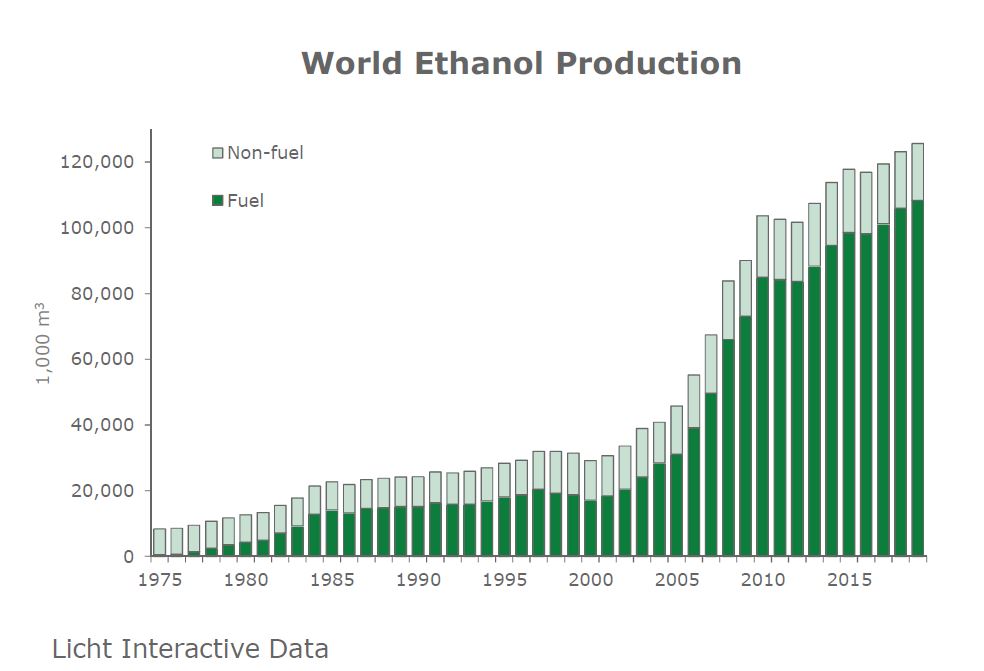

The global trend towards an increased use of environmentally friendly fuels is likely to gather pace again.

This may sound surprising at first given the headwinds the sector is facing in the US and in Europe.

Even though these two countries are important players, it has to be acknowledged that the discussion about the role of biofuels is moving on, both geographically and with regards to the motivations behind the most recent growth programs.

The obligations that were entered into as part of the 2015 Paris agreement feature in a number of new schemes that have emerged recently. This is a new development.

Also, the question of energy independence gains in importance again as prices for crude oil and those for agricultural commodities move in opposite directions.

All of that may justify the expectation that the sector may be headed for a new wave of growth in the medium to longer term future.

