Set Your Clients Up For Success

Asset Allocation Software

Illustrate the Ideal Portfolio to Your Clients.

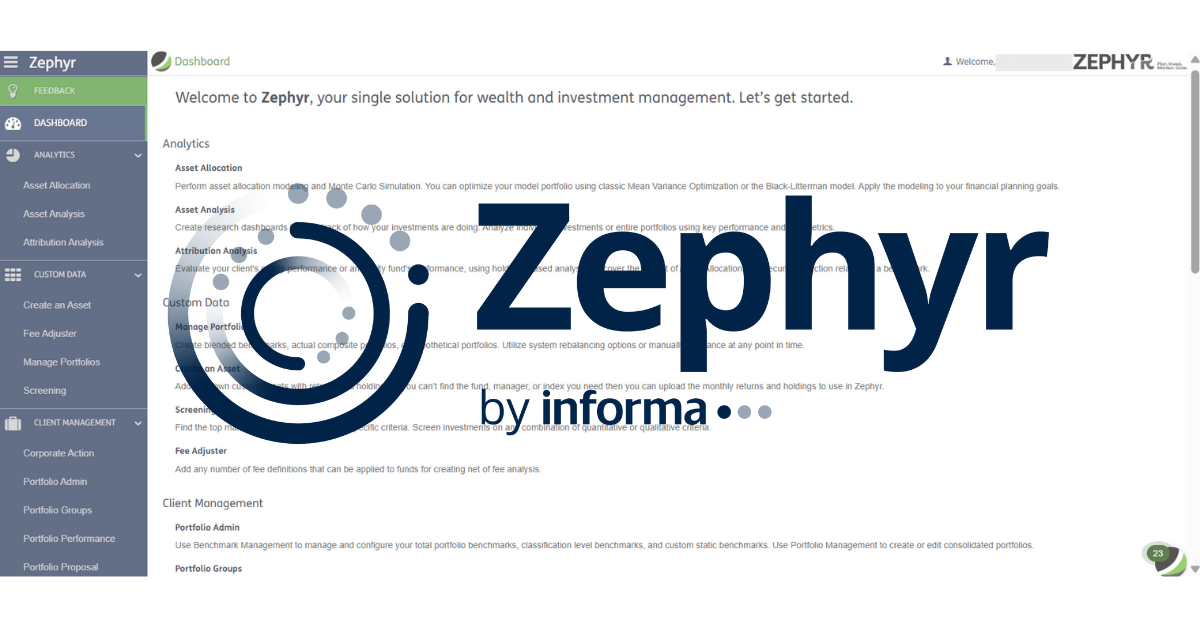

Zephyr’s asset and wealth management software will give you an edge enabling you to have a more tactical asset allocation, while also being easy to navigate.

Our asset allocation software includes:

