What market forces will influence European ethanol and biodiesel production and consumption in 2020? This analysis from F.O. Licht considers each of the key European markets in turn, before assessing the outlook for imports of used cooking oil from Asia and ethanol from the US.

2020 could turn out to be an exciting year for the European biofuels industry. This is because of changes:

- in the legislation in the individual member states,

- in greenhouse gas (GHG) savings requirement (against the 2010 baseline) under the Fuel Quality Directive (FQD; 2020: -6%),

- in trade relations,

- in the industry structure as a result of the EU sugar reform, and

- in the perception of double counting (DC) material, such as used cooking oil (UCO).

All combined, this could result in considerable shifts in the way the biofuels are consumed in the Union.

Want more articles like this? Sign up for the KNect365 Energy newsletter>>

France

Following the downturn in the EU sugar market two of the leading companies in this sector, Saint Louis Sucre (SLS) and Cristal Union, have announced the closure of factories in 2020.

In two cases there is a distillery attached to the sugar plant - Cristal Union's facility in Toury and SLS' in Eppeville.

All in all around 130 mln litres of annual ethanol production capacity will be affected by the sugar-related shut-downs.

On top of this Cristal Union decided close down its Deulep distillery in Saint Gilles which had the capacity to produce up to 40 mln litres of ethanol from wine wastes.

The measures represent somewhat less than 10% of the total national production volume.

While the sugar-based plants produced non-fuel ethanol, the Deulep distillery was able to manufacture DC material for the fuel ethanol market.

What will be the consequences for the French market?

Cristal Union is reportedly expanding capacities at its remaining facilities in order to compensate for the shortfall caused by the Toury closure. Whether this will be available in time, remains to be seen.

The ethanol produced at Eppeville was sent to CropEnergies' plant in Dunkirk for processing. Therefore this facility will have to look elsewhere to fill the gap. Most likely a considerable part of the missing volumes will consist of imported material as the unit is rather favourably situated in the port of Dunkirk.

The closure of Deulep will result in lower volumes of DC material on the French market. Indeed currently only the Dunkirk plant and the one operated by Vertex in Lacq are registered as producers of DC material, but the volumes are rather small.

The changes in the country will mean that output of non-fuel ethanol will drop. At the same time, more imports will be required from T2 countries to compensate for the Eppeville, and possibly the Toury closure.

Germany

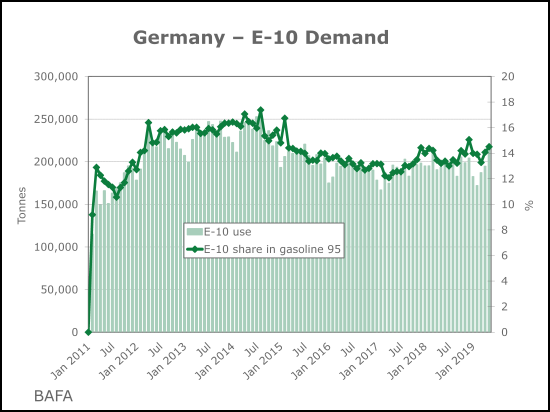

The GHG reduction target in the transportation sector will have to rise to 6% next year (in line with the FQD), from 4% at the moment. That is an increase of 50%!

It has to be recalled that the GHG quota is the only regulatory instrument in the country which can help raise the share of renewables in the fuel pool.

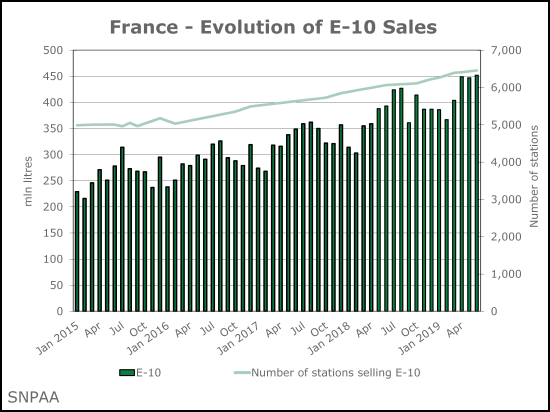

According to the industry, the current 4% limit offers no additional incentive to transition from E-5 to E-10 given considerable use of biodiesel under the B-7 limit.

In 2017 the average GHG savings of ethanol when compared to conventional gasoline was 82.7%. If all gasoline sold in Germany was E-10 with this emissions profile the GHG saving could rise to even 6.5%.

The oil industry argues that B-7 and E-10 are not sufficient to achieve the envisaged reductions. Indeed, it says that it is next to impossible to achieve the envisaged GHG savings.

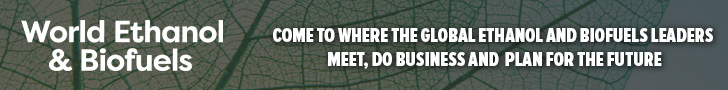

It definitely looks like a daunting task but that is not the least because of the poor preparation on the side of the oil industry for the 2020 switch-over. Even though E-10 is available at almost every forecourt, relatively little progress has been made with regards to growing its market share. However, for the time being this and the use of ethanol with very high GHG savings are the only means to get anywhere near the target in the short term.

