World ethanol production to rebound in 2021

This latest piece of analysis from F.O. Licht assesses the situation for biofuels producers in the latter half of 2020 through to 2021, covering Europe, Asia and the Americas.

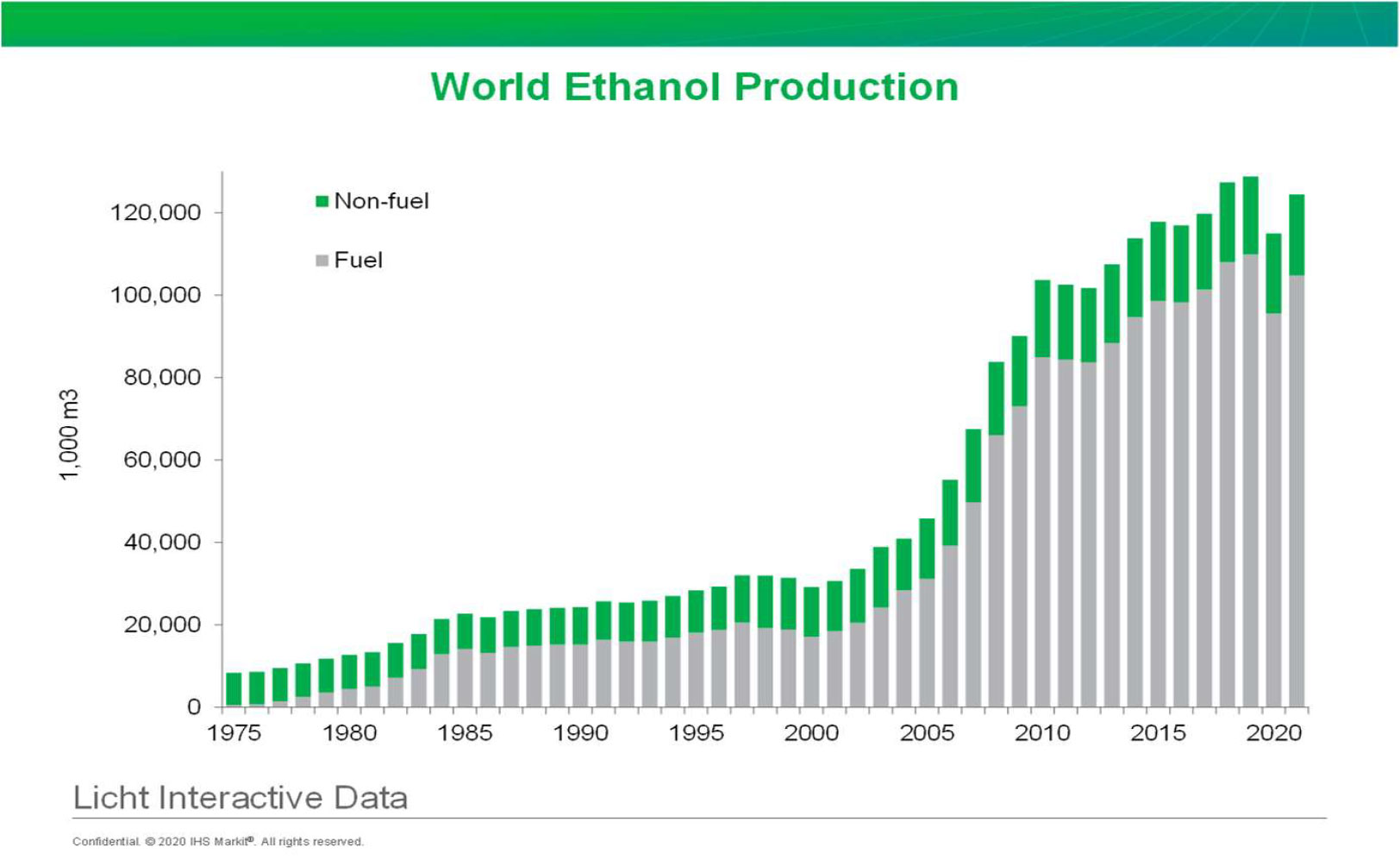

Global ethanol output will drop sharply in 2020 as a result of COVID-19 with the United States and Brazil bearing the brunt of the decline. Other regions will be hit as well but their lower reliance on the fuel ethanol markets means that the negative impact of the pandemic will be relatively less. For 2021, we expect a robust rebound which, however, will not be strong enough to reach the levels seen before the lock-down period.

