The Recovery of Brazil's Ethanol Industry May Be Short-Lived

This article has been originally published in F. O. Lichts’ World Ethanol & Biofuels Report, 16 (1).

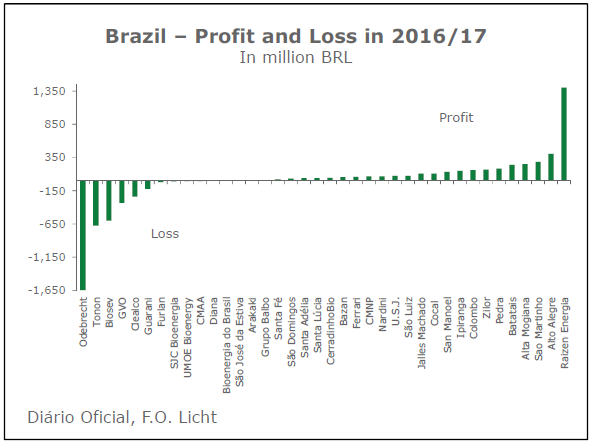

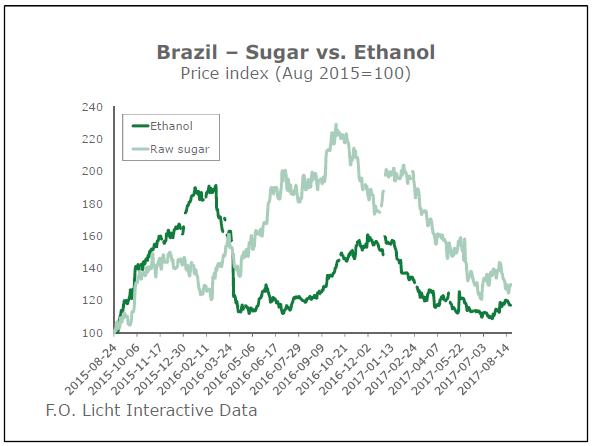

As the 2016/17 reporting season for Brazil’s sugar and ethanol industry is drawing to a close there are strong signs that the sector has managed to turn around its fortunes after its long slump. Our sample of roughly 40 groups in the centre/South, representing an annual milling capacity of around 350 mln tonnes, shows that the sector swung back to profit last season amid rallying sugar and ethanol prices. The total net profit amounted to BRL0.5 bln against a net loss of BRL2.6 bln the prior season and a record loss of BRL3.9 bln in 2014/15. However, this trend of improving financial results may ground to a halt this year and could potentially reverse in 2018/19 if not earlier. The main reason for this assumption is the deteriorating outlook for sugar and ethanol prices.

Despite the generally much improved market conditions there are huge differences between the performance of the individual companies and the picture is far from uniform.

Milling capacity and financial performance

Those mills that continued to make a loss in 2016/17 control a milling capacity of around 147 mln tonnes, equivalent to 42% of the sample. This compares with 180 mln tonnes and 52% last year, respectively.

In this group one finds industry majors such as Odebrecht Agroindustrial, Biosev Bioenergia, Guarani, GVO and Tonon which are the country's No. 2, 3, 6, 12 and 22 in terms of crushing capacity.

Therefore it would be difficult to justify that economies of scale per se are a guarantee for a solid financial performance. This view is corroborated by the fact that the three mentioned market leaders are among the five worst performers in terms of losses. However, all of them were able to cut their losses against the 2015/16 season.

In many instances there is a direct connection between the level of indebtedness and the extent of the losses. Many milling groups struggle with their US-dollar credits which greatly increased the interest burden following the depreciation of the Brazilian real in recent years.

Therefore it also comes as no surprise that a considerable number of the loss-making companies are in bankruptcy protection and as such face an uncertain future.

At the other end of the scale there is Raizen with a profit of BRL1.4 bln, 40% more than what was seen last year. The world's biggest cane processor beat all other competitors in the country in terms of profits leaving a large gap to No. 2, Usina Alto Alegre, with a profit of BRL407 mln (+156%), No. 3 São Martinho with BRL284 mln (+37%) and Alta Mogiana at No. 4 (BRL249 mln).

These companies provide another reason to reject the simplistic argument that "big is beautiful". While Raizen is indeed the largest cane crusher, Alta Mogiana is one of the smaller companies with a cane crushing capacity of 5.7 mln tonnes per year. São Martinho on the other hand has now risen to No. 4 in the cane processors league with more than 22 mln tonnes.

Newcomers vs incumbents

Another explanation for the strongly diverging performance in terms of profitability could be the point in time when a company entered the industry. Those that either built new plants or acquired existing assets during the boom years often did so at very high prices and therefore may be burdened with high write-offs and high costs in the form of interest rate payments. This may make it difficult for them to generate a profit even in times of high sugar or ethanol prices.

Indeed a first look at the history of our sample may confirm the view that those companies that have entered the industry only fairly recently (during the 'boom' phase of 2005-2009) seem to suffer more than those mills that already had a significant presence before that time.

