The availability of big data, new technologies (AI, machine learning, natural language processing, blockchain) and increasing connectivity are changing the market dynamics across different industries. Gabriella Kindert, Expert in Alternative Lending and Board Member at Mizuho Europe, and speaker at SuperReturn Private Credit Europe 2019, shares her research on the role of technology in the industry and aims to answer: What are the implications on the Private Debt market? How will it shape our industry? How can these technological trends be turned into opportunities for value creation for GPs and LPs?

Where will technology have the biggest impact?

Private markets are still characterised by various inefficiencies. New applications can provide significant operational improvements and better client experience. Technology is likely to transform Private Debt’s underwriting process, risk assessment, portfolio management, and matching supply and demand of capital.

I expect to see the biggest changes particularly in the following areas:

(i) Quality of credit scoring, disbursement, and monitoring

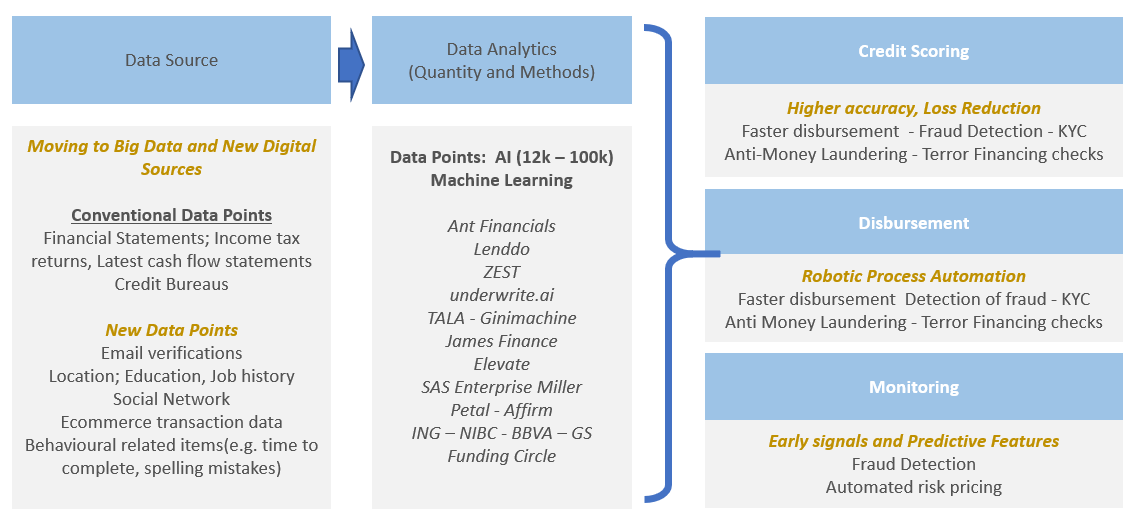

Data analytics and AI are making a significant difference in the quality and speed of risk assessment. There are several new applications, often developed by rating agencies, that are using traditional information matrix (primarily financial statements) and process it more efficiently.

In the lower SME and Consumer Finance segments, there are new applications that are able to assess creditworthiness faster and more accurately. Utilising a higher volume of data and new techniques, new companies are born, and new applications are developed by existing players (e.g. ING, Funding Circle).

Examples of new companies in Credit Risk Analytics:

- Underwrite.ai applies advanced AI on traditional and new data sources and uses a dynamic credit risk model; claims to have an improved ability to price risk.

- ZEST Finance is using automated machine learning techniques to make more accurate lending decisions.

- James Finance is also using AI to apply predictive models and claims it had been able to decrease the default rate by 30%.

Unlike traditional scoring methods that use 20-30 data points, these companies are using hundreds of data points to fine-tune credit scoring. These techniques are also time-saving since they automate hundreds of processes that usually have to be manually constructed. These methods use psychometric scoring that measure regular and unconventional behaviour of borrowers. Big data-based AI are used to pick out irregularities and unusual behaviour, and enable the underwriters to focus and analyse “suspect” cases.

New software such as Exact utilises accounting data directly to determine borrowing capacity, monitors signals more accurately, and creates a direct link between lender and borrower. Wholesale banks operating on private markets, like ING, are increasingly using AI-driven technologies for predictive risk assessment, peer group analysis, client service, and identifying potential problems.

(ii) Funding and liquidity

The biggest challenges in private markets are the lack of liquidity and the cumbersome process of connecting borrowers with lenders. To be efficient, markets need some level of standardisation and the ability to compare risk adjusted return quickly. Technology enables cheaper unit costs, scalability, transparency for smaller deal sizes, and access to capital market funding.

