethanol market will mostly likely be harder hit biodiesel as gasoline-powered passenger vehicles will bear the brunt of the slow-down in overall demand for transportation fuels. At the moment, we expect fuel ethanol consumption in 2020 to fall by around 12% to 4.43 mln cubic metres.

The decline in demand has triggered a sharp downturn in prices which hit a record low of below EUR400 per cubic metre in the last week of March. This compares with well over EUR600 before the crisis hit.

The development has forced producers to react. In France the No. 2 ethanol producer, Cristalco, has said that its plants have reduced their run-rates. The Vertex facility in the south of the country has reportedly shut down. In Belgium, CropEnergies will leave their plant in Wanze longer in maintenance and the Alcogroup is just in the process of deciding whether to shut down its site in Rotterdam (which is Europe’s largest plant) or the smaller facility in Ghent. All in all, more than one billion litres of capacity is currently either off-line or in the process of being shut down.

This is bound to influence fuel ethanol production and for the time being we have lowered the number to around 4.2 bln litres, 12% less.

While capacity adaptations are one counter-measure, changing the production portfolio is another. The demand for disinfectants is surging and some European producers are confident that a large part of the losses seen in the fuel market may be compensated for by increased sales to this sector during the months of the COVID-19 crisis.

There is a wide range of estimates for the disinfectants market for none of which there is a tested data-base. At the lower end there are estimates of 20-30 ml of disinfectants demand per person and day for the most affected countries in the EU. This alone would translate into around 140-200 mln litres of additional demand per month. In some countries health authorities are calculating with 30 litres of disinfectants per person and year which would translate into around 600 mln litres of ethanol demand per month. Other estimates work with an additional 2020 ethanol demand for disinfectants in the order of almost 700 mln litres, which would also more than compensate for the loss in fuel consumption.

And while quite impressive one should not forget that considerable logistical and legal challenges will have to be overcome before this volume can be achieved.

Corona cuts growth prospects for biofuel markets in the US, Brazil

Demand losses are also on the cards for the biofuel sector in the United States. Before corona started to bite in, nationwide biodiesel demand was set to rise by 1 mln tonnes on the back of a higher biodiesel mandate in the Renewable Fuel Standard, an increase in the GHG reduction target under California’s Low Carbon Fuel Standard and the re-introduction of the Blender’s Tax Credit for biodiesel in late 2019.

How will the projected demand-side contraction in diesel demand (13%) impact the US biodiesel balance?

| U.S.A.: Ethanol Balance (1,000 cubic metres) | ||||

| Jan/Dec | ||||

| 2020 | 2019 | 2018 | 2017 | |

| Opening stocks | 3,543.6* | 3,783.3* | 3,709.1* | 3,002.9* |

| Output | ||||

| Fuel ethanol | 50,400.0* | 59,725.0 | 60,801.6 | 59,984 |

| Non-fuel ethanol | 2,400.0* | 1,600.0* | 1,575.0* | 1,550.0* |

| TOTAL | 52,800.0* | 61,325.0* | 62,376.6* | 61,534.0* |

| Imports | 1,350.0* | 1,334.1 | 1,059.6 | 1,053.4 |

| Consumption | ||||

| Industrial ethanol | 2,000.0* | 1,070.0* | 1,047.0* | 903.0* |

| Potable ethanol | 815.0* | 810.0* | 803.0* | 797.0* |

| Fuel ethanol | 45,000.0* | 54,600.0* | 54,165.0* | 54,060.0* |

| TOTAL | 47,815.0* | 56,480.0* | 56,015.0* | 55,760.0* |

| Exports | 6,100.0* | 6,418.8 | 7,347.0 | 6,121.3 |

| Ending stocks | 3,778.6* | 3,543.6* | 3,783.3* | 3,709.1* |

| Source: Licht Interactive Data | ||||

How will the projected demand-side contraction in diesel demand (13%) impact the US biodiesel balance?