Out of the Top 5 loss-makers in 2016, three can be considered as newcomers under the above definition. Odebrecht entered the market only in 2007 with the acquisition of the Alcidia plant. However, currently it is the country's No. 2 cane processor. Tonon Bioenergia, the No. 2 loss-maker started out in 1979 but embarked on an expansion strategy in the 2000s with the construction of a new plant at the height of the investment boom (2006) and the acquisition of another mill in 2013. Finally, Biosev came into existence when Louis Dreyfus acquired the Tavares de Melo Group in 2007 and the Santelisa Vale mills in 2009.

The 2016/17 data suggest that those groups that implemented a growth and acquisition program during the boom years indeed find it hard to return to profit despite a favourable environment.

M&A activity picks up speed

Brazil's sugar producers are just starting to move out of one of the longest depression that the sector has seen in recent history. Companies loaded up on debt to carry out their aggressive expansion plans in the early 2000s, more than doubling sugarcane processing between 2000 and 2010. The industry was hurt badly in the last few years by a plunge in the nation's currency, which made the dollar debt more expensive, and falling prices for sugar and ethanol.

The situation improved considerably last season not only because of better sugar and ethanol prices but also because of the appreciation of the Brazilian Real. This helped to reduce the industry’s debt and consequently its interest burden.

According to local consultants Archer, the total debt of the Brazilian sugar and ethanol industry reached BRL86.13 bln (BRL27.52 bln) earlier this year. That amount is 5.95% lower than total debt recorded at the same time last year.

The improvement in cash generation of sugar mills since last year puts the sector on a better financial footing in 2017/18, according to Itaú BBA.

However, the low competitiveness of companies producing sugar, ethanol and bioenergy, without investments to increase yields and the use of financial resources to repay debt, will limit growth and the inflow of new money into the industry.

According to the bank, the ratio of net debt to sugarcane processed by Itaú BBA's client companies was expected to remain practically stable in the 2016/17 crop compared to 2015/16, at BRL128 ($1=BRL3.13) per tonne and will decline to BRL105 per tonne in the 2017/18 harvest. The ratio of net debt to EBITDA (earnings before interest taxes, depreciation and amortization) is expected to be two times in 2017/18, compared to 2.7 times in 2016/17 and 3.5 times

in 2015/16.

The improved cash generation and profits have been mostly used to pay interest, with increased financial expenses, said Guilherme Pessini Carvalho, senior manager of Agribusiness at Itaú BBA. The bank has 57 Centre/South sugar-energy groups as clients, which process 411 mln tonnes of the 607 mln tonnes of cane ground in the region in 2016/17.

Given this environment it is no surprise that investment in new capacity remains rare but the market for mergers and acquisitions is heating up. The month of December 2016 was particularly active as para-statal oil company Petrobras was offloading its sugar and ethanol assets.

In mid-December the company signed a deal to sell its 49% stake in Nova Fronteira Bioenergia SA to partner São Martinho SA. In exchange it will receive 24 mln new São Martinho shares. Petrobras said in the filing that it will attribute a $133 mln value to the deal.

Sugar and ethanol producer São Martinho currently owns 51% of the joint venture (JV) which was founded six years ago and has a state-of-the-art mill in the center-west state of Goiás.

According to Licht Interactive Data, the JV operates a mill with a cane crushing capacity of 4 mln tonnes per year in Quirinópolis (Usina Boa Vista) which started operations in 2008. Its ethanol production capacity is 0.45 mln litres of anhydrous and 1.55 mln of hydrous per day while its cogen capabilities are 80 MW.

The Nova Fronteira JV dates back to 2010 when Petrobras bought its 49% stake for around $240 mln.

In late December the company sold its 45.97% stake in Guarani for $202 mln to France's Tereos. Earlier Petrobras had announced a 25% cut in planned investments to reduce its debts and revive investor confidence sapped by a corruption scandal, including a commitment to pull out of the biofuel sector.

Guarani operates seven sugar and ethanol mills in Brazil, making it one of the largest processors in the country.

Between 2010 and 2015 Petrobras had invested a total of BRL1.611 bln ($900 mln) in Guarani.

Also in December Commodities trader Glencore presented the highest bid in an auction for the sale of the distressed Unialco sugar mill in Guararapes. The Swiss company offered around BRL350 mln ($103 mln) for the unit, which is under court protection against creditors.

The mill located in the main cane belt in São Paulo state has installed capacity to process 2.5 mln tonnes of cane per year.

Unialco has around BRL700 mln in debt, so creditors will likely have to accept some losses despite Glencore's bid.

Glencore already operates the Rio Vermelho mill with a capacity to crush 2.8 mln tonnes in Junqueiropolis in the same state.

In the middle of 2017 Raízen Energia accepted the conditions for the purchase of two sugar mills in São Paulo, run by Tonon Bioenergia SA, set by the latter's creditors.

Earlier the company had won a judicial auction after bidding BRL823 mln ($250 mln).

The mills have a combined annual cane crushing capacity of 5.7 mln tonnes and are capable of producing both sugar and ethanol. Tonon aims to retain its third mill, in Mato Grosso do Sul.

Raízen said that if the operation is concluded, it expects to operate total annual crushing capacity of approximately 73 mln tonnes of cane.