As the further political and economic ramifications development of the corona crisis are highly uncertain, forecasts remain difficult. As a result, there are bound to be changes as the year progresses.

Our main assumptions for are the following:

- fuel alcohol production is currently expected to fall by double digit numbers (10-15% in the Americas; 15% in Europe; 10-15% in Asia).

- non-fuel production will fall by less than that. While most industrial applications may see a decline in line with the economy as a whole, the use of disinfectants will cushion that to a certain extent. During the peak months of the pandemic demand in this sector was up about 10-fold. Even after economic restrictions are eased demand will remain high. For 2020 we currently work with an ethanol demand for hand-sanitisers and disinfectants which is about 2-3 times higher than before the pandemic. For 2021 we expect it to be 30-50% above the levels before Corona struck.

- The beverage alcohol market is likely to see a mild contraction in 2020 as increased home consumption will not fully compensate for the losses seen in out of home drinking.

All in all, next year's ethanol output could be 124.5 bln litres for all types of ethanol, up almost 10 bln on the year. Fuel ethanol production remains the main driver with a share of 104.8 bln litres, a gain of 9.6 bln when compared with the revised numbers for 2020.

The Americas

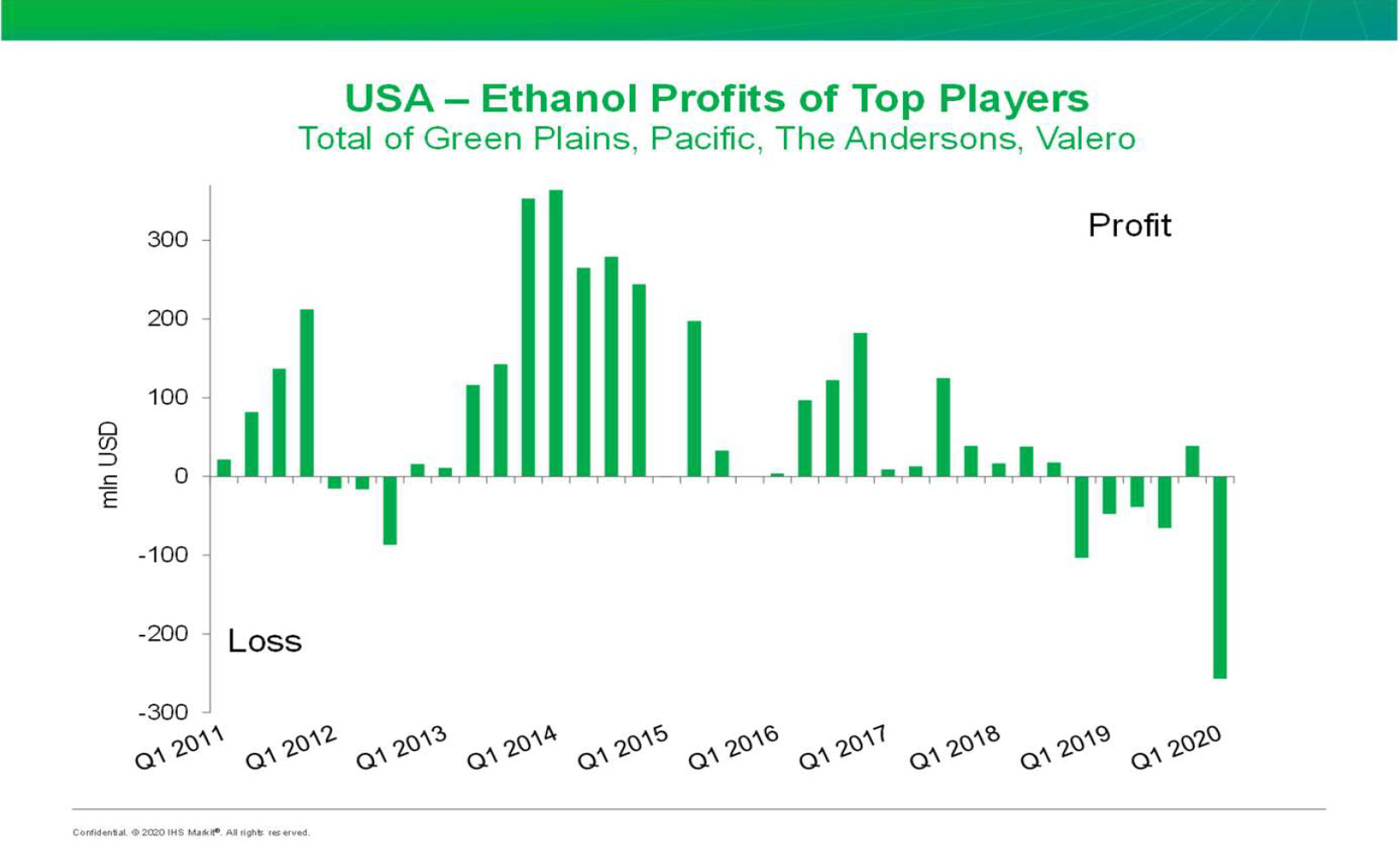

Despite good corn supplies, ethanol production in the USA will fall to the lowest level since 2014 following the deep economic crisis that was caused by the COVID-19 pandemic. We currently expect output to drop by around 11% for total output while fuel alcohol production could fall by 12%.