Assuming constant blending ratios, the 2020 biodiesel market is set for a small y/y increase to slightly above 9 mln tonnes. The coronavirus is seen costing almost 1 mln tonnes of “lost demand”. Regarding the FAME vs HVO competition, the availability of HVO rises also here.

The outlook for the ethanol market is considerably gloomier. Gasoline consumption is expected to tank by about 20% in 2020 and by 50% in Q2. This is due to the composition of the passenger car fleet which is predominantly gasoline-powered. As ethanol is blended at a relatively fixed rate of 10% vol., it will see a similar decline.

| U.S.A.: FAME/HVO Balance (1,000 Tonnes) | ||||

| Jan/Dec | ||||

| 2020 | 2019 | 2018 | 2017 | |

| Opening stocks | 1,371.9* | 1,576.6* | 1,300.7* | 1,432.7* |

| Output | ||||

| FAME | 5,670.0* | 5,742.3* | 6,185.3* | 5,316.0* |

| HVO | 2,125.0* | 1,750.0* | 1,450.0* | 1,300.0* |

| TOTAL | 7,795.0* | 7,492.3* | 7,635.3* | 6,616.0* |

| Imports | ||||

| FAME | 600.0* | 591.6 | 564.0 | 1324.4 |

| HVO | 763.0* | 800.8* | 550.8* | 631.6* |

| TOTAL | 1,363.0* | 1,392.3* | 1,114.7* | 1,955.9* |

| Consumption | ||||

| FAME | 6,070.0* | 6,032.1 | 6,311.9 | 6,611.6 |

| HVO | 2,900.0* | 2,675.2* | 1,816.6* | 1,779.4* |

| TOTAL | 8,970.0* | 8,707.3* | 8,128.5* | 8,391.1* |

| Exports | ||||

| FAME | 400.0* | 382.1 | 345.6 | 312.8 |

| TOTAL | 400.0* | 382.1 | 345.6 | 312.8 |

| Ending stocks | 1,159.9* | 1,371.9* | 1,576.6* | 1,300.7* |

| Source: Licht Interactive Data | ||||

As diesel demand is less affected the discount for gasoline has reached the highest level since the 2008/09 recession. As a result, fuel ethanol prices have fallen to all-time lows and operators are suffering considerable losses.

A substitution process like the one in the EU (fuel for industrial) will occur but the this is likely to be less successful for two reasons:

- the fuel ethanol market is about 11 times the size of the EU’s

- the population is about 60% that of the EU (including the UK which will be part of the common market at least until the end of the year).

This means that capacity will have to be adapted at a large scale and industry representatives have already announced that 3 bln gallons are currently in the process of being shut down. This would be equivalent to around 20% of total capacity.

As it was the case in the other markets, the outlook for Brazil is for an increase in the blending share in 2020. Brasilia boosted biodiesel blending from March 1 to 12.0% from 11.0% since March 2019. The next increase to B-13 is scheduled for March 2021.

Based on an 8% contraction in blending, this would lower 2020 biodiesel demand by 0.5 mln tonnes to 5.6 mln, still a 10% increase on 2019.

At the same time, the ethanol market will shrink for three reasons:

- as in other countries, Brazil is likely to move into recession which will have direct bearing on the number of miles driven by passenger vehicles (which are exclusively powered by ethanol or gasoline/ethanol mixes).

- the sharp price decline for gasoline will squeeze hydrous ethanol out of the market

- the relatively higher sugar price will prompt Brazilian millers to produce more of the sweetener at the expense of ethanol.

Some fuel/industrial substitution will take place, but the effect will be even less pronounced than in the EU or the USA.