Want more articles like this? Sign up for the KNect365 Energy newsletter>>

Low feedstock prices to boost production

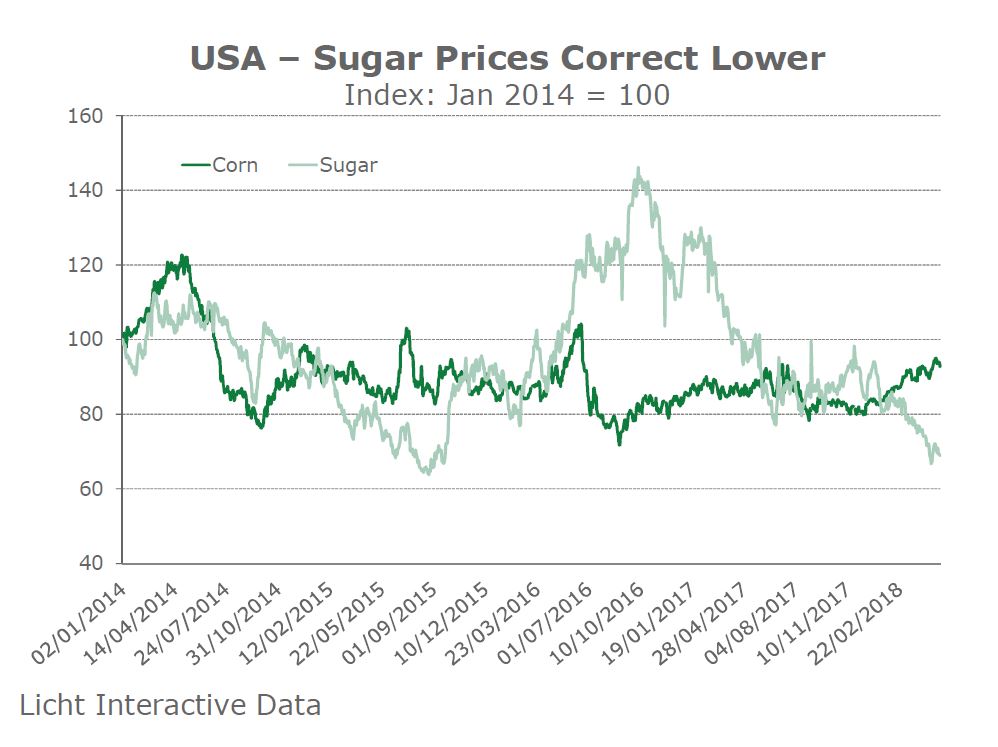

On the most important feedstock markets for ethanol the outlook is for a continuation of the situation seen last year.

The corn markets continue to be well supplied and prices have stabilised at a low level.

The outlook for sugar remains poor and prices have fallen to multi-year lows.

This means that the industry can rely on sufficient supplies of both sugar and corn. And while the stocks-to-use ratio for corn will fall somewhat in 2018/19, that for sugar will continue to rise as surpluses are here to stay.

In both cases, the supply conditions do not suggest that a price rally is on the cards which could boost the cost of production for ethanol.

What the trends on the feedstock markets suggest is that sugar-based ethanol could catch up somewhat with starch-based product in terms of market share after the strong losses in recent years.

And even though the dominance of starch-based ethanol is likely to suffer somewhat, it is not going to be seriously challenged. Nevertheless it looks like output of starch-based ethanol could grow at a slower pace in 2018 and 2019 than sugar-based material.

This favourable situation on the cost side is also reflected in our latest estimates for world fuel ethanol pro-duction. In 2018/19 the lower cost of sugar ethanol in general and in Brazil in particular will provide an extra boost for global production.

At the time, production of non-fuel alcohol will remain largely stable. The numbers presented here have to be taken with a pinch of salt. The times when the distinction between fuel and non-fuel production was clear cut are over. Whenever the price of fuel ethanol is attractive enough it will be used in industrial applications.

In general, it can be said that the food sector is growing steadily at rates of between 1.0 and 1.5% a year, while the industrial sector is some-what more volatile.

USA-E-15 may help to reduce surplus

In the US production growth is likely to slow further in 2018 and 2019. Demand on the domestic market is to develop in line with gasoline while higher ethanol blends are not being used in sufficient volumes to make a difference.

This mostly has to do with the Reid Vapour Pressure (RVP) rules which do not allow the use of E-15 during the summer months. In order to avoid the extra cost of emptying and cleaning the tanks before and after the summer driving season, many gasoline retailers do not offer E-15 at all.

With new RVP rules this could change. However, progress so far is slow.

The recent months have underlined that the Trump Administration is not business as usual for the industry.

In September 2017 the EPA took many by surprise when it proposed that ethanol exports should be counted against the Renewable Fuels Standard (RFS) targets. This would add one billion gallons for Renewable Identification Number (RIN) generation and prompted prices to fall sharply.

Even though the proposal was rejected in October it was discussed again more recently alongside other options for RFS reform causing RIN prices to drop again.

As such, RIN prices continue to be a good indicator for the direction of the public policy debate.

Without a new impetus on the regulatory front at home, exports will remain an important part of the sales mix for US distillers. What seems likely, however, is that Brazil will buy less from the US after the intro-duction of the tariff rate quota and the improved production outlook for ethanol.

At the same time there will be new opportunities in South America, Mexico and longer-term Japan. In the first case, free trade accords and higher blends will help, in Mexico the nation-wide use of E-10 and the gradual liberalisation of fuel prices. In Japan, the government recently announced that it would allow the use of US corn ethanol in the production of ETBE. This market had so far been reserved for cane ethanol from Brazil.

Canada

The ethanol sector in Canada continues to be on a growth path. And the outlook is that the pace of expansion could accelerate.

In the frame-work of its obligations under the Paris Accord, Canada has the objective to achieve 30 mega-tonnes of annual reductions in GHG emissions by 2030.

