Overcoming the barriers to entry for aviation biofuels

Aviation is both one of the fastest growing emissions sources and one of the most challenging to decarbonise.

The available solutions are limited. Despite growing hype around passenger electric alternatives, electrification is unlikely to prove a near-term option except for small aircraft on short hop flights.

Similarly, improvements in fuel and navigational efficiency do not go far enough to reduce emissions on their own. Average efficiency gains of 1 – 2% per year are being outpaced by an annual growth rate in airline traffic of 5%.

This leaves Sustainable Aviation Fuels (SAFs) as the only credible means of reducing direct emissions from air travel on a meaningful scale.

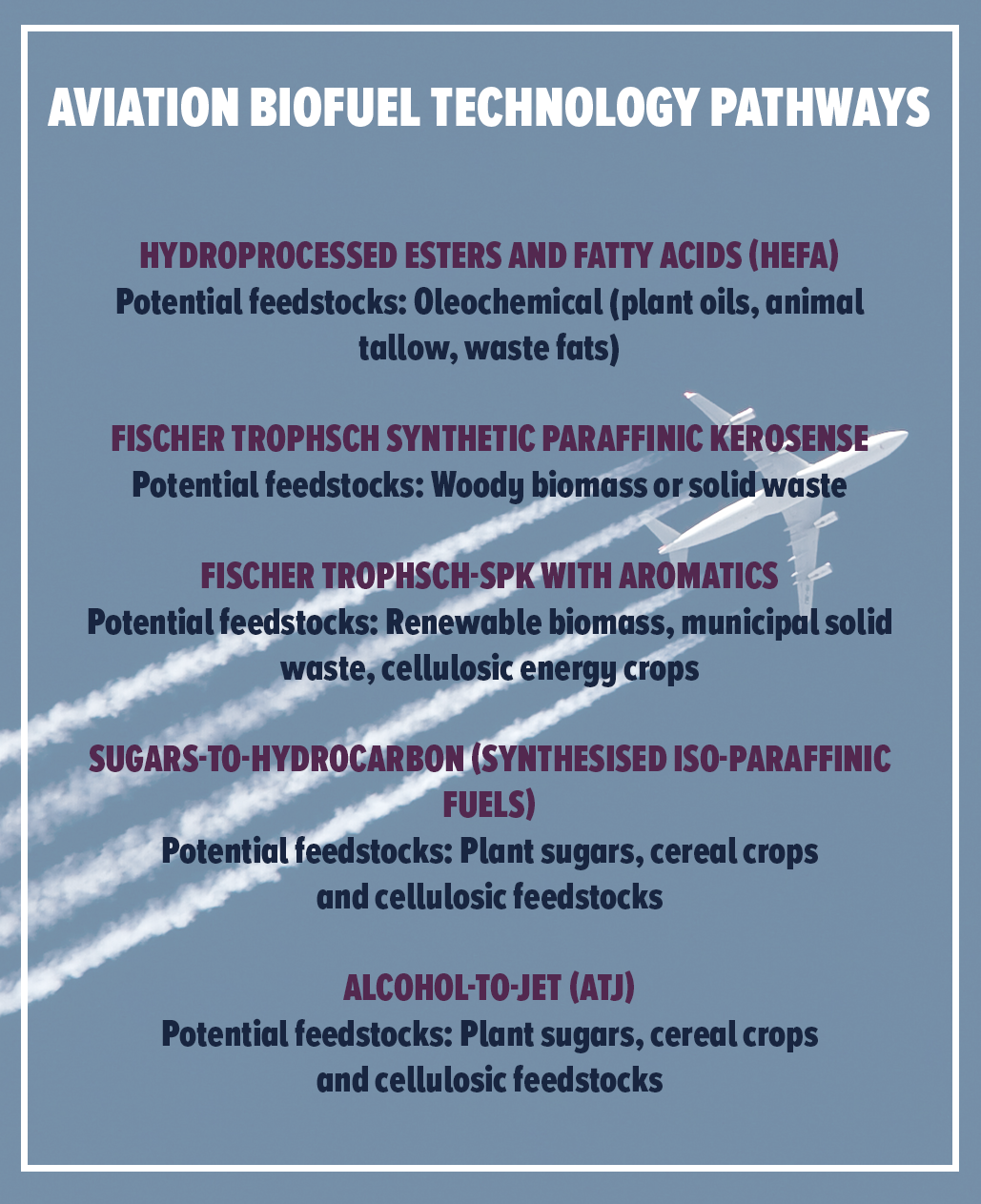

Included within this category are aviation biofuels produced through any of five technology pathways certified to industry standards, as well as electrofuels produced using renewable energy.