The prospects for 2021 are promising, and total output could climb back to over 60 bln litres again. However, for the time being the industry is clearly in reverse as many plants have been shut down and other are operating at reduced run-rates in reaction to the sharp drop in demand for transportation fuels.

On top, there is uncertainty in the policy arena. In June, refiners have filed 52 so-called “gap year” small refinery exemptions (SRE) petitions for Renewable Fuel Standard compliance years 2011 through 2018.

This is considered to be an attempt to circumvent a court ruling from January which struck down three SREs approved by the Environmental Protection Agency (EPA) and determined that the agency cannot extend exemptions to any small refinery whose earlier, temporary exemptions had lapsed.

If applied nationally, the January ruling was expected to limit eligibility for future SRE petitions to a handful of small refiners.

Since Mr Trump took office, the EPA has more than quadrupled the number of waivers it has granted to refiners, saving the oil industry hundreds of millions of dollars, corn growers charge. Refiners dismiss the argument.

American farmers, a key constituency for Trump as he eyes re-election in 2020, have been among the most hurt by his trade war with China, a key buyer of US farm exports before the dispute began.

Meanwhile, the export markets continue to be of great help to work off the domestic surplus.

However, the record of 2018 was not repeated in 2019 and it will be out of reach this year as well. As a result of the corona crisis exports dropped to a three-year low in April after a promising start in Q1.

With the Chinese import market still virtually closed to US product, it has proven difficult but not impossible to greatly raise shipments to overseas destinations.

