As financial advisors navigate an increasingly complex investment landscape, the traditional 60/40 stock-bond portfolio allocation is facing unprecedented challenges. With heightened market volatility, quick market moves and evolving client expectations, alternative investments have emerged as a critical component in modern portfolio construction. Understanding how to effectively integrate these non-traditional assets can enhance your ability to deliver superior risk-adjusted returns for your clients.

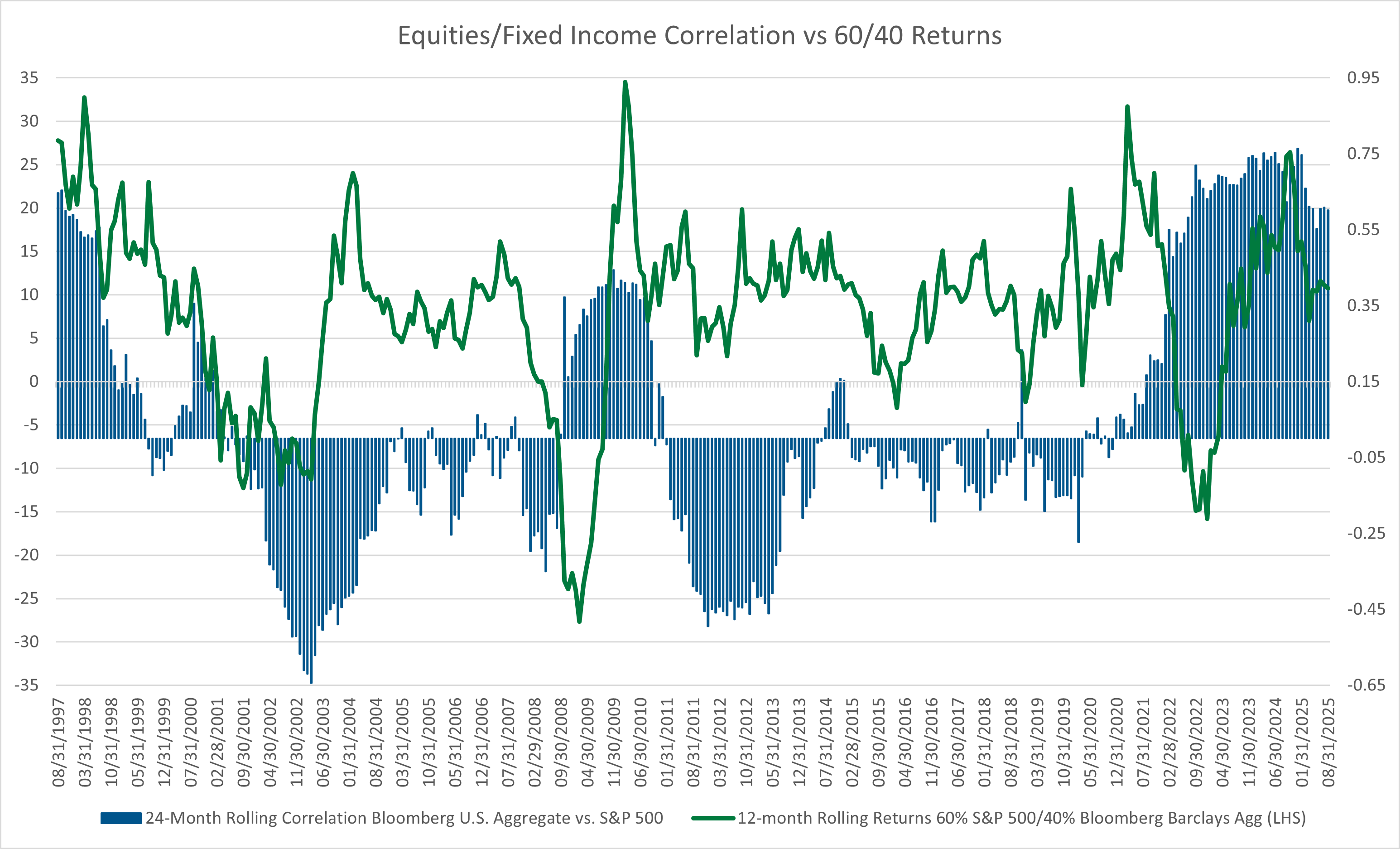

Diversification has come under the microscope during times of crisis like the Great Financial Crisis and the Pandemic lockdown. Portfolios that were traditionally considered diversified could not withstand the global reach of the two crises and protections failed when they were needed most. Furthermore, the baseline 60/40 portfolio has come under scrutiny due to the ending of the fixed income bull market which has also coincided with the steep equity market sell-off in 2022. The 2022 dual sell-off in both fixed income and equities has reinforced the notion that to increase portfolio diversification one should consider including alternative investments. Similar to what we have experienced in 2022, correlations between equities and fixed income increase during times of crisis. It is no coincidence that during these times of increasing correlations, the 60/40 portfolio (60% S&P 500 index/40% Bloomberg Barclays U.S. Aggregate index, rebalanced monthly) returns falter, which is displayed in Figure 1.