But SAF deployment is still in its infancy, and creative thinking is needed to enable these fuels to thrive.

From a policy perspective, the most progress has been made in Norway, where a new quota is scheduled to be introduced next year. Though it is a promising first step, the quota will see biofuels making up only 0.5% of the country’s aviation fuel supply.

Worldwide, deployment is still more limited. Aviation biofuels currently account for less than 0.1% of the industry’s fuel consumption, mostly down to adoption by individual airlines. Electrofuels have yet to move beyond the laboratory testing stage for air travel.

The deployment barriers are much the same as with any aspiring technology. Progress is being obstructed by the relatively high cost of novel fuels compared to the incumbent technology (fossil kerosene), as well as by the scarcity of existing production capacity.

Concerns about feedstock sourcing (including questions around the sustainability of oil crops, and availability constraints for some waste-based feedstocks) may also be a factor.

Regulatory measures that work to lower costs and incentivise the use of sustainable aviation fuels are needed – especially in light of an aspirational target set by the industry to achieve a 50% reduction in net CO2 emissions from aviation by 2050.

Want more articles like this? Sign up to the KNect365 Energy newsletter>>

But the consequences for SAF adoption of the most important piece of regulation currently in prospect, the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), are still somewhat ambiguous.

Drawn up by ICAO, the UN body responsible for regulating the global aviation industry, CORSIA will oblige airlines to purchase carbon offsets to hold the industry to its commitment to achieve “carbon neutral growth” from 2020 onwards.

Sustainable aviation fuels are included within the framework of CORSIA as one of the offsetting measures airlines can use to satisfy their obligations. But there is a risk that airlines may opt for cheaper offsets if specifications are not tightened.

This article will take a considered look at the market prospects for aviation biofuels, covering the need to reduce emissions, the availability of feedstocks, how CORSIA could impact the use of aviation biofuels, and which regulatory instruments could stimulate their uptake in future.

Emissions from aviation

In 2018, aviation accounted for only 2.4% of global anthropogenic CO2 emissions. This makes it a much smaller emissions source than big offenders like power generation and heating (25%), agriculture and land use (24%), road transportation (18.5%) or cement production (8%).

But the rise in passenger journeys expected over the next few decades, as well as the well developed near-term means of decarbonisation in other sectors, mean that aviation will account for an increasingly significant proportion of global CO2 emissions.

In 1990, there were approximately 640 million passenger journeys globally – an average of 0.14 journeys per year for every human being on earth. By 2017 this had risen to over 4 billion.

By 2037, the International Air Transport Association (IATA) forecasts that passenger numbers could reach 8.2 billion. That would mean a global average of almost one journey per year, assuming population growth tracks in line with current estimates.

Without low carbon fuels, increasing air traffic will have serious consequences for the climate. According to analysis by Dr Joeri Rogeli of the International Institute for Applied Systems Analysis, published by Carbon Brief, the aviation sector’s existing targets through to 2050 put it on track to consume 12% of the global carbon budget consistent with 1.5 degrees of warming.

If the aviation industry fails to abide by these targets, its share could rise as high as 27%.

Although not within the scope of this article, it should be said that other aviation exhaust gasses and aerosols, such as NOX and soot, also play a role in atmospheric warming.

The effects of these emissions are poorly understood – but according to some estimates they could be increasing the aviation industry’s climate impact by a factor of two.

Technologies and feedstocks

The five ASTM certified pathways for producing aviation biofuels are detailed in the infographic below.

The only one currently commercialised is the HEFA route, which works with vegetable oils including used cooking oil, animal tallow and waste fats. It is expected to remain the sole commercially viable option for the next five years at least, according a recent commentary piece by IEA analyst Pharoah Le Feuvre.

Production costs are a key consideration. Research by the International Council on Clean Transportation (ICCT) shows that HEFA is by far the least expensive pathway, with an average levelised production cost of €0.88 per litre for fuel made from waste fats and oils. This makes it approximately double the current price of fossil kerosene.

By comparison, the estimated production cost of direct conversion of sugar to hydrocarbons (the synthesised iso-paraffinic fuel route) is €3.44 per litre.

A different way of computing costs is in terms of cost per tonne of CO2 abated. Assuming conducive policy measures – such as high carbon pricing for aviation fuels, or a low carbon fuel standard – reckoning costs this way could provide a better indication of the relative attractiveness of the pathways down the line.

HEFA using waste oils still comes out on top with a cost of €200 per tonne of CO2 equivalent abated, according to the ICCT. Second is the Fischer Trophsch method applied to municipal solid waste and lignocellulosic feedstocks, at around €400 to €500 per tonne of CO2 equivalent.