And the prize is immense. Should obligated parties miss the target they will have to pay EUR470 per tonne of CO2. An E-10 blend with 80% GHG savings result in 0.20 kg of CO2 eq less emitted per litre of gasoline. In money terms this represents almost EUR0.10 of penalty avoided per litre of fuel. If the better part of this is used to lower the price of E-10 at the pump beyond the current 2 cent discount it could spark a similar transformation as in France. Here a 10 cent discount has resulted in E-10 becoming the most popular gasoline fuel within a relatively short period of time.

Therefore there is a good chance that demand for E-10 at the pump will rise next year. By how much will critically depend on the ability of obligated parties to prevent the penalty payments by other means.

The Netherlands

Compared to recent years the latest Dutch statistics on renewable energy use in transport showed not much change in the kind of renewable energy used. But there may be some change happening in the final quarter of this year and in 2020.

In early July the Dutch Emission Authority (NEa) published its yearly report on the use of renewable energy in transport (RET). The 2018 data showed that physically a total of 24.3 mln GJ of renewable energy was used. A large part of this volume will be DC resulting in 41.6 mln GJ or 8.9% of RET (the blending obligation was less: 8.5% for the year 2018).

Crop-based biofuels, limited to 3.0%, accounted for 1.5%, and advanced biofuels for 0.8% (the mandate was set at 0.6%), the vast share of other RET being waste-based lipids (UCO and animal fat).

Feedstock-wise waste-based biofuel, mainly lipids, accounted for 72% of all RET. The remaining 28% were crop-based fuels, above all maize and wheat.

The relatively low number of crop-based biofuel is understandable considering that the DC system on waste provides a strong incentive to use as much waste-based fuel as possible.

However, it is very likely that the final quarter of 2019 may show the beginning of a shift in complying with the blending obligation that will continue in 2020.

Three explanations can be given for this expected change in the market:

- The 2019 blending obligation, set at 12.5%, may well result in the biodiesel share hitting the blend wall of 7%. A higher share of renewable energy will be coming from electricity and advanced biofuel, but it will be incremental. Ethanol is the cheapest and obvious alternative to fulfil the higher demand for renewable energy.

- The second reason why we may see more ethanol is due to the recent fraud with waste-based biodiesel - UCO-oil certificates used whereas palm oil was the product blended. This fraud may well be the beginning of the process to abolish DC. Dutch Parliament will discuss the fraud on September 5.

- The final and most important explanation why there will be more ethanol in the market is the mandatory use of E-10 that kicks in this year on October 1.

All of these changes will mean a stimulus for using more ethanol, the largest part stemming from crop-based product.

Q4 of this year and the next year will be crucial for ethanol. Now being the only conventional biofuel used in the Netherlands - UCO pushed conventional biodiesel out of the market - the 2020 consumption of it will determine how much can be used in the years after 2020.

The Dutch government, by the way, does not favour the additional one percentage point that member states can add to the 2020 consumption according to the Renewable Energy Directive (RED) II which makes the level of 2020 consumption even more important.

However, the conditions seem to be right to give ethanol use a strong boost. Even though the E-10 law does not force all fuel outlets to offer the blend but in view of the high mandate for next year (16.4%) fuel suppliers have little choice but to offer more ethanol.

In Belgium Euro 95 E-5 virtually disappeared from the market and the Netherlands will follow the same path but slower. The Dutch have a far bigger petrol fleet than the Belgians, and a much higher share of this fleet is considered too old to use E-10.

The high price of premium fuel (Euro98) now around EUR1.80 per litre may result in still a relatively large number of small and independent fuel suppliers to offer Euro 95 E-5. But to avoid that the Euro 95 E-5 would undercut the E-10 market fuel suppliers will, so the expectation, offer Euro 95 E-10 at a lower price than Euro 95 E-5.

Spain

In May 2018, DC provisions were introduced in Spain as per Royal Decree 235/2018. However, it was not before March 2019, that the National Commission of the Market and Competition (CNMC) issued the necessary circular in the official gazette.

Accordingly, all biofuels made from feedstock listed in the Decree count twice as long as they can prove their sustainability and traceability. This includes among others UCO and animal fat of the categories 1 and 2.

There is strong potential demand for DC biodiesel in the country as cold filter plugging point requirements are weak, thus allowing year-round high sales. Previously, local DC production of around 200,000-300,000 tonnes had to be exported, a considerable part of which to the United Kingdom and the Netherlands.

Should Spain use more DC material at home it is likely to create a severe shortage in other parts of the EU as alternative sources for this product are not at hand.