With the popular 60/40 portfolio susceptible to a market crisis, one should consider the implications of taking a broader view of diversification to increase your portfolio’s ability to withstand market sell-offs. Below we take a deeper look at diversification and the impact alternative investments have on a portfolio and whether they are doing their intended job or not.

Figure 1 - Source: Zephyr

Figure 1 - Source: Zephyr

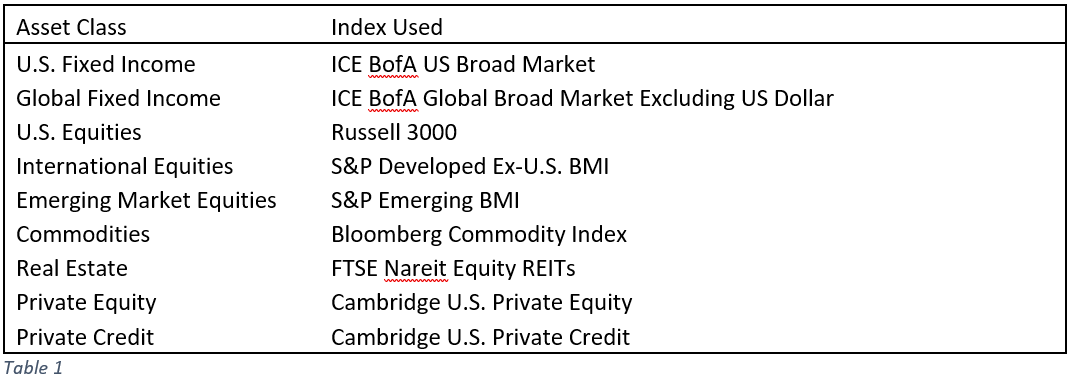

Before we get started it’s important to disclose the asset classes and corresponding indexes used to run the mean variance optimization analysis. Table 1 displays the basic asset classes, in addition to the four alternative assets used – commodities, real estate investment trusts (REITs) and private equity and credit.

Learn more about the different alternative investment asset classes here.

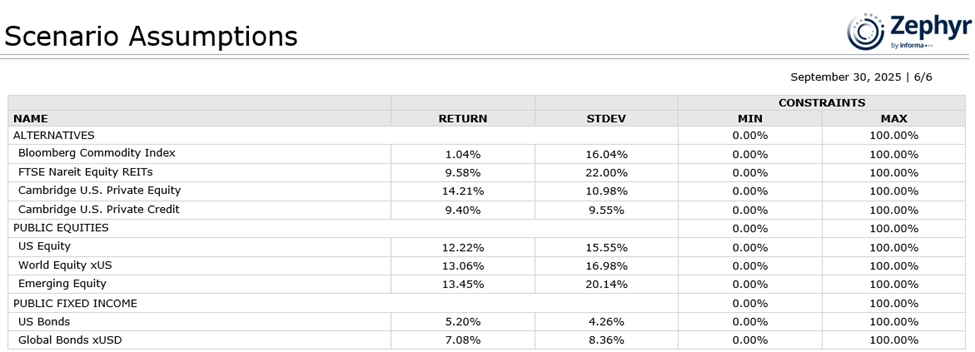

With the above knowledge in hand, we can move forward with constructing an efficient frontier to determine the impact alternatives have on a traditional asset allocation consisting of the core asset classes. To determine the forecasted returns for the core asset classes (U.S. and Foreign equities and fixed income), we use the Black Litterman forecasting model, whereas for the alternative asset classes (commodities, real estate and private equity and credit) we use the historical returns. Table 2 displays the forecasted returns and risk based on the time period between March 2005 – March 2025 that were used in this analysis.