Without existing production at scale, these cost estimates are necessarily inexact. But interpreting how the four technology pathways play out over the short to medium term is essential for gauging the extent of biofuels’ future involvement in aviation.

Because the choice of technology determines the choice of feedstock, a wider range of commercially viable production methods implies a broader base of feedstocks for the industry to draw upon.

The quantities of waste feedstock available for the HEFA route are ultimately finite, and place constraints on the potential for aviation biofuels uptake, particularly given that these feedstocks are also consumed in much larger quantities by road transportation.

Utilising oil crops like canola, palm oil or soy would broaden the feedstock base for HEFA – but the aviation industry is understandably cautious about utilising any feedstocks with proven indirect land-use impacts.

Different organisations have contrasting perspectives on just how much feedstock is available for aviation biofuels. According to the European NGO Transport & Environment, biofuels will not be able to replace more than a limited share of current aviation fuel demand.

“We're sceptical that a 50% reduction in emissions through biofuel use is possible,” T&E’s Aviation Manager, Andrew Murphy, told KNect365 Energy. “We don’t see sufficient feedstocks being available given other demands.”

The NGO’s preferred pathway relies heavily on electrofuels to make up the supply gap.

“Crop-based biofuels and bioenergy can maybe get you towards 12 - 14% [of aviation fuel consumption],” Murphy says. “Let’s say we’re being too negative and it’s twice that. You still need to develop fuels beyond the biofuels.”

The producers themselves see greater potential. Meeting the demand implied by the 50% GHG reduction target may require a broader approach to feedstock sourcing, believes Pat Gruber, CEO of the advanced biofuels company Gevo.

“To produce that kind of quantity of fuel, it will take a variety of feedstocks,” Gruber says. “The good news is that technologies like ours can use wood, starch, sugar, agricultural residues, molasses, etc."

Focussing on feedstocks with subsidiary benefits, such as grain crops which also provide protein to the animal feed market, would also increase the quantity of feedstock available with fewer adverse impacts on food production and biodiversity.

But taking this approach requires that multiple technology pathways reach production at commercial scale.

Another factor to consider is that feedstock availability is intrinsically linked to demand from other sectors.

“The key question is whether road transport will still need liquid fuels by 2050. Here, forecasts are vary enormously,” says Alexander Zschocke, Senior Manager of Aviation Biofuels at Lufthansa.

“The outcome will be the driving force in the decades to come. Aviation use of liquid fuel is far smaller than road use,” he says.

Estimates of liquid fuel demand over the coming decades are highly variable, and linked to the prospects for electric vehicle uptake.

Recent analyses are upbeat about the falling costs of EVs. For instance, BloombergNEF estimates that electric vehicles in the EU are expected to reach cost parity with internal combustion engine vehicles by 2022.

But the electric vehicle market is still a small segment. Even exponential growth in sales will leave a high proportion of ICE vehicles on the road for decades.

Moreover, electrification may not be suitable for all forms of road transportation, including vehicles in remote areas and road freight.

Since 2000, trucking has been responsible for 40% of oil demand growth, according to the IEA. If this level of expansion is sustained, oil demand from road freight could grow by 5 million barrels per day through to 2050, leaving a strong justification for increased biofuel use in the sector.

Biofuels are also one of the few technologically mature low carbon fuels available to the shipping industry. Ensuring sufficient quantities of feedstock are available for aviation may therefore require policies which favour the use of biofuels in sectors without alternative solutions.

Where does CORSIA fit in?

The purpose of the Carbon Offsetting and Reduction Scheme for International Aviation is to hold the industry to its goal of preventing net CO2 emissions increases beyond 2020 levels.

Among climate experts, feelings about the scheme are mixed. Criticism has centred on two points: firstly, that its goal of “carbon neutral growth” lacks ambition, and is in any case inconsistent with the emissions reductions called for by the Paris agreement.

Secondly, that a lack of clarity around how offsets are purchased and verified may lead to a range of counterproductive outcomes. These include “double-counting”, wherein emissions cuts are counted towards the climate targets of the country they take place in, as well as by the airline that purchases them as an offset (effectively cancelling out any emissions reductions from the purchase).

CORSIA may also permit the use of cheap historical offsets (such as those generated by the Clean Development Mechanism, introduced as part of the 1997 Kyoto protocol), which would in turn undercut the adoption of SAFs.

“Airlines will, understandably, opt for the cheapest compliance strategy,” says T&E’s Andrew Murphy. “What offsets will be accepted under CORSIA remains to be decided, but we know there is huge pressure to go for ICAO to accept old CDM credits, and forest credits.”

