Where quantity meets quality

A venture capital event like no other. Where top-tier LPs meet leading VCs.

1,000+

senior attendees

350+

LPs from 35+ countries

500+

leading VCs

50+

countries

25,000+

meetings

A snapshot of the VCs attending...

- 432 Legacy

- Ada Ventures

- Antler

- Avant Bio

- BackedVC

- Balderton Capital

- Beringea

- byFounders

- Concept Ventures

- Experian Ventures

- Flyer One Ventures

- Hartmann Capital

- Illuminate Financial

- Inference Capital

- IRIS

- IQ Capital

- Kvanted

- MMC

- Northzone

- Shield Capital

A snapshot of the LPs confirmed to attend include...

- AAA Family Office

- Al Muhaidib Group

- Allianz Investment Management SE

- AS SmartCap

- Athenaeum Partners

- Aura Pääomasijoitus Oy

- Beiersdorf AG

- British Business Bank

- Church Commissioners for England

- DAMAC Group

- Delfinvest

- European Investment Fund (EIF)

- Fengate Asset Management

- Gothaer Asset Management AG

- Hasso Plattner Foundation

- Henkel Ventures

- Investinor AS

- KfW Capital

- Koejans Capital

- Mubadala Investment Company

- Noa Capital

- Norwegian University of Science and Technology

- NRW.BANK

- Quirin Privatbank Pension Fund

- Rettig Group AB

- Seedling Asset Management Pte. Ltd.

- Temasek

- Tesi

- Tilad

Who will you meet?

Meet 1000+ attendees from the global venture capital ecosystem.

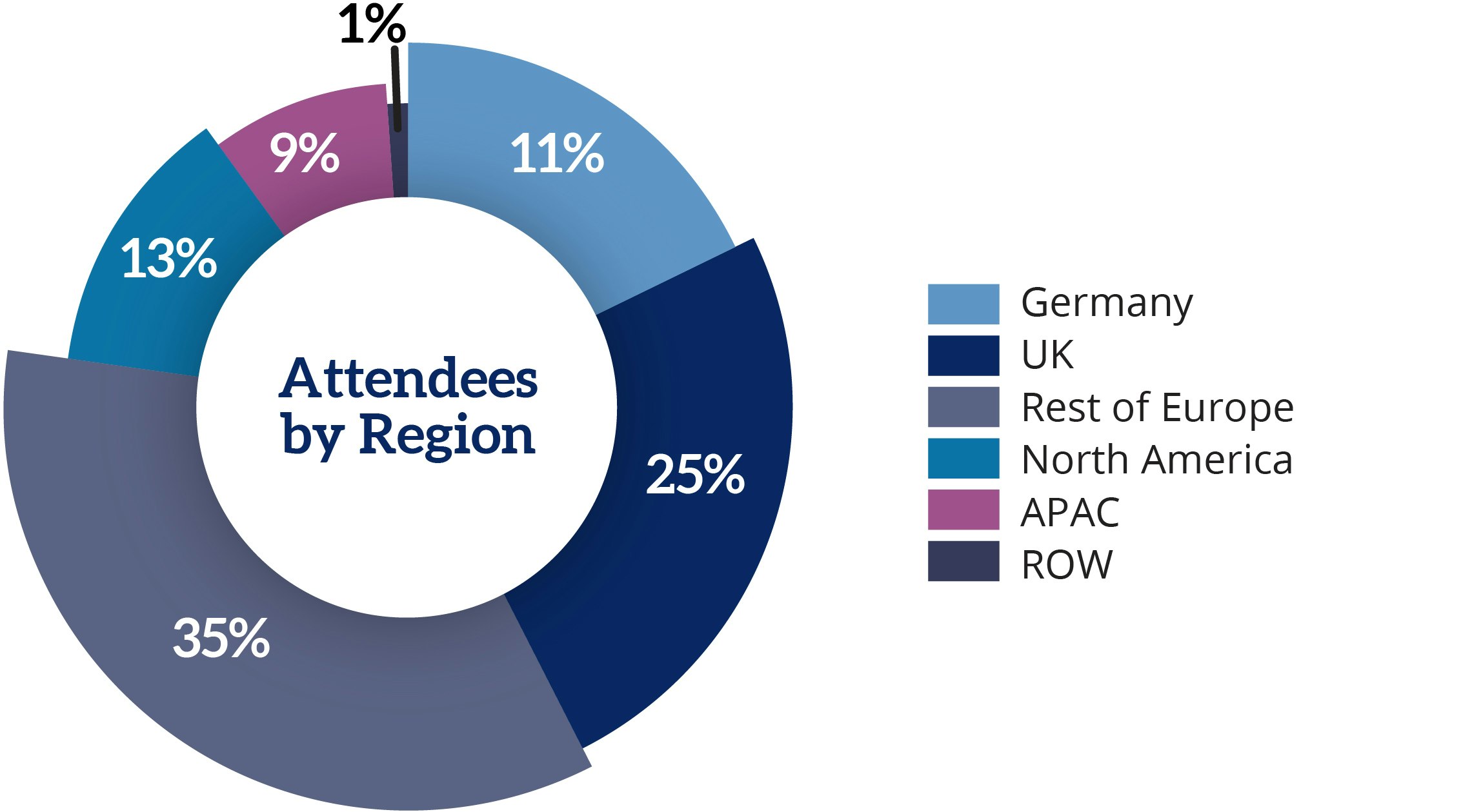

Geography split

SuperVenture brings together attendees from 50 countries worldwide!

Stand out from the crowd

Want to be connect with 1000+ senior VC decision-makers?

Secure meetings with leading LPs and GPs, host a networking event, raise your brand profile…..we can help you with this and more.

Please contact Sam Fullalove on sam.fullalove@informa.com or +44 (0) 7387 139 997