Table 2 - Source: Zephyr

Table 2 - Source: Zephyr

Alternatives Enhance Risk-Adjusted Returns

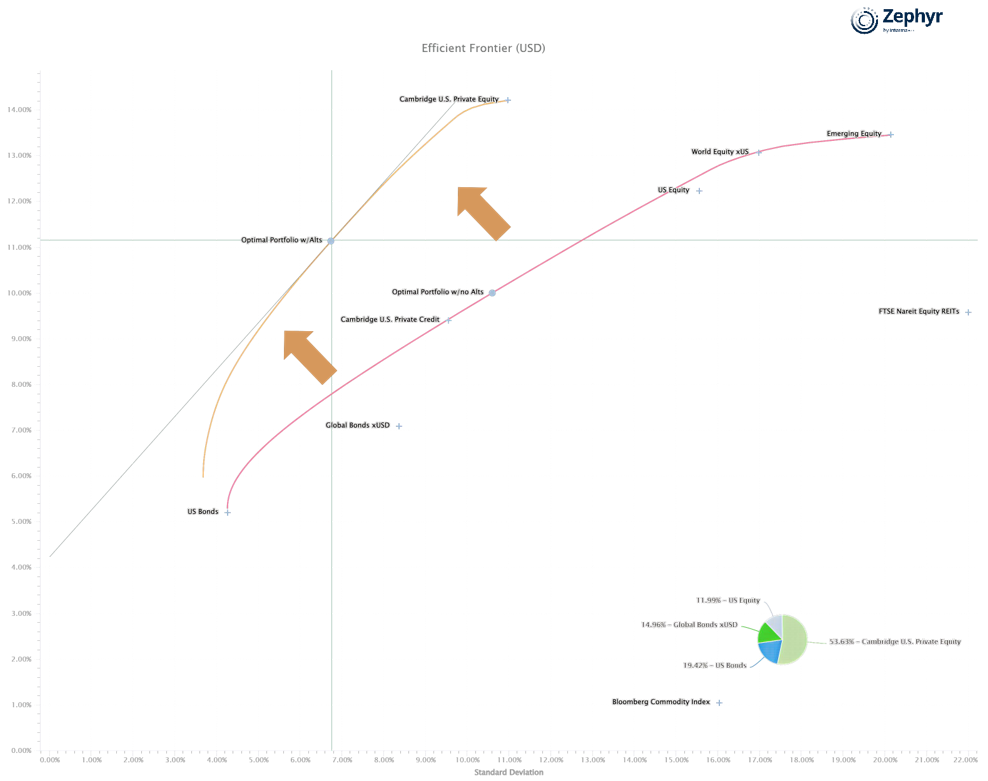

As you can see in Figure 2, by adding the four alternatives listed above to an allocation case which includes the five core asset classes, the efficient frontier shifts to the northwest (orange line), which represents higher returns and lower risk. This is the intended result of adding alternatives to an allocation.

Learn how you can run a mean-variance optimization with Zephyr. Figure 2 - Source: Zephyr

Figure 2 - Source: Zephyr

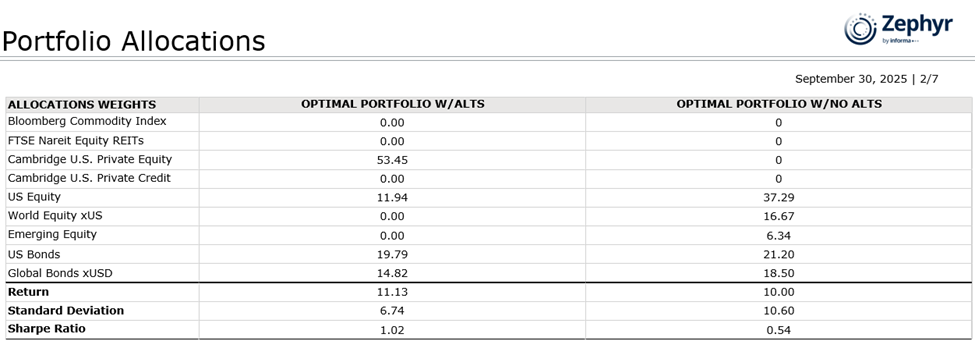

The increase in return per unit of risk by adding alternatives to the mix of asset classes is evidenced by comparing the two hypothetical portfolios listed in Table 3. These two hypothetical portfolios, one composed only of the core assets (Optimal Portfolio w/no Alts) and one portfolio that includes alternatives (Optimal Portfolio w/Alts), represent the most optimal portfolios, or portfolios exhibiting the highest Sharpe Ratio, along the two efficient frontiers. It is also worth noting that these two hypothetical portfolios are just that, hypotheticals, that are created using mean-variance-optimization with no human alterations. These portfolios are for illustrations purposes only to show the impact of alternatives and may not be appropriate for your clients. The most optimal portfolio along the efficient frontier consisting of just core asset classes has a Sharpe Ratio of 0.54. Conversely, the Optimal Portfolio w/Alts portfolio has a Sharpe Ratio (1.02) that is nearly double that of the portfolio with no alternatives.