Spain has a 7.0% cal. biofuels mandate in 2019, rising to a minimum 8.5% in 2020. Physical demand for biodiesel may march towards 2 mln tonnes, but this will also depend on what share of the DC volumes produced in the country will go where in the EU, and how much imports will be available. Spain is a key destination for FAME from Argentina and Indonesia.

Sweden

In Sweden, obligated parties have to meet the objectives of two GHG reduction systems:

Under the EU-wide Fuel Quality Directive, a 6% GHG reduction has to be achieved. The penalty for this is SEK7/kg CO2 eq, which is about EUR0.66/kg CO2 eq.

The second GHG quota system is part of its national plan:

- The gasoline requirement for 2020 is 4.2% GHG reduction and the penalty is SEK5/kg CO2 = EUR0.47/kg CO2 eq

- The diesel requirement for 2020 is 21% GHG reduction and the penalty is SEK4/kg CO2 eq = EUR0.38/kg CO2 eq.

In the gasoline market, the latter will require the introduction of E-10 with relatively high GHG savings. So far, Sweden has exported large volume of its ethanol with high GHG savings to Germany where prices were better. This is likely to change next year as more savings must be made at home.

With regards to the diesel market, Sweden has developed into one of the major consumers of hydrotreated vegetable oils (HVO) in the EU with demand temporarily exceeding 1 mln tonnes per year.

However, the change from the tax subsidy to the GHG quota and restrictions regarding the use of palm fatty acid distillates have diminished prospects for HVO supplies.

Nevertheless, suppliers should be able to react so a sharp decline can hardly be expected. There also are not that much alternatives: local FAME capacity and rapeseed supply is limited, and FAME imports are capped by the special diesel specs.

The import market for biofuels

Recently, the European biofuel market was hit by an Anglo-Dutch investigation against biofuels producer and trader Greenergy which also involved other companies including refiners and biofuel producers.

There were issues regarding the trade with biodiesel and feedstock. Doubts over the EU biofuel trading system refer to feedstock certification issues (sustainable/not sustainable) and DC.

Regarding the latter, the strong performance of waste- (mostly UCO-) based biodiesel in terms of GHG reduction made it a highly sought after product, priced at considerable premiums over crop-based material.

At the same time, critics say that there is a hidden link between UCO and palm oil. In other words, there is an economic incentive to artificially adulterate palm oil (or other comparably cheap feedstock) to sell it as UCO.

This also applies to the possibility to wrongly declare biodiesel made from virgin plant oil as DC product. One solution would be to monitor the supply chain for both, DC and conventional biofuels.

However, the EU says that the monitoring of the RED implementation remains to a large extent the responsibility of the member states. The DC sector says it is currently working with certification schemes and other industry stakeholders to continue improving traceability in the whole value chain.

The fall-out of the Greenergy case is still difficult to assess. In the immediate aftermath there were reports about traders reducing their activities in order to make sure that they deal with correctly declared product. At the moment it is business as usual but the case will contribute to an even tighter market for DC material.

Amid all these bullish factors there is only one that could help alleviate the emerging tightness. In May 2019 the EU Commission lifted the anti-dumping duties on US fuel ethanol with immediate effect.

The EUR62.3 per tonne (EUR49.2 per m3) duty was implemented in early 2013. This step means that US ethanol will only have to pay the EUR102 per m3 duty for denatured grades (EUR192 for undenatured).

It is not expected that the move will impact on trade flows at once. GHG savings and other specs of US ethanol are below the values on the EU market. On top, the weak euro would speak against any greater increase in exports for the time being. Nevertheless it can be expected that EU forward prices will now trade at levels equivalent to the new DDP price of US product.

The markets that could be affected the most are likely to be those in the Netherlands and the UK because they allow denatured product in the fuel pool and operate a volumetric biofuel policy.

Currently, a total of five US ethanol producers have the necessary certification to ship ethanol to the EU.

- Marquis Energy (certification is valid until September 2019)

- Green Plains' River Wood unit (October 2019)

- ADM's Peoria unit (February 2020)

- Valero's Albion unit (March 2020) and

- Plymouth Energy's Merrill unit (March 2020).

It will be interesting to see whether these companies will renew their certification in the next couple of months.

Conclusion

The EU biofuels market will find itself between a rock and a hard place in 2020. While requirements will rise in several key consuming countries, supplies of DC material will become much tighter. This not only has to do with the new market in Spain but also with the fraud investigation which is currently going on in several member states.

This will raise demand for single-counting material with high GHG savings. Therefore more ethanol may find its way into the fuel pool as it saves more GHG on average than the biodiesel alternatives.

Imports of US fuel ethanol are also likely to play a bigger role but given their higher GHG emissions they do not really address the fundamental problem which is likely to arise in the EU next year.

Higher demand and lower supplies (from a book-keeping point of view) will result in tighter market conditions and it can be expected that the highest volumes of biofuels will be consumed in those countries that have the highest penalties in place for missing the reduction targets.