Investors Win More Games with Consistency

In the ever-changing financial landscape, avoiding unnecessary risks is paramount. While periods of high market performance are enticing, they are not everlasting. With the aid of robust portfolio performance software, portfolio managers can proactively detect early signs of market downturns and leverage data-driven insights to optimize their investment strategies. This data-driven approach enables them to maintain portfolio consistency, maximize performance, and foster investment portfolio growth, even when faced with market slumps. Stay ahead of the curve and safeguard your investments with the power of performance analytics.

Investors experienced the second longest bull market (period of high asset growth), in history following the Great Financial Crisis of 2009. It produced exceptional performance within investment accounts prior to experiencing downward trends because of the global shutdown of the COVID-19 pandemic in February of 2020.

Although being classified as a favorable market, this period still brought turbulence. As investors recovered from the recession, they dealt with the Euro crisis, U.S. Treasury downgrade, turmoil in Greece, the Chinese market correction and Brexit.

The world is unpredictable and bull markets don’t last forever. When looking back at the previous 10-year bull market, financial advisors must look beyond annualized returns and consider rolling returns along with consistency and downside risk measures in analyzing portfolio manager performance to maximize investment accounts.

Below are annualized returns of two portfolio managers. The figures highlight how consistency rewards investors through usage of portfolio analysis tools. Aside from reviewing investment analytics, Zephyr aims to locate managers that excel in these areas by leveraging an investment management software application.

Zephyr also reviews investment analytics that measure consistency and locate managers that excel in these areas by leveraging an investment management software application.

When creating a long-term investment portfolio for a client, a financial advisor will look beyond the typical annualized time periods. For example, take Fund ABC and Fund XYZ, both mid-cap SMA managers. As you can see in figure 1, Fund XYZ shows superior annualized returns over the common time periods.

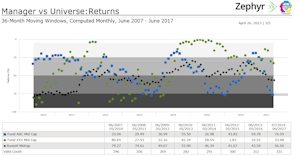

Figure 2 displays a similar narrative, with Fund XYZ outperforming its neighboring mutual funds. Because a favorable market is unlikely to last for ten years as it did during the last bull market, it is important for investors to use portfolio analyzer tools to visualize manager performance over shorter periods.

Figure 3 exhibits rolling returns (average annualized return in given period), which reveal some inconsistency in Fund XYZ. This 36-month moving window, shows Fund XYZ has periods of stellar performance, along with some periods of mediocre performance. The table also shows that Fund XYZ has a better median rank when compared to Fund ABC, however, Fund XYZ’s volatility of rank is greater. Fund ABC may not produce as many periods of stellar performance, but it makes up for what it lacks in quantity with consistency.

Figure 4 confirms that Fund XYZ takes bigger risks while Fund ABC is successful over the long term. Figure 4 also shows that Fund ABC does a better job of preserving capital during market downturns or times of crisis. Consistency allows clients to rest easy knowing their assets risks will be minimal even during crisis.

Figure 5 proves that consistency is key to long term growth among mutual funds, as Fund ABC rewards investors with a cumulative return of 141% versus 109% for Fund XYZ.

Financial advisors can find portfolio managers who idealize consistency by using some metrics found in the below table.

Portfolio managers need to consider how a mutual fund arrived at its current value. They may not be in position to make a market correction across their time horizon or afford to do so. By utilizing portfolio analysis tools managers can create clarity, provide insight into market trends and ultimately grow funds efficiently by offering lower risk, consistent insights.

Tags: Portfolio Analysis Software, Investment Research