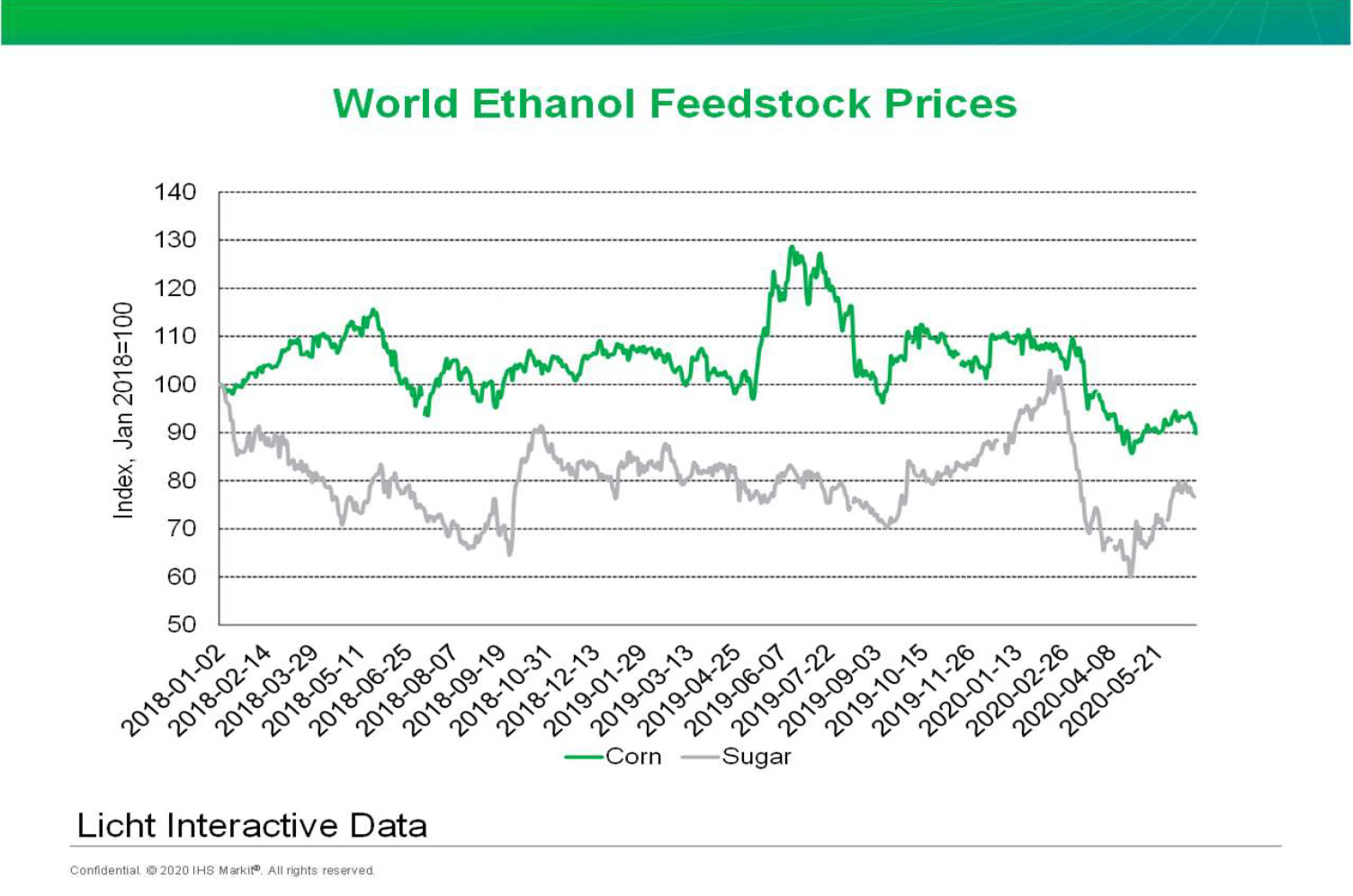

The major advantage of US ethanol in the first couple of months in 2020 was its low cost. This allowed higher sales to markets such as India, South Korea, the UK and the Netherlands. COVID-19 has put even more pressure on prices but demand has shrunken as well and therefore it is not certain that exports will resume their growth once the world returns to more normal conditions.

Short-to-medium-term the US industry will also have to keep an eye on developments in California, the country's biggest ethanol consumer by far. Here the carbon intensity of the transportation fuels pool will have to fall by 20% by 2030, up from 7.5% next year. This would close the market to corn ethanol.

The effects of the rising CO2 reduction schedule could already be felt in 2019. Of the almost 1.6 bln gallons of ethanol used, only 1.2 bln were made from corn. Only in 2018, almost 1.5 bln gallons out of a total of 1.6 bln were from corn.

