The Growing Benefits of The Alternative Investment Space

Explore the Advantages of Alternative Investments:

Alternative investments provide investors with diversification, risk mitigation and potential for superior returns, bolstering portfolio resilience. These assets serve as a crucial hedge against market volatility and inflation, offering unique opportunities and valuable tax benefits for long-term wealth accumulation. With options like real estate, private equity, and more, consider incorporating alternative investments into your strategy to secure financial stability and growth in any economic climate.

The perception of alternative investments has evolved over time. Initially earmarked for large institutional investors, alternatives consisted of hard as well as real assets, more recently, investors associate hedge funds, long/short funds, liquid alternatives and MLPs with alternatives. This evolution does not look to be slowing, as retail investors continue to gain awareness to the benefits of alternative investments.

According to the CAIA Association’s “The Next Decade of Alternative Investments: From Adolescence to Responsible Citizenship” report, alternative investments made up 6% or just $4.8 trillion, of the global investible market in 2004. Fast forward to 2018 and alternative investments grew to $13.4 trillion or 12% of the global investible market. Finally, according to a survey conducted by the CAIA Association, respondents expect alternative investments to make up 18% - 24% of the global investible market by 2025.

As investors continue to seek diversification and long-term alpha. Public pensions and sovereign investors have been increasing their exposure to alternatives for some time now, while retail investors have benefited from increased accessibility due to product innovation, for example, liquid alternatives. According to the Money Management Institute’s 2017 “Retail Distribution of Alternative Investments” paper, retail investors allocated 5% of their portfolio to alternatives. Meanwhile, PublicPlansData.org reported that U.S. pensions allocated over 27% of their portfolios to alternative investments in 2019.

Alternatives are a sought-after asset class due to their attractive benefits of enhancing portfolio diversification, asset allocations and improving returns. While those two pillars make alternatives an attractive option for investment portfolios, there has been a bigger underlying force that has boosted the appeal of alternatives – accommodative monetary policies.

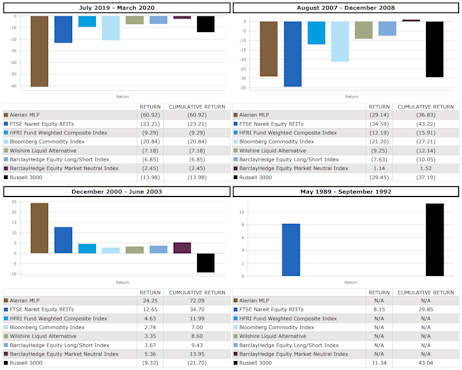

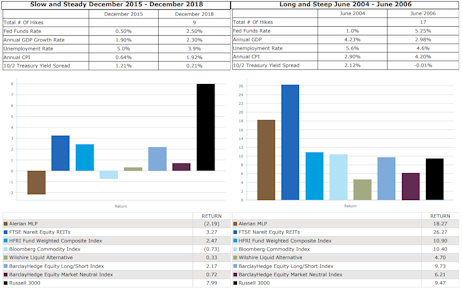

Over 40 years, falling interest rates reduced bond yields. Quantitative easing boosted equity valuations, making select alternative investments attractive. Recent 10-year Treasury yields surpassing 3% bring competition. Figure 1 shows mixed performance of alternatives in past easing cycles. Liquid alternatives like long/short funds excelled, beating Russell 3000. All alternatives outperformed equity market, positive in Dec 2000 – Jun 2003. Figure 2: Mixed alternative performance in recent tightening cycle (Dec 2015 – Dec 2018), REITs excelled, MLPs lagged, all trailed equity market. June 2004 – June 2006: Alternatives outpaced U.S. equity market.

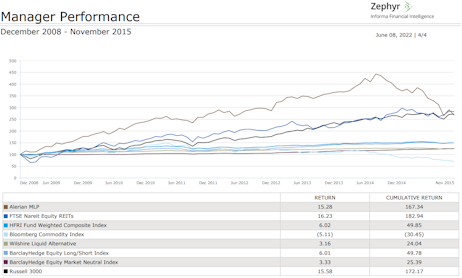

According to Figure 3, alternative performance from December 2008 to November 2015, during a period of Fed Funds rate at 0 – 0.25%. Commodities and liquid alternatives (long/short, market neutral) underperformed. MLPs and REITs aligned with U.S. equity market.

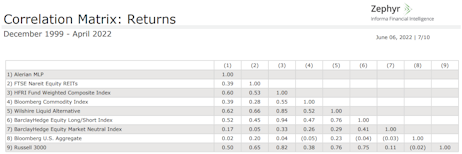

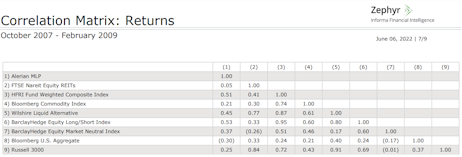

Alternatives offer portfolio diversification, especially in crises. Bonds and stocks correlate during crises, but alternatives act as a hedge. Figure 4 shows asset class correlations (Dec 1999 - Apr 2022), differing from Great Financial Crisis (Figure 5).

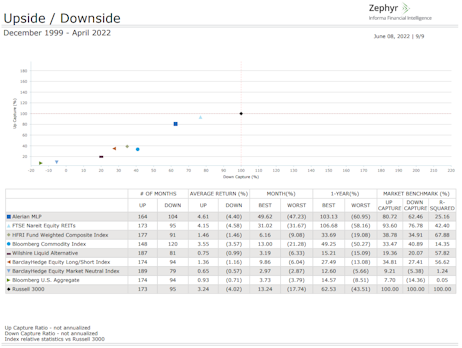

Understanding asset class correlations and equity market cycles matters. Figure 6 displays alternatives' performance in up and down equity markets since Dec 1999. U.S. REITs excel in up markets, with better downside resilience. Liquid alternatives hedge equity downturns.

In Figure 7 we look at how these alternative investments performed during similar up and down periods for the U.S. bond market (Bloomberg U.S. Aggregate index).

Alternative investments can provide multiple benefits to all types of investors regardless of the market or monetary cycle. Alternatives can also provide enhanced portfolio diversification, which can help soften the blow in case of a market correction. It’s important for financial advisors to understand their client’s investment objectives, and the risks and opportunities that accompany the different alternatives.

Tag: Strategies for Wealth Management, Investment Research, Investment Management Software, Alternative Funds, Alternative Assets, Passive Income Investments

Tags: investment management software, investment management tool, investment tracking software investment portfolio management software, portfolio management software for advisors, fund management platform, investment portfolio tracking software, alternative investment management software, portfolio management software for financial advisors, portfolio tracking tool, portfolio management tools, portfolio management software, ria tool, portfolio performance reporting software, portfolio attribution software, portfolio attribution analysis software, investment performance tracking software, portfolio performance analysis software, digital asset management, asset managers, passive income investments, alternative investment, alternative investment management