- Portfolio Construction

- Asset Allocation Modeling

- Mean-Variance Optimization model

- Black-Litterman Optimization model

- Monte Carlo Simulation

Assess, Allocate and Present

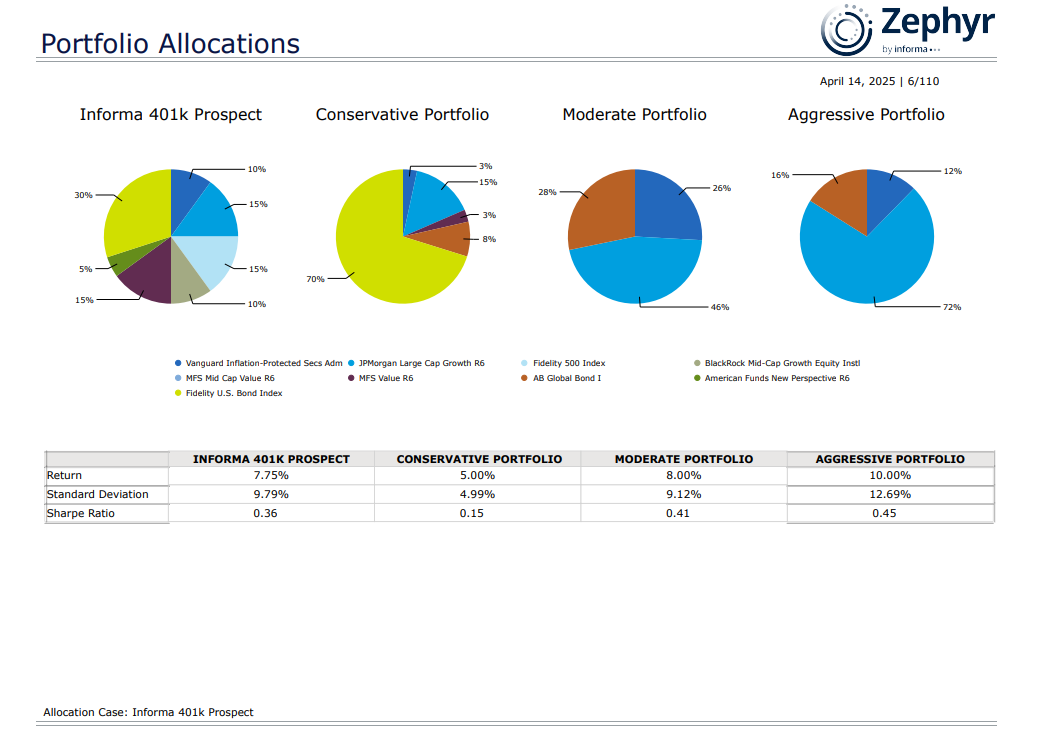

Deliver your clients with the most tailor-made asset allocation and management with detailed reports, asset allocation proposals and financial planning presentations.

- Guide your clients toward their unique goals with Monte Carlo financial planning scenarios.

- Provide your clients with easy to interpret reports to help them better understand where their funds are going.

- Combine our new Zephyr Portfolio DNA analysis with your allocation and portfolio construction.

Set a New Standard in Asset Allocation

We help asset and wealth managers like you in setting the standard for asset allocation services. By leveraging our grand arsenal of asset allocation tools, you can provide the most personalized and tactical asset allocation and wealth management services to your clients. Expand your reach and set a new industry standard with Zephyr.

Don't Be a Pain in The Assets

A well-thought-out and efficient allocation strategy is key to achieving your clients’ financial objectives and fostering better client relationships. Use Zephyr and make it a painless process.

Create The Most Tailored Asset Allocations

Creating the best portfolio allocation for your clients can be achieved by making carefully planned and executed investment decisions in Zephyr's asset allocation software.

Mix it up With Alternative Asset Allocation

Alternative assets often have low correlations with traditional stocks and bonds, making them valuable tools for risk management. These investments have become more accessible to individual investors through various vehicles such as mutual funds, exchange-traded funds (ETFs), and real estate investment trusts (REITs).

Zephyr Asset Allocation FAQ's

Learn more about Zephyr's asset allocation capabilities.

What is asset allocation?

Asset allocation involves distributing investment assets among various categories or classes, like stocks, bonds, cash, and alternative investments (e.g., real estate, commodities). This strategy aims to diversify and balance investment portfolios according to an investor's goals, risk tolerance, and time horizon.

What is an asset allocation fund?

An asset allocation fund, also known as a target-date or lifecycle fund, is a type of investment fund that is designed to provide a diversified portfolio of assets across different asset classes. The fund's asset allocation is typically based on a target retirement date or a specific investment time horizon which can be explored using Zephyr's analysis tools.

Will I have to build my portfolio from scratch?

Zephyr allows wealth managers to build highly customized portfolios for clients based on their financial goals, risk tolerance, and market analysis. This involves selecting suitable assets and regularly monitoring and adjusting the portfolios to align with changing market conditions and client preferences. Importing existing portfolios is often done through various means, such as manual entry, CSV file uploads, or data integration with custodians and other financial institutions.

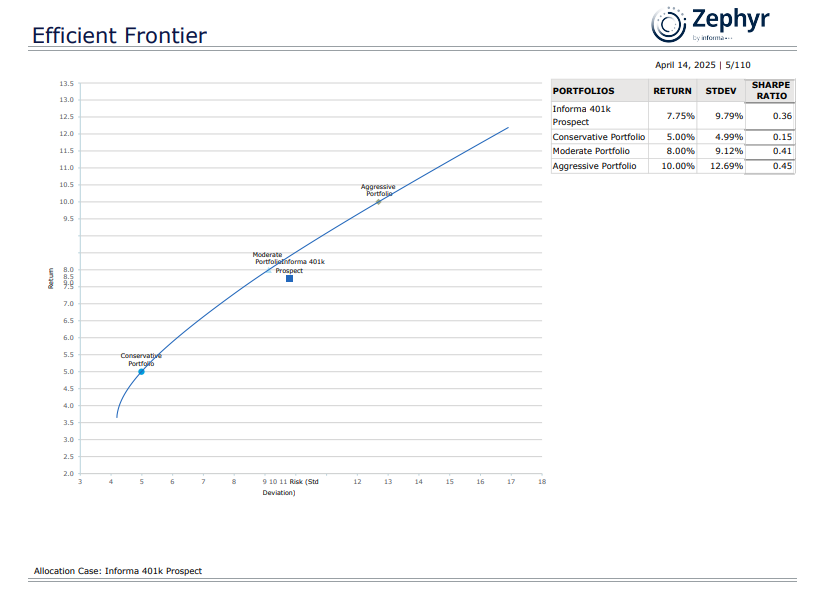

What are the best tools for asset allocation?

Zephyr's Asset Allocation module provides two models, Mean Variance Optimization (MVO) and Black-Litterman, for asset allocation and optimal portfolio construction. These models help in calculating risk, expected return, and estimating market equilibrium.