This market will continue to shrink for US corn ethanol unless the greenhouse gas (GHG) savings in its production process can be dramatically improved.

In Brazil the 2020/21 (Apr/Mar) cane harvest will be higher than last year while the focus will dramatically shift towards sugar.

This means that ethanol production will fall by several billion litres. This unprecedented decline in output is putting a considerable part of the industry at risk. According to market sources, up to a third of the country’s mills are facing bankruptcy unless the government steps up its support program. While President Bolsonaro ruled out to raise taxes on gasoline, the proposal to implement a 6 bln litres buffer stock was positively received.

In early June, the country development bank BNDES approved BRL1.5 bln (USD1=BRL5.43) for this purpose. One condition is that commercial banks have to match this amount so that the total volume of the program is BRL3 bln. The credit line will have a two-year tenor, with 12-month grace period, and will be collateralized by ethanol.

However, it is doubtful whether this credit facility will meet its objective. The large diversified groups have the option to adjust their production to weather the current crisis. On top, they do have enough storage capacity at their disposal. In short: they do not need these credits. By contrast, the companies most at risk at the moment are unlikely to meet the criteria for obtaining the money.

In the meantime, the Energy Ministry has announced that it will review the RenovaBio target for 2020 as a result of the corona crisis. This will come as a disappointment to the industry. By mid- June, 210 units had been certified by the national fuel regulator ANP of which 21 biodiesel producers.

In Canada, the continent's third largest user and producer, the industry continues to stagnate now that the Clean Fuels Standard (CFS) has been delayed to the fall of 2020.

Plans to develop a national CFS were first announced in late 2016. The program aims to reduce the country’s GHG emissions through the increased use of lower-carbon fuels, energy sources, and technologies.

One implemented, the CFS is expected to achieve up to 30 mln tonnes of annual GHG reductions by 2030, making a significant contribution toward Canada’s target of reducing emissions to 30% below 2005 levels by 2030.

CFS regulations will cover all fossil fuels used, with separate requirements set for liquid, gaseous and solid fossil fuels.

Under the revised development timeline, engagement with the technical working group on key regulatory design elements related to liquid fuels regulations will take place during the spring and summer of 2020. Proposed regulations for liquid biofuels are expected to be published in the Canada Gazette this fall and be subject to a 75-day comment period. Liquid fuels regulations are currently expected to be finalized in late 2021 and come into force in 2022.

In 2019 the country imported 1.3 bln litres making it one of the largest markets for ethanol worldwide.

This was down from the all-time high of 1.4 bln litres seen in 2018. For 2020 another decline is on the cards as a result of the corona crisis.

Europe

2020 is a critical year for the European biofuels industry, not only because of the COVID-19 crisis. This is because of changes higher mandates in the individual member states, the rise in required GHG savings under the Fuel Quality Directive and the introduction of double-counting rules in Spain, which so far was one of the major exporters of these grades.

Numerous countries also have higher blending mandates for biofuels in 2020. The key question will now be which country will enforce them and which penalties will apply.

The current economic crisis has already prompted some member states to back-pedal on their biofuel commitments. After initial concerns it seems as if there have only been some minor incidences and not a general trend.

Another big concern is the sharp fall in prices in the United States which is raising fears that export volumes will grow further.

While this threat is real it should not be forgotten that US ethanol delivers only minimal CO2 savings and is mostly offered in a denatured form. This is limiting its use in almost all EU-27 markets.

Nevertheless, more ethanol from this origin came in so far in 2020. It remains to be seen whether the corona crisis will re-enforce this trend.

Currently, a total of five US ethanol producers have the necessary certification to ship ethanol to the EU.

- Valero’s Albert City unit (May 2021)

- Conestoga Energy, Liberal unit (May 2021),

- ADM's Clinton unit (March 2021),

- Valero's Albion unit (March 2021), and

- Marquis Energy (September 2020).

Asia

Output in Asia can be expected to drop this year as well but by a smaller margin than what will be seen in other parts of the world. This is mostly the result of the relatively lower share of fuel ethanol.