Another issue is that China is pushing for the eligibility criteria for offsets to be determined by individual countries, rather than by ICAO. This could deliver a competitive advantage to airlines subject to less stringent offsetting criteria, and provide an incentive for countries to lower their own requirements.

These criticisms notwithstanding, CORSIA does provide a framework which – properly tweaked – could in some respects work to biofuels’ advantage over the long-term.

Updates to the ageing Clean Development Mechanism, for instance, could make aviation biofuels a more cost competitive offsetting option. In this case their inclusion within the scheme can supplement airlines’ individual efforts at biofuels adoption.

As the offsetting value of biofuels under CORSIA is pegged to the actual GHG reductions they deliver (instead of just the quantity of fuel blended), the scheme will also provide an incentive for the use of more sustainable feedstocks and production methods.

But the obligations imposed on airlines by CORSIA are not in themselves sufficient to deal with the problem of emissions from the aviation sector. Ultimately, it may be the misconception that they are – rather than any issues to do with the credibility of offsets – that proves to be the scheme’s most important failing.

“It’s acting as a distraction from the sort of policy measures governments need to put in place,” says Murphy. “National ministries in Europe, especially the transport ministries, think that the job is done because CORSIA exists.”

New policy approaches

If CORSIA cannot do the job on its own, what additional policy measures are needed to stimulate the uptake of aviation biofuels?

The first consideration needs to be the scale on which any policy approach would be implemented. The obvious answer is to work through ICAO to establish additional regulations globally.

But international regulations do not factor in the availability of fuel at different hubs, or the complex supply chains that will need to be developed for aviation biofuels and other SAFs. What works well in one region may not work so well in another.

A more localised approach, centred on individual airports, could help to prevent any problems around fuel availability, at least while those supply chains are being developed.

This would be a very different course to the one taken by biofuels in road transportation, where national blend mandates are very much the default option for boosting biofuels use.

As in Norway, mandates can be a viable solution where adequate fuel supply is assured. “[They are] a fair way of causing adoption because everyone would have to do it,” says Pat Gruber. “That said, airlines wouldn’t be keen on it, because it will cost them more (assuming biofuels cost more).”

Airlines will also “no longer have anything to say on the fuel or the feedstock,” says Alexander Zschocke. In Indonesia, where discussions are ongoing about implementing a mandatory blend rate for aviation fuels, there are worries that airlines may be forced to use palm oil based HEFA biofuel with questionable sustainability standards.

Sustainable sourcing needs to be a key component of a successful emissions mitigation strategy involving biofuels. To prevent inexpensive feedstocks with low GHG reduction profiles from predominating, a low carbon fuel standard (as seen with California’s LCFS, and soon in Brazil with the RenovaBio programme) could be a suitable option.

This type of policy approach would actively incentivise airlines to purchase fuels with better GHG reduction profiles. A stepped-up version of CORSIA, with the emphasis placed on reducing emissions rather than preventing further increases, could in theory serve the same purpose.

Another way to achieve this objective would be to do so through more effective carbon taxation. Aviation has been included within the European Emissions Trading Scheme since 2012, but low carbon prices mean that the impact of the ETS has so far been limited.

“The first thing [to do] is to try and reform ETS as much as possible,” says Andrew Murphy. “The aviation cap will start declining from 2021, but we think the overall ETS cap should be declining at a faster rate.”

Transport & Environment’s modelling indicates that a carbon price of at least €150 per metric tonne would be needed to stimulate change within the aviation industry in Europe (including moderation of fuel demand through fleet renewal and efficiency improvements).

The ETS allows airlines to reduce their allowance purchases – i.e., their exposure to higher carbon prices – if they can demonstrate alternative fuel use. But with carbon prices currently around €25 per metric tonne, there is little incentive to do so.

A final point is that these measures will count for little if demand from other sectors means that insufficient quantities of feedstock are available to aviation.

Multipliers that allow biofuel use in certain sectors to contribute more to meeting overall emissions targets are one approach to solving this problem. The EU’s Renewable Energy Directive II currently has a 1.2 multiplier applied to alternative fuels for aviation and shipping.

But because the production of advanced fuels is to some extent reliant upon a production base sustained by conventional biofuel demand, the inclusion of multipliers within RED II is controversial. Critics say that it leads to inefficiencies and reduces the overall quantity of low carbon fuels produced and consumed.

Each of these policy approaches has its own respective merits, so it is not yet certain which will prove the most effective way to bring down emissions from the aviation sector.

But the goal of any successful strategy should be the same: to reduce the cost to airlines of adopting SAFs over fossil fuels.

If this can be managed without compromising fuel availability or the need for sustainable sourcing, biofuels may yet prove to be the aviation industry’s most powerful weapon in the struggle to reduce emissions.