So far, it is not yet clear how the government will implement this policy but industry sources expect that a system similar to California’s Low Carbon Fuel Standard (LCFS) will be introduced.

In this case, fuel alcohol consumption could rise to somewhat below 6 mln cubic metres by 2025 and 9 mln by 2030.

And while it is not clear whether or not these targets will be reached the discussions around the Clean Fuels Standard have underlined that there are hardly any short-term alternatives to ethanol and biodiesel at hand to meet these aggressive targets.

Mexico

Mexico has not introduced an E-10 mandate but allowed the blend in all of the country except three metropolitan areas where the old 5.7% mix will remain the limit.

The main argument for E-10 in the country is its lower cost. Also, it makes importing product from the US where almost all gasoline contains 10% ethanol, much easier.

Potentially, the move has opened a market of 4 mln cubic metres of ethanol a year. Of course, consumption is not going to go up to this level in the short term.

However, the role of ethanol as a fuel component will rise in the years ahead.

Brazil

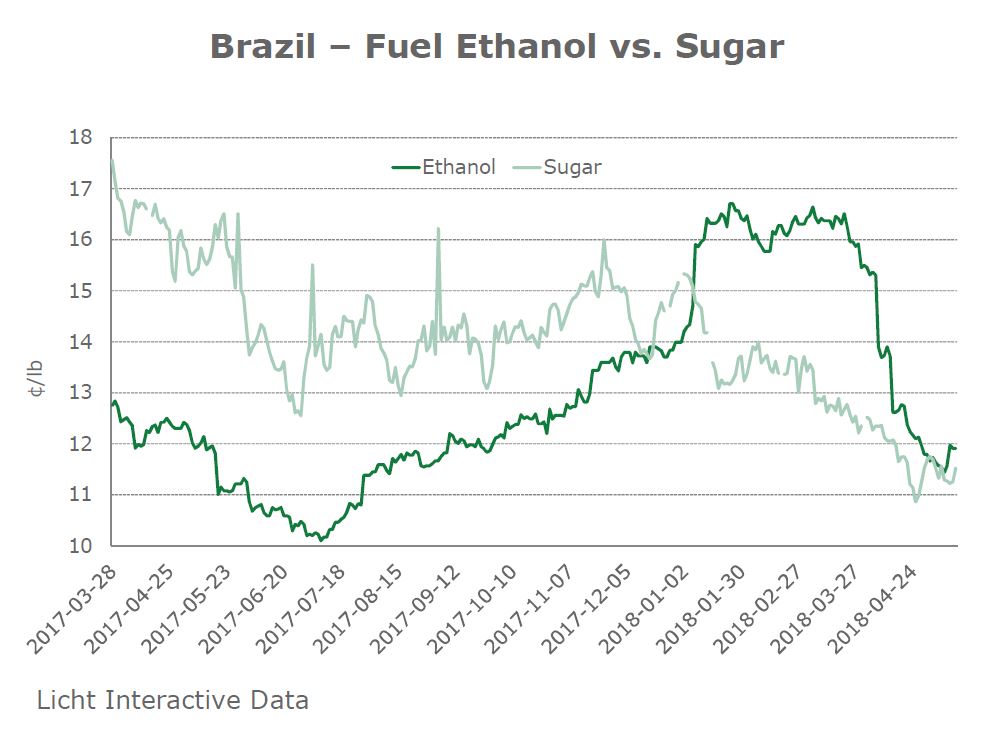

In Brazil this year’s cane harvest will be only little changed.

As the industry is keen to cash in on better ethanol prices, sugar production will be negatively impacted during the season.

There are several reasons for these assumptions:

- Demand for transportation fuels has started to pick up as the country is moving out of recession. This will support ethanol as well.

- Firmer international crude oil prices will also support ethanol demand after the country has liberalised gasoline prices

- Finally, the tariff rate quota system may also support the sector.

Another important factor for the expectation of a recovery in ethanol production is the negative outlook for the sugar market in 2018/19.

In contrast to the previous two years focusing on sugar production is not making much sense for millers.

Ethanol is now consistently more attractive to produce than sugar and this has started to trigger an increase in the allocation of cane to ethanol.

Longer-term, Brazil’s RenovaBio program may fundamentally change the way the sector is operating.

Even though it has not been determined how this program will work in detail, it will provide incentives to substitute green fuels with a low carbon intensity for fossil fuels.