The next event to watch will be the auction of Renuka do Brasil’s Revati mill, located in Brejo Alegre (São Paulo state) in September.

Renuka do Brasil is going through a judicial recovery process and will sell Revati mill to raise funds to help pay creditors.

The Revati mill can crush up to 4.5 mln tonnes of cane per crop, and produce 157 MW of energy through co-generation. The unit produces up to 1,350 tonnes of sugar per day. Revati is able to distill up to 900,000 litres of hydrous ethanol per day, which can also be converted into anhydrous ethanol. The unit has a factory producing up to 10,000 tonnes per crop of dry yeast, with a protein content of up to 43%.

The auction of Revati mill was proposed by Renuka do Brasil, after it failed to sell Madhu mill in January, when an auction was suspended by a court order at the request of Brazil's National Bank of Economic and Social Development (BNDES).

Renuka do Brasil filed a petition for judicial recovery in October 2015, when its total debt was estimated at BRL2 bln ($610 mln).

Chinese commodities trader COFCO, sugar and ethanol producer CMAA and credit security company Interface have asked to participate in the auction. Local press reports recently suggested that Raízen is also interested in bidding for the plant.

COFCO already owns four sugar and ethanol plants in Brazil capable of processing a combined 15 mln tonnes of cane per year. Companhia Mineira de Açúcar e Álcool (CMAA) owns two mills in Minas Gerais state and had acquired the Vale do Pontal mill from US-based Archer Daniels Midland (ADM) in 2016. It is sponsored by Indonesia’s Salim Group.

The Pizzo family, which controls sugar and ethanol group Clealco, is reviving its efforts to sell the company.

With three mills in São Paulo, Clealco has accumulated debts of over BRL1.5 bln ($1=BRL3.19).

The last time that the group had made a profit was in 2012/13. Losses in the 2016/17 cycle hit a record high of BRL237 mln.

Finally, the Cambuí mill in Santa Helena de Goiás and Contromation SA of Spain are reportedly bidding for the four remaining mills of the bankrupt João Lyra group.

The auction is to take place on August 25 with results likely to be announced on September 16.

Cambui is mainly interested in the Triálcool and Vale do Paranaíba which are both located in the state of Minas Gerais and have an annual crushing capacity of 3.7 mln tonnes and their value is estimated at BRL430 mln ($1=BRL3.19).

Contromation is primarily after the Guaxuma and Laginha mills which are located in Alagoas state. The value of this transaction is estimated at BRL850 mln.

The 2017/18 season

Given the fragile finances it can be expected that 2017/18 will see more consolidation and little investment in new capacity.

Raízen Energia announced at the beginning of the current harvest that it would invest BRL2.1-2.4 bln ($1=BRL3.18) this season. The lower end of that range would mean a stable investment compared to last season, while the upper end would represent 14% growth, yet lower than the 18% increase in the previous harvest.

In both cases, Raízen is already considering investment in four sugar production projects that began in the 2016/17 season and ended recently, according to João Abreu, vice president at Raízen. After acquiring Tonon's mills, Raízen is expected to review its investment targets, to focus on the cane fields of the acquired mills, which are older than the rest of its crops.

Louis Dreyfus-owned Biosev plans to invest BRL1.355 bln in its crop, or plus/minus BRL90 mln. The lower end would mean a 8% drop from last season, while the upper end would be equivalent to a 5% increase. In the past season, the company increased investment by 19% in relation to the prior harvest. Biosev might revisit the investment target for the current season to maximise cash generation, according to Rui Chammas, president at Biosev.

Odebrecht Agroindustrial is the only major player expected to invest more than last year. The investment is estimated at BRL640 mln this season, up 43% from 2016/17. But the focus will be on cane plantations, said Alexandre Perazzo, vice president of finance for OA. The company is adding 16,000 ha of new sugarcane fields and renewing another 62,000 ha. By doing so it aims to reduce the average age of its fields from 3.2 years to three years. Odebrecht also aims to invest BRL72 mln in agricultural equipment and machinery, according to Celso Ferreira, vice president of operations and engineering.

Tereos Açúcar and Energia Brasil plans to increase its investments by 1% to BRL686 mln. Investment in cane fields will total BRL200 mln, but the company will also invest in its cogeneration plant at Cruz Alta, in Olímpia (São Paulo state), to improve energy efficiency and refinery. It will also invest BRL60 mln in its Tanabi mill as a result of which the total crushing capacity of the group will rise to 23 mln tonnes by 2018/19.

São Martinho is expected to increase its investment in maintenance by 3% to BRL900 mln, but will probably reduce investment in expansion and modernisation to BRL70 mln from BRL107.8 mln in 2016/17.

All in all, there is consensus in the industry that new investment will remain restricted to smaller projects and de-bottlenecking efforts which would require only little funds.

The cost and lack of capital for big projects, combined with the long maturation cycle of any greenfield plant, will continue to make investors think twice before making any decision.

This means that by and large Brazil will continue to cater for the world's growing sugar needs with the same plant inventory. The resulting mismatch between supply and demand could bolster sugar prices in the medium term despite the current setback.