Passively Managed Mutual Funds Outpace Their Active Counterparts During The First Quarter

Despite the growing concerns and uncertainties, the S&P 500 index posted a +7.50% return during the quarter, which corresponds to the fall in volatility. With the lower volatility and strong equity market performance, let’s take a look at how actively managed mutual funds fared against their passively managed counterparts during the quarter.

Passively Managed Mutual Funds Outpace Their Active Counterparts During The First Quarter

There is a common perception in the investment world that active managers have an advantage over passive managers during times of increased volatility, since active managers can go on the defensive, whereas passive managers have strict mandates to mimic an index.

After an extended time period (2012 – 2019) where equity volatility, measured by the CBOE VIX index, traded below its 20-year average of 20.2, volatility increased during the peak of the pandemic. After a bout of low volatility in 2021, volatility surged above its 20-year average in 2022. However, in somewhat of a surprise, equity volatility fell from 21.67 at the start of the quarter to 18.7 at the end despite uncertainty regarding monetary policy and the regional banking crisis.

Despite the growing concerns and uncertainties, the S&P 500 index posted a +7.50% return during the quarter, which corresponds to the fall in volatility. With the lower volatility and strong equity market performance, let’s take a look at how actively managed mutual funds fared against their passively managed counterparts during the quarter.

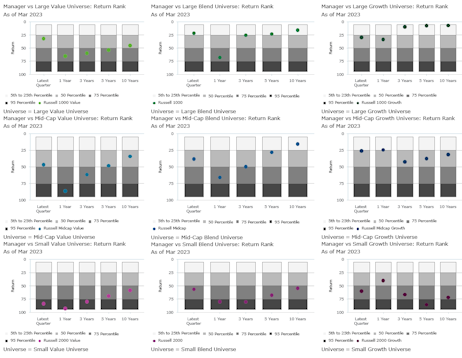

As you can see in the Zephyr graph below, the percentage of mutual funds that outperformed their respective category index during the first quarter of 2023 fell. Roughly only 25% of large value, large blend and large growth mutual funds outperformed their category index, while only 25% of mid-cap growth funds beat the Russell Midcap Growth index. The story is different on the opposite side of the size spectrum. Nearly 80% of small value mutual funds beat the Russell 2000 Value index while more than half of small blend and small growth mutual funds beat their respective category index.

The pace of market moves has increased over the years, which makes it important to strive to create diversified asset allocation strategies that can withstand the different financial market dynamics and changing investment landscape.