Make data-driven decisions and stay ahead of your competition.

Portfolio Analysis Software

Numbers Speak Louder Than Words

With Zephyr, you gain access to one of the industry's best investment analysis tools. You can evaluate and run analytics using hundreds of market indices with ease, enabling you to deliver clearer and more detailed investment reports, further enhancing your client relationships.

Examine Your Client’s Portfolio DNA

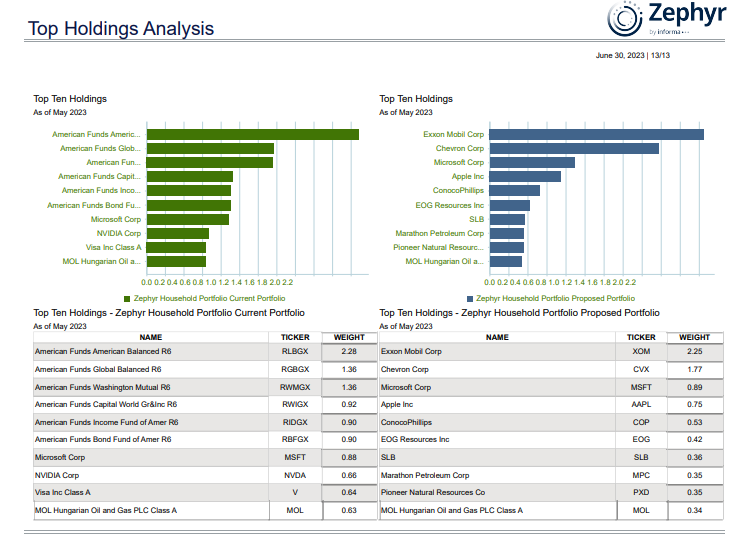

Zephyr’s investment analysis tools enable you to quickly and easily evaluate the overall composition of your client’s investment portfolio, including mutual funds, ETFs, SMAs, and model portfolios.

Portfolio Analysis Features:

- In-Depth Exposure Analysis

- Equity Characteristics: Sector and regional weightings

- Fixed Income Characteristics: Sector, regional, quality, and maturity weightings

- Holdings Exposure

- Region and Country Exposure

You Won't Find a More Capable Investment Analytics Software

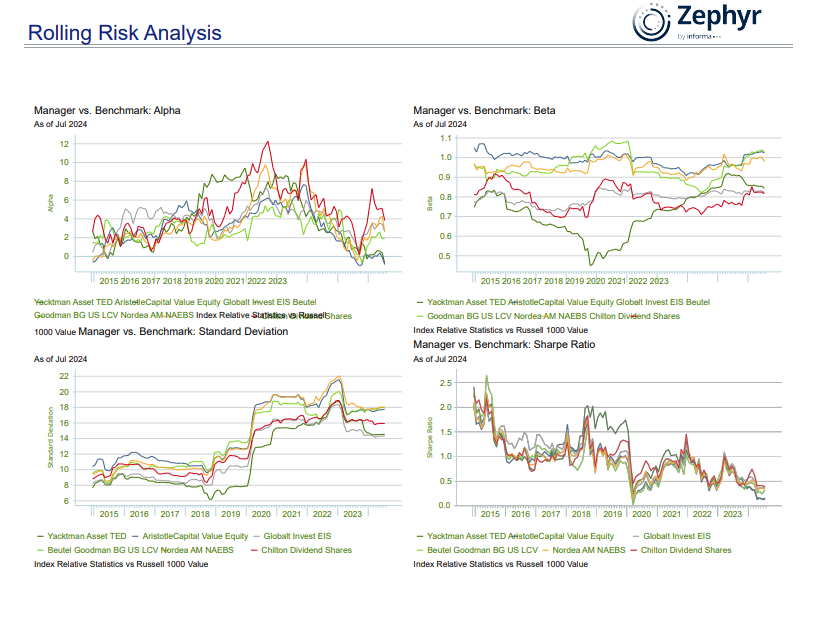

Zephyr’s portfolio analysis software allows you to create dashboards to analyze individual investments, or entire portfolios performance using key performance and risk metrics to ensure your clients' portfolios align with their unique financial goals and expectations.

Key Features:

- Portfolio Analysis: Easily analyze portfolios to meet client return/risk profiles.

- Equity Performance Evaluation: Use holdings-based analysis to evaluate your client’s equity performance or an equity fund’s performance.

- Impact Analysis: Uncover the impact of asset allocation and security selection relative to a benchmark.

View Zephyr StatFacts

Lead the Charge Toward a More Analytical Approach to Investing

Using Zephyr's award-winning investment analysis tools.

Explore Beyond Traditional Assets with Zephyr's Tools for Portfolio Analysis

Zephyr’s investment analytics extends beyond traditional assets, offering investment professionals like you a robust tool for analyzing alternative investments. Whether you’re dealing with private equity, crypto, real estate, or commodities, Zephyr provides detailed insights into these complex asset classes.

Investment Analytics You Can Trust

Gain a more holistic view of your clients' investment portfolios and serve them better. Learn more about Zephyr's portfolio analytics software below.

Expand Your Arsenal with Our Portfolio Analysis Software for Advisors

Reshape the way you view investment analytics using Zephyr's portfolio analytics software.

Zephyr Portfolio Analytics FAQ's

Find out how Zephyr’s Portfolio Analytics can maximize portfolio growth.

What are portfolio analytics?

Portfolio analytics uses quantitative methods and data analysis techniques to evaluate and optimize the performance of an investment portfolio to its fullest potential. The main objective of portfolio analytics is to help portfolio managers make informed decisions about their investments, assess risk, and achieve their financial goals.

How can I build a wealth portfolio?

First, understand your comfort risk tolerance and engage in discussions with financial advisors to discuss your goals, risk tolerance, investment timeframe and any other relevant factors. They can provide personalized guidance and recommend suitable investment strategies based on your unique circumstances. Using Zephyr’s comprehensive portfolio analysis tools, managers can determine the appropriate asset allocation for your unique portfolio.

How customized will my experience be?

Long-term investment decisions can be made using Zephyr's performance analytics and historical data, helping users evaluate different strategies and adopt disciplined approaches. Zephyr's analysis tools assist in evaluating the costs associated with various investment products and promoting effective cost management. Zephyr Financial Solutions offers a robust suite of tools and features that empower financial professionals to implement tailored wealth management strategies aligned with their clients' specific needs and objectives.

What are the best tools for portfolio analysis?

Zephyr Financial Solutions offers a range of powerful portfolio analytics tools. Users can perform performance attribution, risk analysis, style analysis, peer group analysis, factor analysis and correlation analysis to gain valuable insights into their portfolios. Additionally, they can access various risk-return metrics and utilize portfolio optimization through Monte Carlo simulation for efficient portfolio construction and goal assessment. Zephyr's platform also supports customized reporting, facilitating effective communication of portfolio performance and strategies to clients.