Are Rate Cuts Good for Equities?

When trying to position your client’s investment portfolios for a rate cutting cycle, it’s important to ask yourself: “why is the Fed cutting rates?” rather than just focusing on the cuts themselves.

Since the beginning of 2023, investors have had to contend with interest rates at levels not seen since 2007. However, the recent rate hiking cycle is now behind us, and it is time to focus on what a rate cutting cycle means for markets.

The Federal Reserve (Fed) has signaled that a rate cut could be on the horizon while traders are putting a 100% probability on a rate cut during the September FOMC meeting (Source: CME FedWatch). Furthermore, recent market volatility and soft economic data has provided the Fed with additional support to start its rate cutting cycle.

When determining the impact interest rate cuts have on financial markets, it’s important to consider why the Fed is cutting rates. The cutting cycle is usually triggered by a slowing economy, rising unemployment, and lower inflation, i.e. a looming recession. Recent economic data and the steepening of the yield curve could be warning us that a recession is near. Now, I am not saying we are about to go into a recession, but what I am saying is that it’s an important factor when considering the potential impact rate cuts have on certain parts of financial markets.

The S&P 500 index has posted a very strong 20% (Source: Zephyr) return since the last rate hike (July 26, 2023) through the first six months of 2024. However, equity volatility has spiked recently, and equities have fallen as we near the start of a potential rate cutting cycle. With all indicators signaling an upcoming rate cutting cycle, it’s time to revisit how different asset classes have performed in past rate cutting cycles and answer the question: “Should investors be careful of what they wish for when wishing for a cutting cycle?” I took a look at the past five rate cutting cycles to help answer those questions.

In a vacuum, some investment professionals believe rate cuts are good for the broad equity market, during both recessionary and non-recessionary periods. However, that is not necessarily the case, especially during the last five rate cutting cycles.

By leveraging the award-winning investment management application, Zephyr, we see if how different investments fare during rate cutting cycles. As you can see in figure one, the S&P 500 index performed well in anticipation of the first rate cut. However, equity performance was a mixed bag during the year following the first cut of a cutting cycle. The fate of equity performance hinged on why the Fed was cutting rates and the health of the U.S. economy. The cutting cycle that started in 1984 and ended in 1986 was the only cycle of the five that did not coincide with a recession. Not surprising, this cycle experienced the best performance during the year following the first rate cut. Interestingly, the average return of the S&P 500 index after one year was -0.5%.

REQUEST A FREE TRIAL OF ZEPHYR

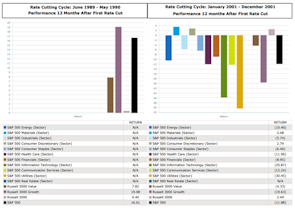

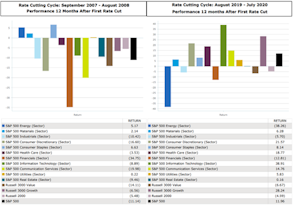

As you can see from figures two and three, equity performance for the 12 months following the first rate cut has been mixed. The S&P 500 index posted positive returns during the 12 months following the June 1989 (+16.61%) and August 2019 (+11.96%) cuts, while posting negative returns following the January 2001 (-11.88%) and September 2007 (-11.14%) cuts. It’s important to note that those four cycles also coincided with a recession. We have to go back to the rate cutting cycle that started in September 1984 to find one that didn’t include a recession. Equities performed much better during the 12 months following the start of the 1984 cycle with the S&P 500 index posting a +18.23% return and the Russell 2000 index posting a +15.69% return.

It's also a mixed bag when looking at equity sector performance following the first rate cut (Note: S&P 500 Equity Sector indexes were created in October 1989). The materials sector was the only sector to produce positive returns during the last three cutting cycles.

The story is different for fixed income during rate cutting cycles (Figures 4 and 5). It has been well documented that fixed income, both government and corporates, experienced some of their worst drawdowns ever during the recent rate hiking cycle in 2022. However, a rate cutting cycle has presented opportunities for total return investors in the past. When interest rates fall, bond prices appreciate, so a rate cutting cycle can provide attractive total return opportunities for investors. That is exactly what happened during the previous four cutting cycles. In fact, only one of the primary fixed income asset classes – high yield – produced negative returns (June 1989 and September 2007). Outside of high yield, every other fixed income asset class produced strong total returns during the 12 months following the first cut. That isn’t a surprise as high yield bonds are riskier than other asset classes and the corresponding recessions negatively impacted the asset class. Additionally, higher duration asset classes that are more sensitive to interest rate movements outperformed. A slow and methodical rate cutting cycle could provide opportunities for both total return and income seeking investors.

When positioning your client’s investment portfolios for a rate cutting cycle, it’s important to ask yourself: “why is the Fed cutting rates?” rather than just focusing on the cuts themselves. Additionally, look at the pace of the cuts, if a recession is near or already in place, the Fed is likely to make steep cuts, which will likely spook equities. Or is the pace of the cuts slow and methodical to ease the brakes some and give the economy a little more fuel? Watching the pace of cuts is a good indicator if the Fed is concerned that a recession is near or is a soft landing in sight. It’s important to focus on the health of the economy and corporate earnings while constructing diversified asset allocations that are diversified across uncorrelated asset classes in order to withstand a rate cutting cycle.

About the Author

As Zephyr’s Market Strategist, Ryan Nauman provides analysis and research on market trends across asset classes, sectors, and regions to help empower better asset allocation strategy decisions. He is an accomplished investment strategist who has spent the last 22 years in the investment management industry ranging from working with plan sponsors, managing the investments of retail investors, and providing actionable thought leadership to investment professionals.

Nauman is the host of the popular A to Zephyr and Adjusted for Risk podcasts. He is a well-respected investment industry strategist regularly featured on TD Ameritrade Network, Yahoo! Finance, Bloomberg TV, Bloomberg Radio and Chuck Jaffe’s Money Life podcast. His opinions and market expertise have been published in Reuters, CNBC, Bloomberg, MarketWatch.com, Yahoo! Finance, and the Wall Street Journal.