There are several initiatives aiming to achieve this. CrossLend is offering a flexible form of securitisation to transform loans into notes on a portfolio or on a “1 loan, 1 note” basis. Other parties such as Bedford Row Capital offer listing solutions and provide secondary liquidity via efficient capital market solutions.

Delio offers a digital infrastructure, processes, and tools that help organisations enhance their private asset propositions. It optimises the distribution, transaction and reporting the investment opportunities.

In order to scale up secondary market and liquidity-related initiatives, the industry would clearly benefit from a widely applied, standardised risk scoring. (Similar to the FICO score in the US, a widely applied and accepted credit scoring would be beneficial for European SMEs.) Companies like Brismo make significant contributions to standardise data. Subject matter experts agree that standardisation and comparability are two aspects that improved technology will address in the coming years.

(iii) Deal sourcing, operations, and reporting

There are also many analytical tools that enable a more efficient deal sourcing. For example, Axial Networks, BankerBay and Intralinks Dealnexus have taken the lead in the last decade in the development of such tools.

In MIS, operations, back-office and reporting, a lot of heavy lifting had already been done by Efront or Black Mountain’s Private Debt Solutions. These systems are designed to manage the entire workflow process in the investment life cycle.

Applications like CEPRES offer innovative solutions to spot opportunities in private markets and optimise investment decisions across different funds. Contract management applications and contract intelligence (e.g., JP Morgan’s COiN) will also become significant.

(iv) Data management

I believe also in Private Credit, blockchain will be a game-changing infrastructure in certain sub-segments such as Trade Finance and areas where a shared database and collateral management will reduce costs and risk for all parties involved. It offers a new and safer approach to data management, where all participants work from a common database in real-time. Open-source blockchain platforms like Corda (R3) will be increasingly used for Private Debt solutions and applications.

What are the concerns and reservations related to new technologies?

With new technology, you address existing problems, but also create new risks and issues to solve. For regulated entities like financial institutions, it could be challenging to demonstrate an acceptable audit trail for algorithm-based processes.

Data-driven applications without consistency in data input remains a challenge and adoption of software remains a cumbersome process. Standardisation of data remains a key issue across different stages. Full transparency is required in manifold segments (fee model, look-through eligibility).

Any technology should start with: “What is the problem we are trying to solve?” and “Who, why, and at which costs will benefit?”

Key points to take away

Private market will always have the element of art and not science. I believe that relationship, trust, and manual underwriting will always be core elements in the value chain of private debt business models, especially in the higher Enterprise Value segments.

Nonetheless, many aspects of the business and value chain can be done more efficiently. There are manifold applications that can reduce operational costs, improve processes, and improve the journey experience for all involved (borrowers, GPs, LPs).

Fast-forward 5 years from now, I see:

- many elements of the underwriting risk assessment and servicing process will be a more digital AI-based process;

- some applications and standards used in lower SME segments are likely to move up in the higher segments of the value chain serving larger borrowers;

- higher standardisation in risk assessment and reporting and widely applied MIS/back-office applications to help efficiency;

- more Private Debt firms partner up to create a shared transaction database based on blockchain technology.

While technology offers key opportunities in Private Debt/Alternative Credit, it is still a cog in the wheel of your organisation. I say invest in digital capabilities, foster a learning culture, and involve new talents to shape your strategy. Once all these work together, you can offer a seamless journey to LPs and provide real value to customers, which will ultimately be your competitive advantage.

Sources:

- Barrachin, Marc, en Saeed Shoaree. „Demystifying Artificial Intelligence (AI): A framework to get it right .” S&P Global, 2019.

- Bear, Salem. „The 3 types of innovation: product, process and business model.” Digital Innovation, 2017 .

- James Finance. „Artificial Intelligence for Credit Risk.” 2019.

- Kulkarnini, Tatjana. „The Rise of Alternative data in the lending market.” Bank Innovation, 2017.

- McKinsey. „Private Markets come of age.” 2019.

- Oliver Wyman. „Blockchain in Capital Markets. The Prize and the Journey.” 2018.

About the author: Gabriella Kindert

Gabriella Kindert, PhD is a senior banking and investment professional specialized on Alternative Credit, Private markets and the digital transformation in the financial sector. She is currently a Supervisory Board member of Mizuho Europe and independent advisor to various entities, a.o. the EU on Fintech projects. She is the (co)author of several bestselling books; a.o. Alternative Credit and its asset classes, The Wealthtech book.