China's industry is seeking direction now that the government has shelved its E-10 policy because of low corn stocks. However, in its Annual Energy Plan for 2020 the National Energy Administration said that it wanted to push forward the production of fuel ethanol as well.

Poor demand at home and the lack of Pakistani material has prompted exports to rebound to the highest level since 2020. In the first four months of the year shipments were more than 80 mln litres, almost four times as much as during the whole of 2019.

Imports on the other hand remain lackluster despite the implementation of Phase 1 of the Sino-US trade deal under which Beijing waived some additional tariffs on 696 American products, ethanol among them, to support purchases of US farm goods.

Tariffs on US fuel ethanol had ranged as high as 70% after Beijing increased retaliatory tariffs on US shipments in its tit-for-tat trade dispute with Washington, effectively halting trade.

India is the region's No.2 producer and output will fall this year amid the COVID-19 crisis and a lack of molasses during the 2019/20 sugar season. For the current blending season (Dec/Nov), oil marketing companies tendered for 5.11 bln litres last August and 2.53 bln each in January and March. So far, 1.9 bln litres were finalized, of which 760 mln were supplied.

Delhi targets a nationwide E-10 blend by 2022 for which ethanol production capacity is to rise to 9.0 bln litres p.a. from 3.55 bln. This requires an INR180 bln (USD1=INR74.88) investment program.

The outlook for next season is much better. Molasses production is forecast to increase strongly, and the government is likely to enforce the fuel ethanol blending program with more vigor again.

Meanwhile, the good prices for fuel ethanol will continue to prompt millers to focus on this product, rather than industrial ethanol. This deficit is filled by US product arrivals of which reached almost 500 mln litres in Jan/May. While the corona pandemic will put a temporary lid on this development it is clear that India will continue to buy as long as prices are at current lows.

Thai ethanol production will fall this year. While a rebound in 2021 is possible this will critically depend on the availability of molasses. At the moment it looks as if this could remain a limiting factor.

In April, fuel ethanol consumption dropped by 1.17 mln litres per day to 2.80 mln, compared to March with COVID-19 related lockdowns being cited as the sole reason. While ethanol production for fuel was lower, that for disinfectants was up at 0.52 mln litres per day from 0.15 mln.

Meanwhile, the Energy Ministry has postponed plans to phase out gasohol 91 and to replace it with E-20 from June 1, 2020 to September 1 due to COVID-19.

This should give retailers enough time to clear their stocks and leaves more product available for disinfectant production.

The boost for E-20 would increase the consumption of fuel ethanol to 7 mln litres per day from the current 4-5 mln. The 26 plants can produce 6.275 mln litres per day, of which 4.763 mln of fuel grades. In addition, and there are expansion plans for a total of 0.5 mln of daily capacity.

Pakistan is likely to produce only little more in 2021 as molasses supplies will be somewhat better. The production downturn this year has prompted prices for non-fuel qualities to rise which provided an incentive for other countries to start selling into this market. The limited recovery is likely to keep prices in the region well supported.

The Philippines will see flat production this year as fuel ethanol is being diverted to non-fuel purposes. The downturn in fuel ethanol production is likely to primarily affect imports. Feedstock supplies continue to be a problem forcing the country to import rising volumes of molasses from abroad. In 2019 molasses arrivals reached a record high of almost 750,000 tonnes.

Outlook

The world ethanol industry will see a sharp drop in production and consumption this year. However, as fundamentals remain intact the rebound forecast for 2021 is likely to compensate for a large part of this year’s losses.

The main drivers next year will be the US, the EU, China and India where good feedstock availability will combine with the expected economic recovery.

COVID-19 will leave deep marks on the ethanol industries in general and those in the USA and Brazil in particular. In both countries it is likely to accelerate the necessary consolidation process. Given the extent of the crisis, policy interventions will nevertheless be required to prevent the current crisis from damaging the industry beyond repair. This will be a challenging task, particularly in the current tense political environment.

This article was first published first published 6 July 2020.