Is It Time to Start Investing in International SMA Funds?

By Head of Zephyr's PSN, Nick Williams

The investment landscape is experiencing a notable shift as institutional and individual investors reassess their portfolio allocations in an increasingly complex global environment. For the past several years, we have witnessed strong positive asset flows into the fixed income separately managed account (SMA) space, primarily driven by institutional investors seeking customization and transparency in their bond portfolios.

The current investment climate presents a fascinating paradox. While domestic equities have continued to generate significant performance gains throughout 2024 and into 2025, investors have remained cautious about increasing their equity exposure. This hesitancy has resulted in negative asset flows as earnings are systematically rebalanced into other asset classes, particularly fixed income and alternative investments. The preference for defensive positioning reflects broader concerns about market volatility and economic uncertainty that have characterized recent market conditions.

International exposure has been particularly slow to attract capital flows in 2025, as geopolitical tensions and uncertainty surrounding trade policies, security issues, and potential tariff implementations have given investors pause about deploying capital offshore. However, beneath this surface-level reluctance, we are beginning to see compelling evidence of renewed interest in emerging markets and international equity investments from multiple perspectives.

The investment management industry's approach to strategy selection and due diligence has evolved significantly with technological advancement. Earlier this year, Zephyr released its Manager Insights dashboard, a groundbreaking tool that allows asset managers to gain unprecedented perspective about their market positioning. This platform provides visibility into how frequently their strategies appear in user reports and identifies the top competing strategies they are benchmarked against.

Looking ahead, Zephyr plans to release an enhanced insights module at the beginning of next year, which will grant users with PSN data access to comprehensive statistics for all strategies in the PSN database. This expansion will include quick comparison statistics for each strategy, enhancing access to previously hard-to-obtain competitive intelligence.

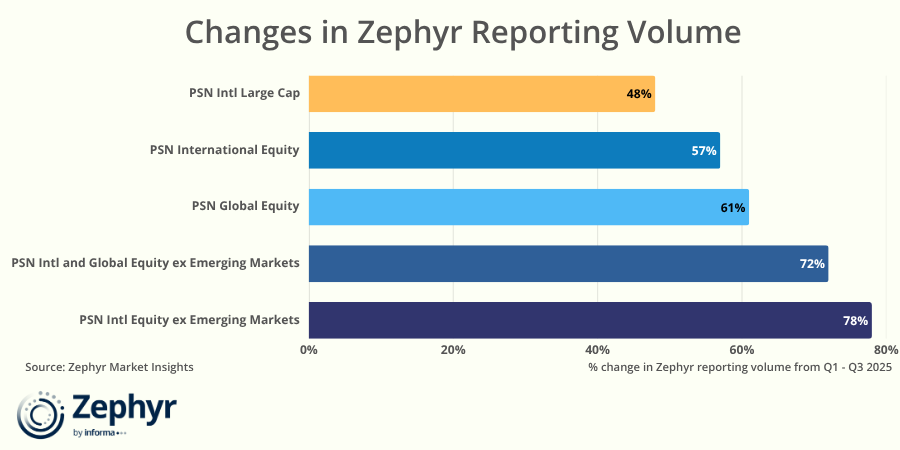

Using data compiled for the upcoming insights module, we have identified the investment universes most frequently analyzed by Zephyr users and tracked how interest patterns have evolved throughout the year. The results reveal a fascinating trend toward international diversification that contradicts the broader narrative of domestic focus.

Equity and fixed income sectors continue to generate the highest reporting volume, international strategies are experiencing remarkable growth in attention. Reports generated from strategies in the PSN Global Equity universe have increased by 60%, and the PSN International Equity universe has seen a 56% surge in analytical activity. This dramatic increase in research activity suggests that investment professionals are actively exploring international opportunities despite the challenging geopolitical environment.

These increased research activities are translating into actual capital deployment, providing concrete evidence of shifting investor sentiment. Both universes have attracted positive asset flows from managed accounts and wrap products during the third quarter. The PSN International Equity universe gained $2.38 billion in Q3, though it still shows net outflows of $3.05 billion year-to-date, indicating the magnitude of earlier redemptions during periods of heightened uncertainty.

More encouragingly, the PSN Global Equity universe demonstrates consistent growth momentum, with $1.51 billion in third-quarter inflows and $2.34 billion in positive flows year-to-date. This sustained positive momentum suggests that investors are finding compelling opportunities in globally diversified strategies.

For investors considering international exposure, SMAs offer distinct advantages including tax efficiency, customization capabilities, and direct security ownership. As global markets present both opportunities and challenges, the flexibility inherent in separately managed accounts may prove increasingly valuable for navigating international investment complexities while maintaining the control and transparency that today's sophisticated investors demand.