This could lift demand to over 40 mln cubic metres by 2030.

Currently the country is busy to sort out the details of the program but the plan is that it will kick in on January 1, 2020.

Europe

Europe could see a substantial sur-plus this year and possibly in 2019 as well.

This mainly has to do with the continuing overcapacity in the sector and the ample supplies of both grains and sugar beet.

Indeed, the large beet crop of 2017/18 will result in a much bigger supply of ethanol from this feedstock than in the last two seasons.

This has dragged down the forward price curve for ethanol over the last six months.

As sugar beet supplies will only little change in 2018/19, the pressure on prices is likely to continue in the months ahead.

We expect the beet ethanol plants in France, Germany, the UK and the Czech Republic to continue working at capacity. As a result they could absorb 12 mln tonnes of sugar beet, almost twice the amount processed in 2016/17.

In the meantime, grain prices are likely to lend some support as the EU might see a grain deficit in 2018/19.

Asia

Output in Asia can be expected to continue growing mostly because of China. Here the industry hopes to benefit from cheaper corn from domestic sources after the government started selling from its huge stock piles last year.

In addition the higher import tariff on US and Brazilian ethanol is sup-porting the industry.

The prospects for production for the next couple of years are quite bright. In September 2017, China presented a very ambitious growth schedule for the sector: Beijing plans nothing less than a nation-wide E-10 mandate by 2020.

This would require about 19 mln cubic meters of ethanol against 5 mln forecast for this year.

The industry has already reacted to the announcement and is in the pro-cess of planning a number of new ethanol facilities.

Nevertheless, it looks improbable that the target of a nation-wide E-10 blend will become reality any time soon. It has to be emphasised that the recent decision to raise the import tariff on US ethanol will make it even more difficult to reach this goal.

India is the region's No.2 producer and there is a good chance that out-put will rise in 2018 and 2019. This would be the result of the recovery in the sugar industry which will boost the supplies of molasses.

In 2018 demand could easily reach more than 1 bln litres and further growth may be expected for 2019.

The pressure from the fuel ethanol market will result in sustained imports as locally produced industrial ethanol will continue to be diverted to the transportation sector where prices are higher.

Meanwhile, the government is undertaking new efforts to lift the ethanol blend to E-10 by 2025.

This plan has gained urgency as the country is reaping its biggest sugar and molasses crop ever this year.

And it could be even bigger next year.

With sugar prices in free fall the production of fuel ethanol from molasses and potentially sugarcane juice may provide a safety net for the industry.

Even though the arguments brought forward sound convincing, history has shown that it will not be easy to reach that goal.

Thai ethanol production continues to be on a growth path and 2018 is unlikely to be an exception. Helped by a rebound in sugar and molasses production the industry expects fuel ethanol output to grow by more than 3%.

And the government remains com-mitted to expanding the role of renewables in transport.

The Energy Ministry plans to ban the use of ethanol blends below 20% by 2027.

Pakistan’s production could be somewhat lower in 2018 as the molasses crop may remain behind earlier expectations.

Despite this, Pakistani suppliers will continue to dominate the export markets in Asia, particularly the non GMO part of it. The only competition that they face in this segment is Australia, Cambodia, and, possibly, Vietnam.

Outlook

The prospects for the industry are quite bright. The fuel ethanol market can be expected to grow a rate of 1.5-1.7% a year during the next decade. The focus will move away from the US and the EU to countries such as Brazil (RenovaBio), China (E-10) and India (E-10).

The non-fuel market will grow as well but at a somewhat slower pace. This is unless the paradigm of renewable chemicals takes off. How-ever, this can only be expected once a breakthrough in the production of cellulosic ethanol has been achieved or crude oil price go through the roof once more.

Whether or not this growth can be realised depends on a number of factors and at the moment there are reasons for concern.

The frequency with which national governments try to protect their local biofuel industries from international competition has increased considerably.

All big biofuels producers are participating in this game.

While it is difficult to exactly calculate what kind of costs accrue for the various stakeholders it has become obvious that trade barriers reduce the flexibility of biofuel programs.

The wish to regain control that is currently holding sway in many of the world’s capitals is currently having the upper hand over the free trade principle.

This comes at a price in the form of less flexibility and a poorer growth outlook.

Therefore, healthy growth rates in the sector are in no way guaranteed. They will only be achieved with a lot of hard work on both the industrial and political front.