| Brazil: Ethanol Balance (1,000 cubic metres) | ||||

| Apr/Mar | ||||

| 2020/21 | 2019/20 | 2018/19 | 2017/18 | |

| Opening stocks | 1,470.6* | 1,608.6* | 1,369.9* | 1,763.0* |

| Output | ||||

| Fuel ethanol | 29,400.0* | 32,740.0* | 30,797.9* | 25,834.0* |

| Non-fuel ethanol | 2,950.0* | 2,460.0* | 2,318.1* | 1,944.5* |

| TOTAL | 32,350.0* | 35,200.0* | 33,116.1* | 27,778.5* |

| Imports | 1,220.0* | 1,500.0* | 1,518.0 | 1,758.1 |

| Consumption | ||||

| Industrial ethanol | 1,750.0* | 1,288.0* | 1,290.0* | 1,302.0* |

| Potable ethanol | 370.0* | 362.0* | 360.0* | 357.0* |

| Fuel ethanol | 30,000.0* | 33,250.0* | 30,875.0* | 26,700.0* |

| TOTAL | 32,120.0* | 34,900.0* | 32,525.0* | 28,359.0* |

| Exports | 1,400.0* | 1,938.0* | 1,870.4 | 1,570.7 |

| Ending stocks | 1,520.6* | 1,470.6* | 1,608.6* | 1,369.9* |

| Source: Licht Interactive Data | ||||

| Brazil: FAME/HVO Balance (1,000 Tonnes) | ||||

| Jan/Dec | Dec | Dec | Dec | |

| 2020 | 2019 | 2018 | 2017 | |

| Opening stocks | 1,273.6* | 1,247.2* | 1,217.0* | 1,194.6* |

| Output | ||||

| FAME | 5,300.0* | 5,193.0 | 4,708.0 | 3,776.3 |

| TOTAL | 5,300.0* | 5,193.0 | 4,708.0 | 3,776.3 |

| Consumption | ||||

| FAME | 5,620.0* | 5,166.6 | 4,677.8 | 3,753.4 |

| TOTAL | 5,620.0* | 5,166.6 | 4,677.8 | 3,753.4 |

| Ending stocks | 953.6* | 1,273.6* | 1,247.2* | 1,217.0* |

| Source: Licht Interactive Data | ||||

The short-term outlook

At first sight, the current projection does not look too so bad for biodiesel. Rising mandates and the fact that vehicle fleets in the US and Brazil have a much lower diesel share means that it will be mainly growth prospects that will be affected.

However, it has to be emphasized that the outlook was based on an economic recovery during H2 2020 and 2021. Sharper than originally projected declines in fuel use would make the decline in biodiesel demand in the EU bigger and could also prompt a decrease in consumption in Brazil and the US.

For ethanol a similar reasoning applies. Should the economic recovery be delayed, demand losses could be bigger, and the crisis of the industry could deepen.

The weaker prospects for 2020 will also cut capacity utilization sharply, mainly for FAME and ethanol:

- for FAME, there are more than 18 mln tonnes of operational production capacity in the EU, in the US more than 8 mln, while in Brazil, the nationwide total exceeds 9 mln.

- for ethanol, it is close to 48 mln tonnes in the US, 30 mln in Brazil and 4 mln in the EU.

In both cases, the earlier projected recovery in utilization rates in some regions and the prospects for an improvement in margins will be delayed.

Finally, the impact on feedstock and co-product markets should not be underestimated. The loss of 3.5 mln tonnes of biodiesel volume against earlier expectations means that earlier contracted feedstock tonnage (mainly plant oils) will become available for the market again. Lower biodiesel demand also cuts stocking requirements. As stocks are already elevated, these may now have to be released onto the market, possibly at very low prices. This is another heavy blow, especially for EU producers.

In ethanol, sugarcane demand for the green fuel will shrink in Brazil, but this volume will be processed into sugar where prices are more profitable for the time being. The country’s corn ethanol producers also will suffer, and there are reports that all projects in that sector are on hold at the moment. With production margins deeply in the red it may well be that plants will have to be shut down. This will mostly concern pure corn ethanol plants.

In the US, grain demand for ethanol may fall to around 4.6 bln bushels of corn (1 bu=25.4 kg) from 5.4 mln. This represents a decline of about 20 mln tonnes. This also means that 7 mln tonnes of animal feed (dried distiller grains) will be lost for the domestic and international feed industries. Prices have already reacted and are on the way up.

In Europe, the fall in ethanol output and demand will be relatively modest provided the disinfectant market is growing in line with current expectations and major logistical bottlenecks can be avoided.