Table 3 - Source: Zephyr

Table 3 - Source: Zephyr

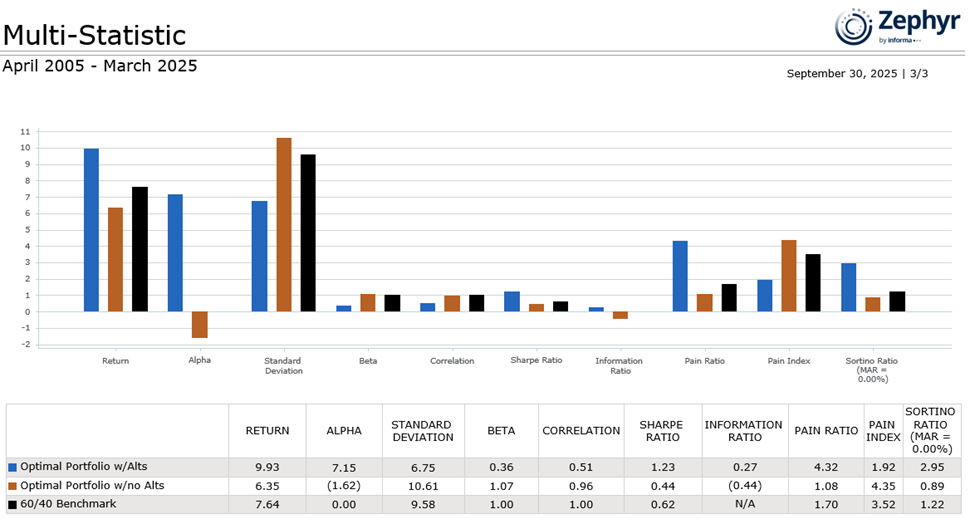

The purpose of adding alternatives to an investment portfolio is to increase diversification, improve returns and reduce risk, resulting in enhanced risk-adjusted returns. Figure 4 confirms the above notion.

Not surprisingly, the portfolio with 53% in private equity exhibits superior performance analytics compared to the Optimal Portfolio w/no Alts and the basic 60/40 portfolio. In addition to having higher annualized returns and lower standard deviation, the portfolio with alternatives exhibits lower beta and superior alpha. Furthermore, the alternatives help limit downside losses, evidenced by the lower pain index and higher pain ratio. While alternatives give the portfolio more juice in terms of higher returns, they also help mitigate risk through lower volatility and reduced drawdowns.

Figure 3 - Source: Zephyr

Figure 3 - Source: Zephyr

What Alternatives Are Doing Their Job

Taking this a step further, we can look at the individual alternative investments to determine if they are adding value to the portfolios. As you can see from figure 2 above, private equity clearly adds the most value to the efficient frontier and this is evidenced by the large allocation to private equity in the Optimal Portfolio with/Alts. On the flip side, commodity’s low expected return and high risk has resulted in the asset class being ignored in all portfolios along the efficient frontier.

Implementation Considerations for Financial Advisors

Successfully incorporating alternative investments requires careful consideration of several factors. Liquidity constraints represent perhaps the most significant challenge, as many alternative investments require longer holding periods than traditional assets. This illiquidity must be balanced against client needs and overall portfolio liquidity requirements.

Due diligence becomes more complex with alternative investments, requiring deeper analysis of investment managers, underlying strategies, and fee structures. The higher fees associated with many alternative investments must be justified through superior risk-adjusted returns or meaningful diversification benefits.

Check out the second installment of “Exploring the World of Alternatives II: Maximizing Alternative Investments Across Macroeconomic Environments” here.

Client education plays a crucial role in successful alternative investment implementation. Many clients lack familiarity with these asset classes, making it essential to clearly communicate the role each investment plays in their overall portfolio strategy. Setting appropriate expectations regarding liquidity, volatility, and return patterns helps prevent misunderstandings during market stress periods.

Strategic Allocation Guidelines

The appropriate allocation to alternative investments varies significantly based on client circumstances, risk tolerance, and investment objectives. Generally, allocations ranging from 10% to 30% of total portfolio value can provide meaningful diversification benefits without overwhelming traditional asset classes.

For conservative investors, REITs and infrastructure investments might comprise the bulk of alternative allocations, providing steady income with modest growth potential. More aggressive investors might include private equity, hedge funds, and commodity investments to enhance return potential while accepting higher volatility.

Conclusion

When creating a portfolio for your client which aims to enhance risk-adjusted returns via diversification, alternative investments should be considered. Keep in mind that not all alternative investments are created equally, and that each alternative provides unique benefits to a portfolio. It’s important to look at all factors including what risk(s) you are trying to protect against as well as how correlations fluctuate during different market cycles.

Zephyr, is an award-winning asset and wealth management software that offers portfolio construction, proposal generation, advanced analytics, asset allocation, manager screening, risk analysis, portfolio performance and more, transforming multifaceted data into digestible intel.

Ryan Nauman is the Market Strategist at Zephyr, which helps investment professionals make more informed investment decisions on behalf of their clients. Connect with Ryan on LinkedIn.