America has a retirement crisis. Workers do not save enough, and they draw down their savings too quickly, the availability of employer-based retirement plans like pensions are becoming rare, social security benefits are far from secure and to top it off, people are living longer than ever.

Traditionally, Americans were able to rely on three buckets of savings for their retirement income: Social Security, defined contribution plans like 401(k)s and defined-benefit plans like pension plans. Well, times have changed and so too have the different retirement savings vehicles.

Consider yourself lucky If you work in the private sector and have access to a pension as only about 15% of private sector workers have access to them.

That brings us to defined-contribution plans like 401(k)s. 70% of private sector workers have access to 401(k)s while only 50% participate in them.

Then there’s Social Security benefits which is a major source of income for people over the age of 65. In fact, Social Security payments represent 31% of the income of people over the age of 65. While on average nearly 69 million Americans per month will receive a Social Security benefits. In fact, the Social Security trust fund is facing depletion by the mid-2030s. There is an overreliance on Social Security benefits considering the benefits retirees can expect to receive in the future is far from secure and certain.

Furthermore, according to the Census Bureau, as of 2022, 48% of retired adults received some form of income outside of social security benefits. The majority of this income came from 401k plans, while just over a quarter came from pensions and 16% came from individual retirement accounts.

Are your clients prepared for retirement?

The underfunded and underutilized retirement savings options and the fact that Americans are living longer than ever is the perfect storm for a retirement crisis and presents a risk to retirees: Longevity risk, or the risk of outliving your money. One possible solution to overcoming longevity risk is creating longevity insurance. Longevity insurance is a way to provide guaranteed income for life to help hedge against the risk of outliving your savings. Longevity insurance is often employed by using annuities.

Annuities are one solution that can help address the need for a steady stream of lifetime income. While annuities can provide guaranteed income for life, there are some cons such as the opportunity cost if equity markets perform very well.

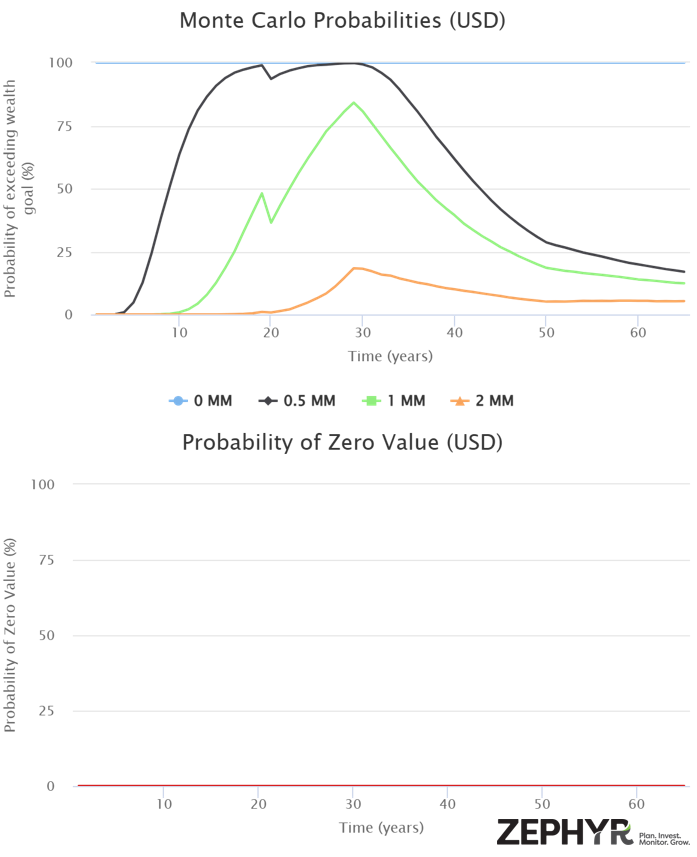

By leveraging Zephyr’s monte carlo simulation and asset allocation tools we take a closer look at if a typical standalone investment account can produce enough income to last a lifetime and what impact does adding an annuity to the mix have on the retirement plan outlook?

How are you helping your clients prepare for retirement?

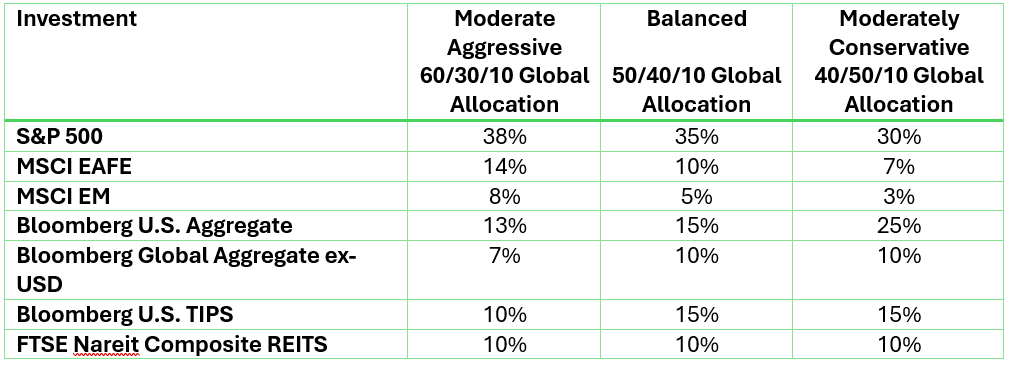

Here are three different hypothetical portfolios that we created in the Zephyr’s Asset Allocation tool that are used for this analysis. For this analysis we have a married couple who are both 35 years old with a household salary of $180,000 and an investment portfolio worth $200,000. The Smiths currently save $20,000 per year and add it to their investment portfolio. The Smith’s goal is to retire at 65 and have enough savings to continue their current lifestyle while not having to worry about running out of money.

For this analysis we have a married couple who are both 35 years old with a household salary of $180,000 and an investment portfolio worth $200,000. The Smiths currently save $20,000 per year and add it to their investment portfolio. The Smith’s goal is to retire at 65 and have enough savings to continue their current lifestyle while not having to worry about running out of money.

Here are two retirement plan scenarios that a financial advisor presents to the Smiths regarding achieving their goals.

Base Scenario Assumptions

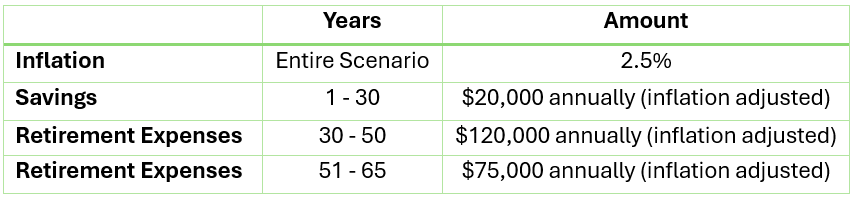

Scenario 1 – The Investment Only Plan

This scenario starts out with the Smiths investing in the moderately aggressive portfolio until they turn 55, at which they decide to reduce the risk somewhat and invest in the balanced portfolio. At age 75 the financial advisor proposes to the couple that they go with the conservative portfolio as they focus more on capital preservation. The retirement plan of investing 100% into the investment portfolio seems to work well as 95% of the simulation trials show the portfolio having at least $2 million come their 64th birthdays. That marks the high watermark for their portfolio as it marks the transition into their retirement years of spending down their savings while trying to maintain their current lifestyle. This scenario budgets for expenses of $120,000 per year adjusted for inflation for the first 20 years of retirement. As they age the proposed spending decreases to $75,000 per year inflation adjusted. Despite the large nest egg they accumulated, the annual spending and conservative portfolios takes its toll on the portfolio. At year 40 of the scenario, or when they turn 75, there is a 10% chance the value of the portfolio is zero. Furthermore, at age 80, the chance of the portfolio falling to zero increase to 30%. This is terrible timing as going back to work is not an option.

As you can see in Figure 1, trying to maintain their current lifestyle while relying solely on their investment portfolio exposes them to longevity risk, or outliving their money, especially if they live into their 80s

Figure 1: Source - Zephyr

Figure 1: Source - Zephyr

Scenario 2 – A Retirement plan that includes a deferred annuity and investment portfolio.

Using the same base case as above, the financial advisor presents a proposal to the Smiths that includes taking $250,000 from their investment portfolio and purchasing a deferred annuity at year 20 or when the couple turns 55. At this time their investment portfolio has a 90% chance of being worth more than $1,000,000. This scenario proposes the Smiths invest in the annuity’s balanced subaccount that earns 6% per year. Meanwhile, the investment account is moved to the balanced portfolio.

This scenario proposes that Smiths annuitize the annuity at retirement, or age 65. After ten years of accumulating, the annuity is worth $447,710, which results in an annual guaranteed lifetime income stream of $30,000.

Zephyr’s monte carlo simulator shows that this scenario has a zero percent chance of reaching a zero value even if the Smiths live to 100. This scenario that combines the appreciation potential of the investment portfolio that is exposed to market growth and fluctuations and the longevity insurance of the annuity provide that greatest probability of the Smiths reaching their goals (Figure 2).

Conclusion

Adding annuities to an overall investment plan is another way to diversify your client’s investments. This holistic investment strategy provides a stable income stream during retirement while traditional investment portfolios gain exposure to capital appreciation opportunities. The stable stream of guaranteed income also allows your investors to take a more aggressive approach within their investment portfolio. While annuities are a sound solution for people who are looking for lifelong income payments, they do come at a cost and it is very important to review all of the associated costs and potential restrictions that come with annuities.This analysis is for illustration purposes only and should not be used as investment advice.

Are you looking for help running investment proposals like above? Zephyr can help.